Inching Our Way Closer To A Top?

With the IWM pushing higher yet again, and outperforming the other indices, it has certainly followed through in our recent expectations. In fact, this current extension is still likely part of wave iii off the recent lows, based upon my primary count.

So, if you don’t mind, since the IWM has presented us with the clearest structure thus far, I am going to continue to use that as our proxy to determine when a completed pattern is in place into a complete 5 wave structure.

As you can see from the 60-minute chart, the MACD is supporting this as being within the final throes of an extended wave iii of 5, off the recent 144.50 low of wave 4. What I still need to see is a wave iv pullback within this 5th wave, which will provide us with a negative divergent set up in the IWM. I would expect the MACD to turn negative during a wave iv pullback, and provide us with a lower high in the MACD on the higher price high for the 5th wave in this structure off the 144.50 low.

Since we do not have confirmation just yet that wave iii has ended, my estimated wave iv target is presented on the attached 3-minute chart of the IWM, and resides between 147.30-148.30. Should we break below 147.30, it may suggest that the yellow count is in play, which can take us to the 156 region in the coming month.

Moreover, we have now come up high enough that we may even consider the outside chance of a truncated 5th wave in the IWM, especially if we break down below the 147.30 region on the next pullback. But, since I do not rely upon truncations for strong signals, I would need confirmation with a break down below the 144.50 level. So, the next time we break down below the 144.50 level, I will be turning my focus towards the 133 region in the IWM, and the 2330-2400SPX region.

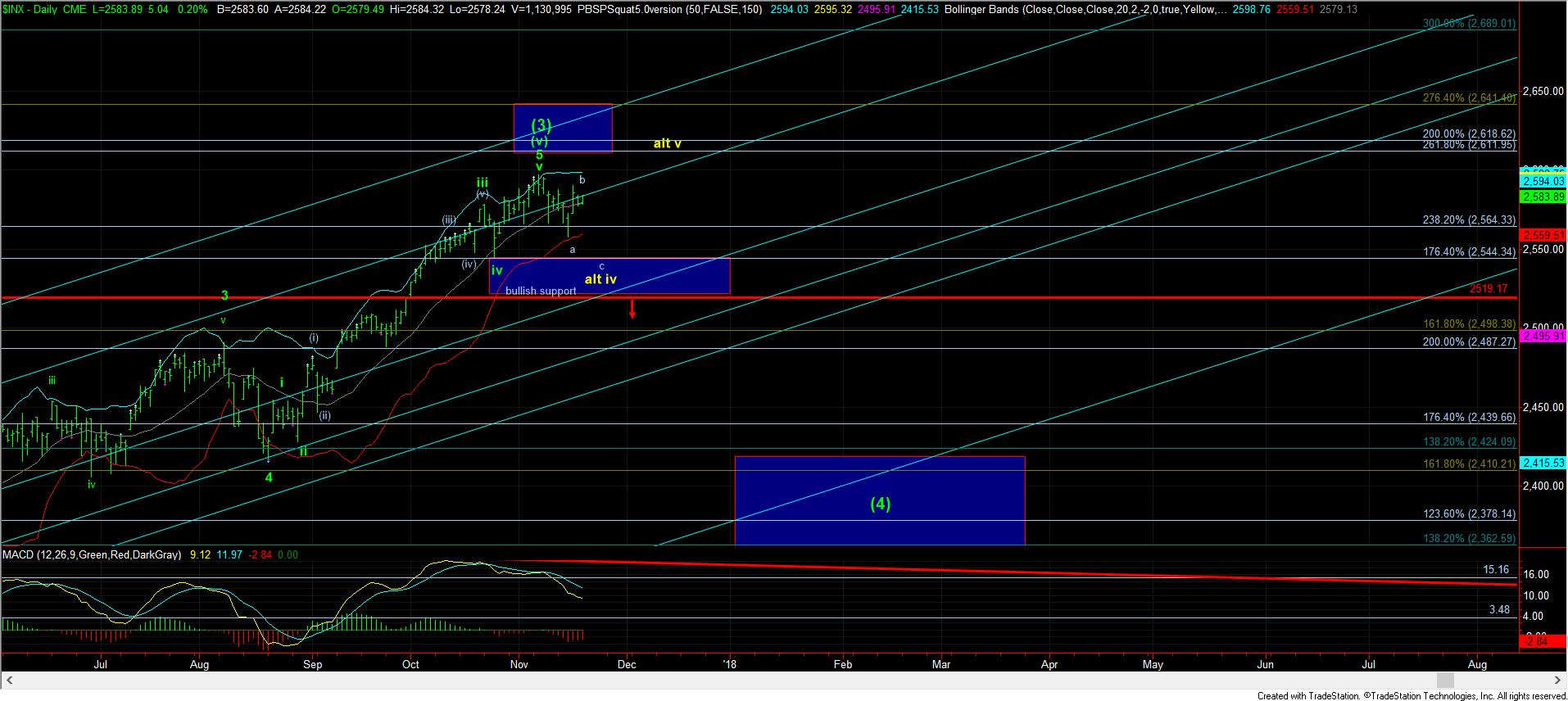

For now, I still think the bulls have a bit more to run, especially as long as we remain over the 147.30 region in the IWM. But, please remember that we are likely tracing out the 5th wave of the wave (3) off the February 2016 lows, which means that wave (4) should be our next expectation over the coming months.