IWM Hit The Target

With IWM hitting its target on the 3-minute chart, it now places me on high alert. So, I want to post something I sent out in an alert today:

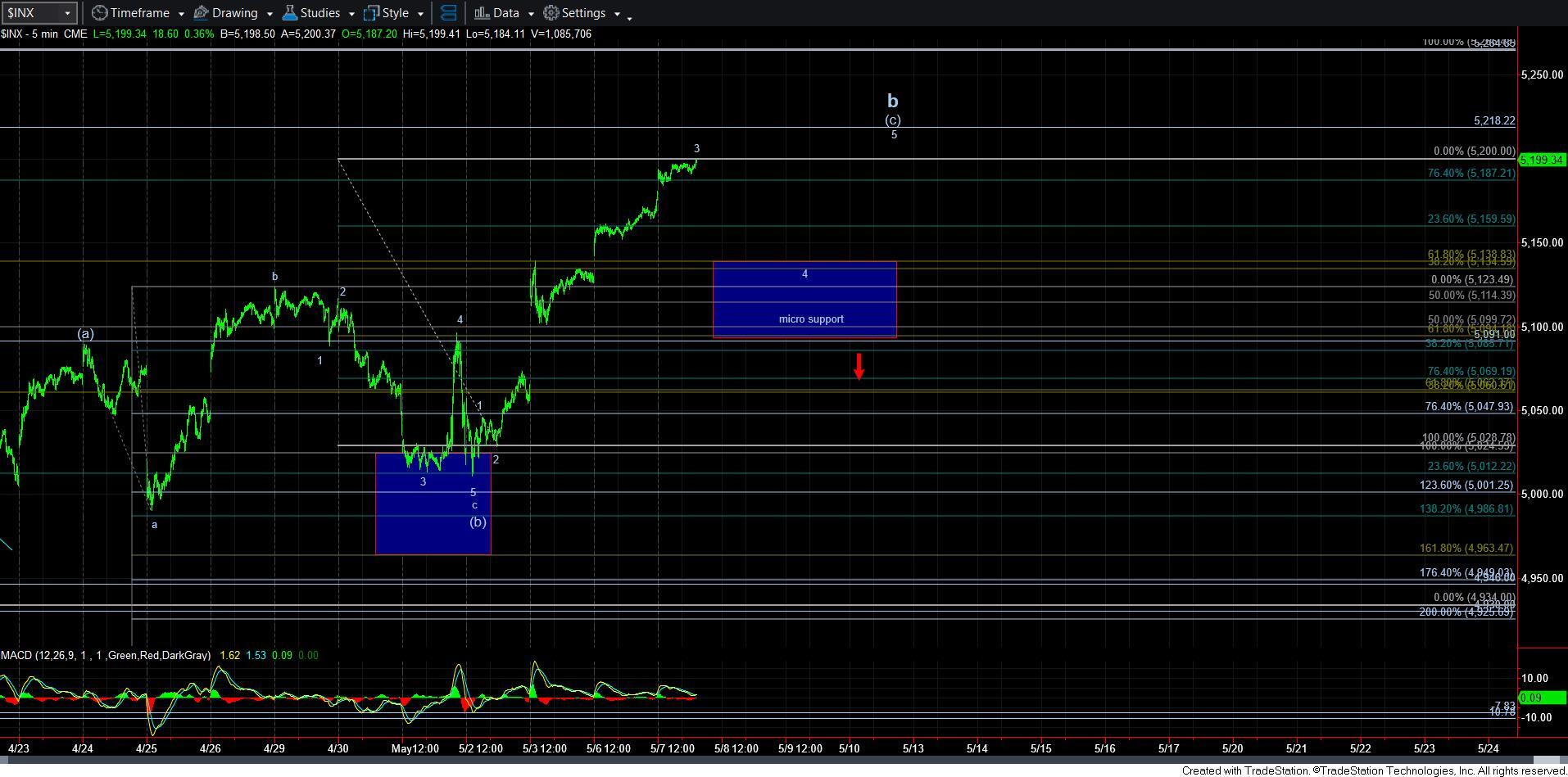

“I want to remind everyone that the SPX and IWM are in two difference counts. We are tracking the SPX as a b-wave, and the structure is supportive of that count. And, that applies even if we do make a higher high - remember the b-wave which topped right before Covid!?!?

As far as the IWM, that cannot make a higher high or it invalidates the wave count we are tracking there. And, since it is lagging, it is still well within expectations for this 2nd wave bounce.

But, I want to again warn that I am not going to get bearish until I see one more 5-wave decline to begin the next bigger decline phase. Until that happens, we do not have confirmation that a larger decline is developing.”

So, now that we have struck our target in IWM, it does not mean we go mortgage our house to short the market. As I wrote over the weekend, we still need a confirmatory 5-wave decline before we have a bearish set up. But, the environment is such that we can see it begin at any time now in the IWM.

Now, I have to say that I can still allow for a 4-5 to be seen in the SPX. So, I would need to see an impulsive move below the support region noted on the 5-minute chart – which means we need to break back down below 5091SPX again to signal that the bearish set up is developing.