In search of another retrace...

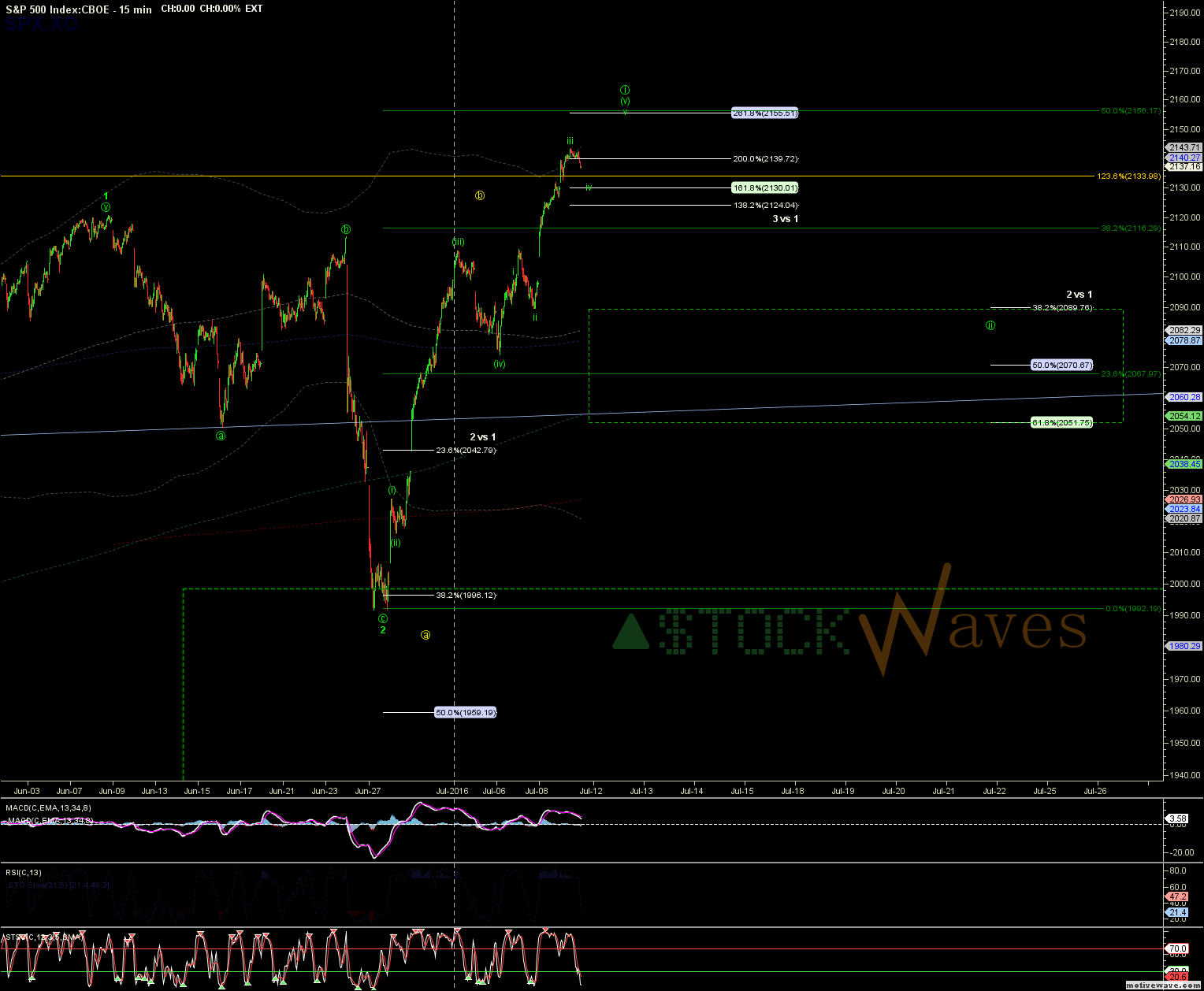

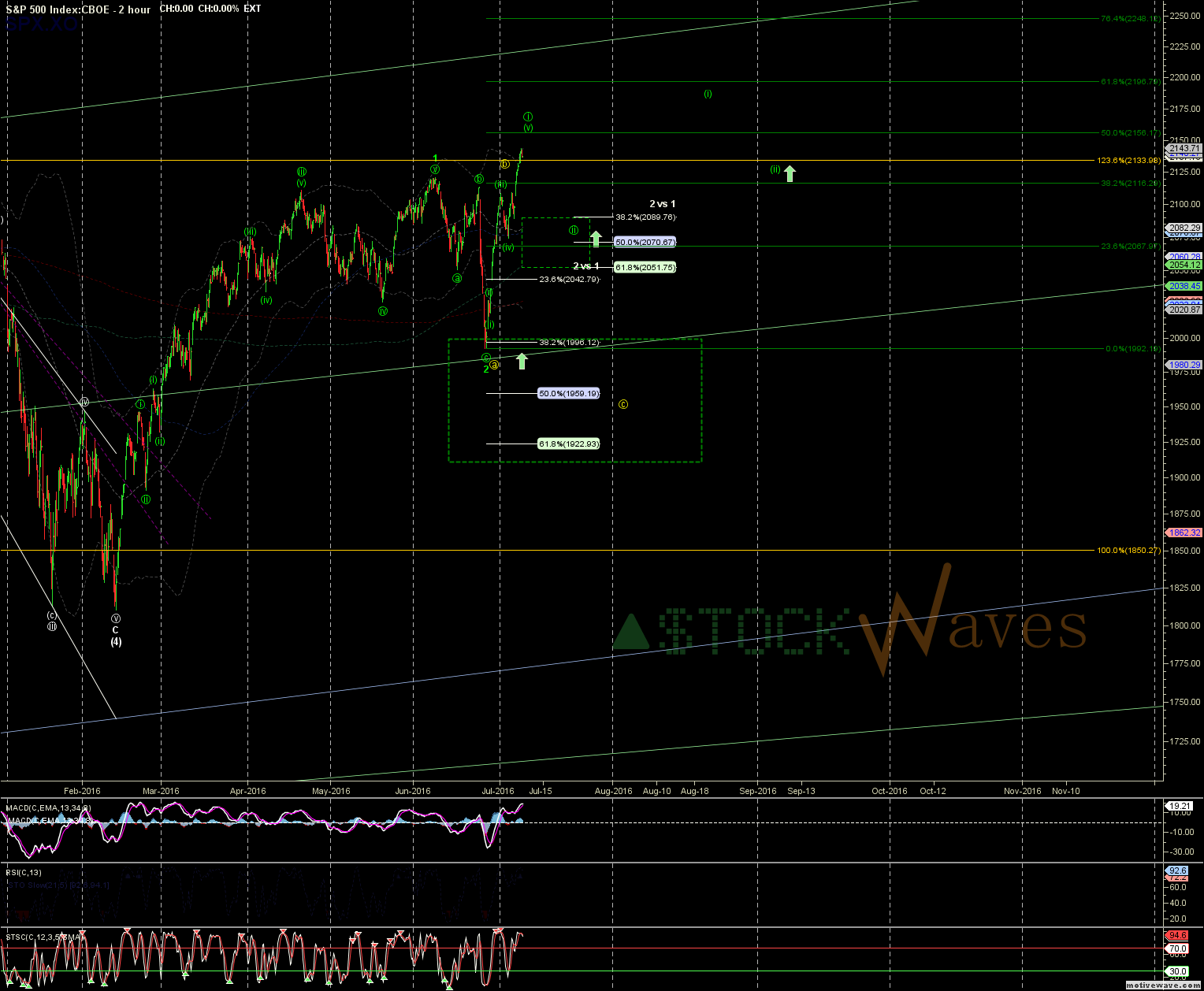

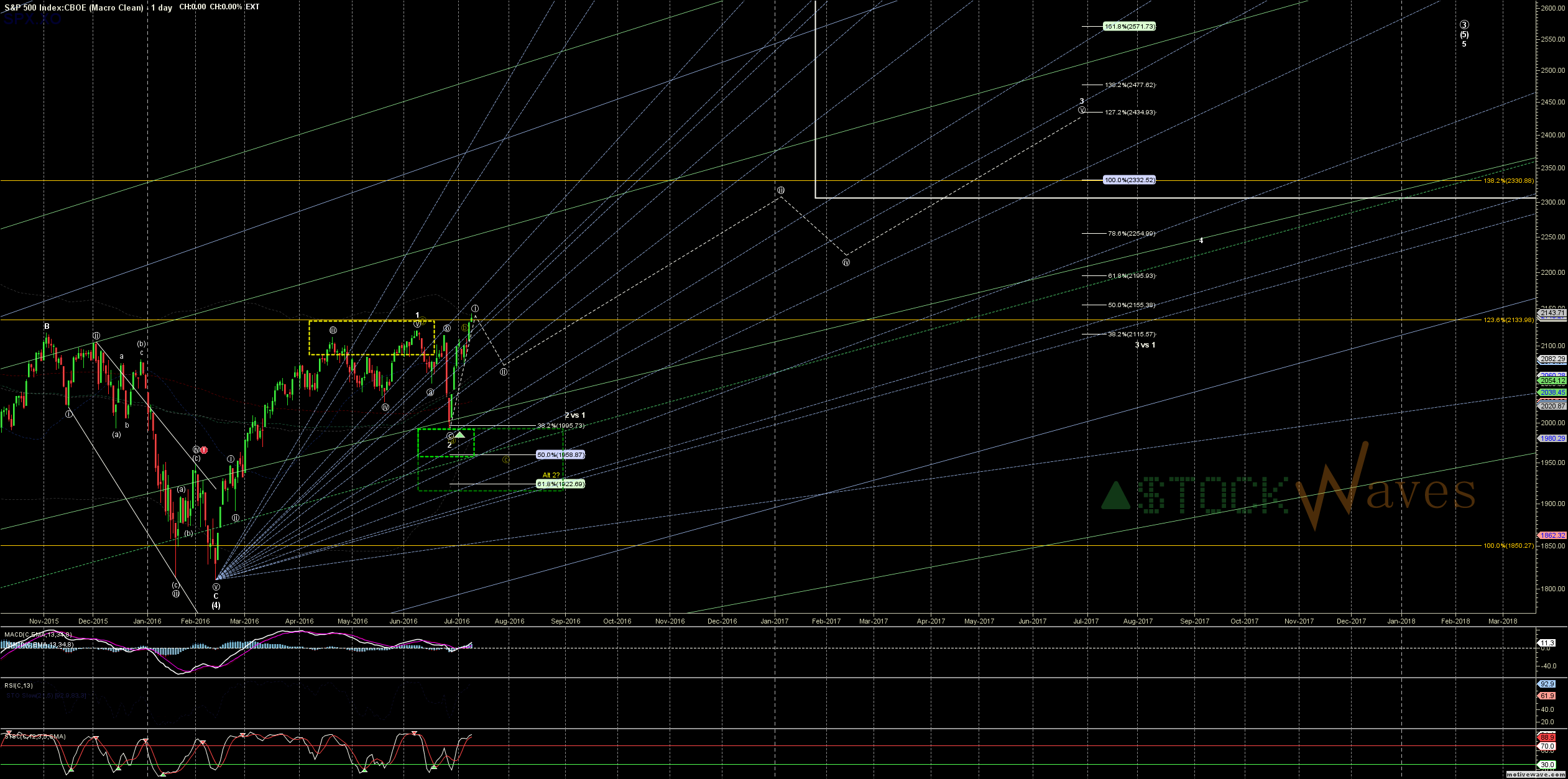

The market is acting relentlessly bullish again, but many indicators and the price pattern are signaling a pending "local top". We are nearly to the .50 Fib extension for the 3rd wave in the larger Intermediate degree (5)th off the Feb low. This is a perfect stopping place for wave i of 3, and we can count a clean 5 waves up post BRexit. The (v)th of that is trying to complete 5 sub-waves up from the 7/6 low, and could get a few more squiggles. The expected wave ii of 3 should find support in the 2090-2050 region in SPX, but please note that is at least a 2.5% draw down and could trigger "feed-back loops" exacerbating things to make it look like a more severe correction... I think at least part of it should be fairly sharp if we are going to shake out some late-to-the-party bulls and start a iii of 3 with few expecting it.

There is still some lingering potential for an alt c of 2 back down to the larger green box, but it is hard to deny the clean impulse post BRexit... IF we were to see 5 down to the 2090 region instead of an abc this concern might increase.

Either way the next move down presents a buying opportunity imo, and I plan to continue to add solid names with strong setups projected to outperform the SPX during the projected rally.