Important Point - Market Analysis for Mar 9th, 2022

I am sending out the afternoon update early today, simply because of where we reside right now, as it can be a potential turning point.

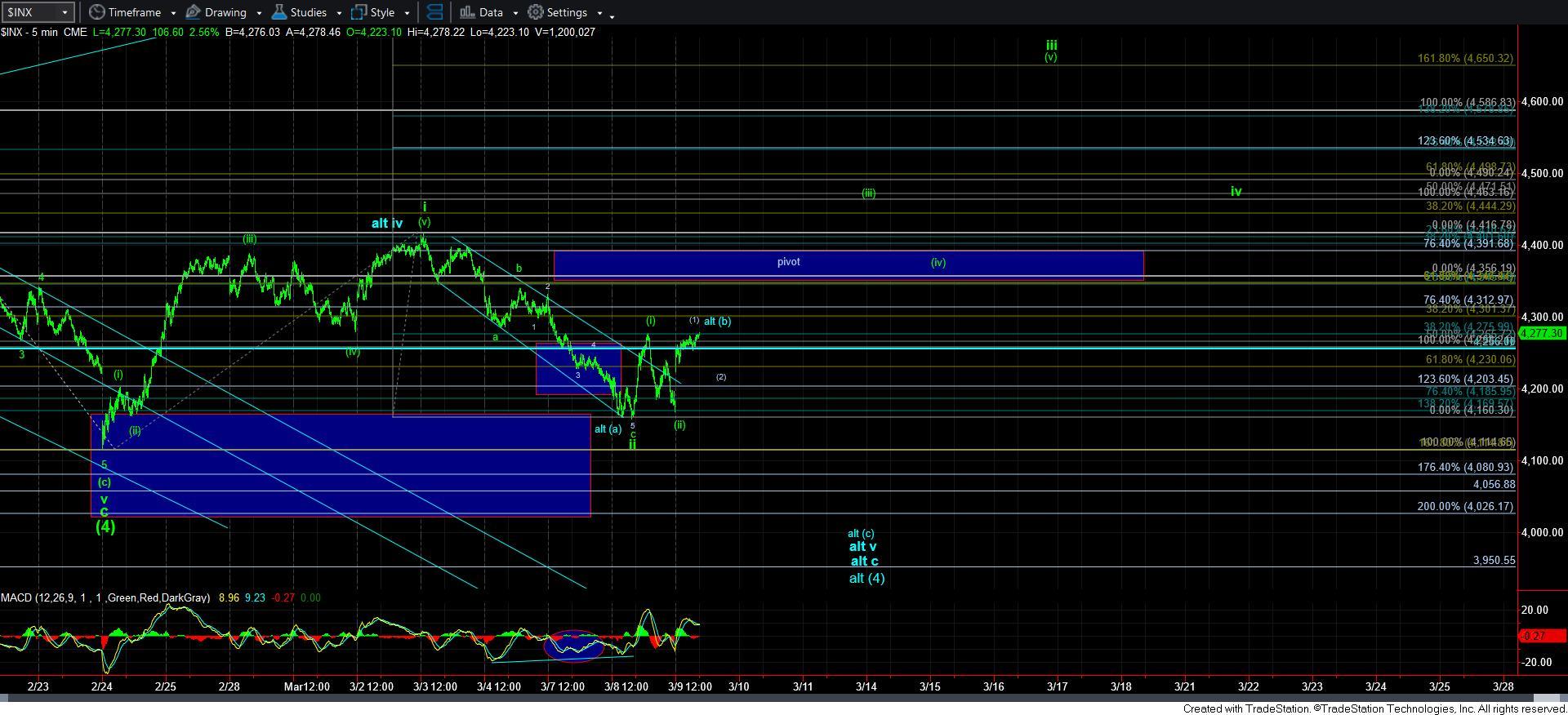

As you may realize, I have had to take the blue count a lot more seriously due to our break down below 4185SPX, as I outlined over the weekend. That being the case, I am viewing the current action as a possible c-wave rally to complete a [b] wave within that blue count. That means that if we hold resistance in their region between 4280-4300, then we can still drop down to the 4000-4070SPX region to complete a more protracted wave [4], as per the blue count.

As far as the green count, it is still well in place, but I certainly have to question it due to the overlap in the ES chart off the recent lows, as well as the break of 4185SPX. But, I am still tracking it.

Since we know that wave [iii] of iii within wave 1 off the recent lows should target the 1.00 extension of waves i-ii, then it would seem that we need a smaller degree [1][2] to be able to extend towards that target overhead. I think that may be the reasonable way to look at the current structure. Therefore, it would make sense to see a corrective wave [2] pullback, even in the more bullish count.

Of course, this all applies if we are able to maintain below resistance. For if we blow through 4300, then it likely means we are already heading higher in wave iii of [iii] in green.

So, I will be back later today to see how this resolves, but just realize we are at an important juncture.