I’m Feelin Blue

At the risk of sounding like a broken record, I am going to begin this update by again warning that we are likely in a whipsaw regime in the market.

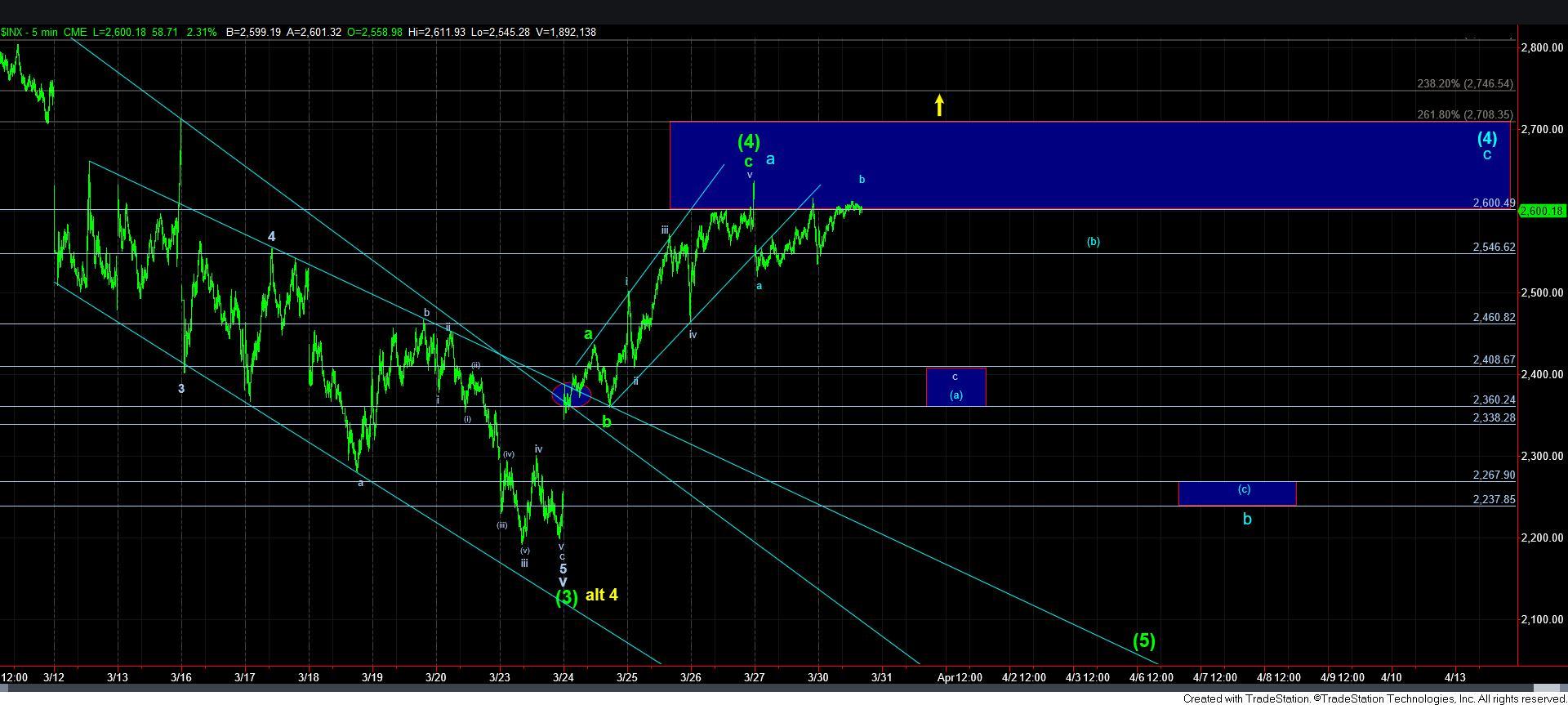

You see, my primary perspective views us as being in wave [4] of this c-wave decline off the February highs. And, what we know of 4th waves is that they are the most variable wave within the Elliott Wave 5-wave structure.

My perspective within that 4th wave is that we have completed the a-wave rally of the a-b-c 4th wave structure, and have now moved into the b-wave of that 4th wave. And, within a 4th wave, the b-wave is the most variable segment within that larger variable structure. So, for this reason, I think it is reasonable to expect market whipsaw.

As the market dropped in the overnight session after the futures opened, we continued down in what I am counting as the a-wave within the [a] wave of the b-wave. Remember, the b-wave breaks down into a 3-wave structure, which I am counting as [a][b][c]. And, within the [a] wave, we have an a-b-c structure. I hope I am impressing upon you the potential for whipsaw again.

Since the low struck in the overnight session Sunday night, the market has rallied in a very corrective looking structure. So, as you can see from the 5-minute ES chart, I am viewing this as a b-wave within the blue [a] wave. And, as long as we remain below last week’s high, then I am going to expect a c-wave down to complete the [a] wave of the blue b-wave.

I also want to again point out that the daily MACD has been rising on the SPX chart, which develops the set up for a positive divergence in the MACD when price strikes a lower low in the wave [5]. But, if we are correct in our micro count, this will still take more time until this wave [4] completes.

Alternatively, if the market is able to break out over last week’s high, and moves through the market pivot outlined on the 5-minute ES chart, then I would have to more strongly consider the potential that we may have already completed the c-wave decline in the larger degree primary wave 4, as presented by the yellow count. But, for now, that remains an alternative perspective.

So, as long as we see downside follow through in price tomorrow, I will maintain my primary count of us being in a whipsaw environment within wave [4] of the c-wave of primary wave 4.