IWM Finally Joining The Party

Over the last few weeks, I was explaining that an ideal target for a 5th wave in wave [i] off the market lows can take us to the 3600SPX region. But, I really did not think we had the “juice” to get there, as it would require some massive extensions that are not normally seen.

Well, the market has now provided us with those extensions, despite my doubts.

Yet, during these same last weeks, I have been imploring those willing to listen to not try to front run a reversal. We have continued to raise support, and the market has continually held support, without providing any initial indications of a top.

Moreover, I have been also watching the IWM very carefully, as it still looked like it needed one more higher high to complete its 5th wave as well. Yet, it has been meandering for weeks, unwilling to join the SPX and also unwilling to break support and confirm a top being in place.

Today, the IWM began to finally move higher and attempt to stretch for that 160+ region to complete its 5th wave. So, I am thinking we are finally nearing that top being completed in the IWM.

For now, micro support in IWM is 158, and we need to break down below 154.50 to suggest that we have completed the upside and have begun the wave [ii] retracement.

So, of course, many are now giving up on the potential for the market to retrace. And, I completely understand it. But, please do not allow your memories to be so short. This was no different than the January 2018 and February 2020 time frames, wherein everyone was convinced that a pullback was simply a figment of my imagination.

In fact, it was both the IWM and the EEM which kept me very skeptical of the SPX movement, and I am at the same point today. While I have wanted to see the IWM provide us with a “catch-up” move before we completed our wave [i] off the March lows, the count seems to clearly still point to this being wave [i] off the lows.

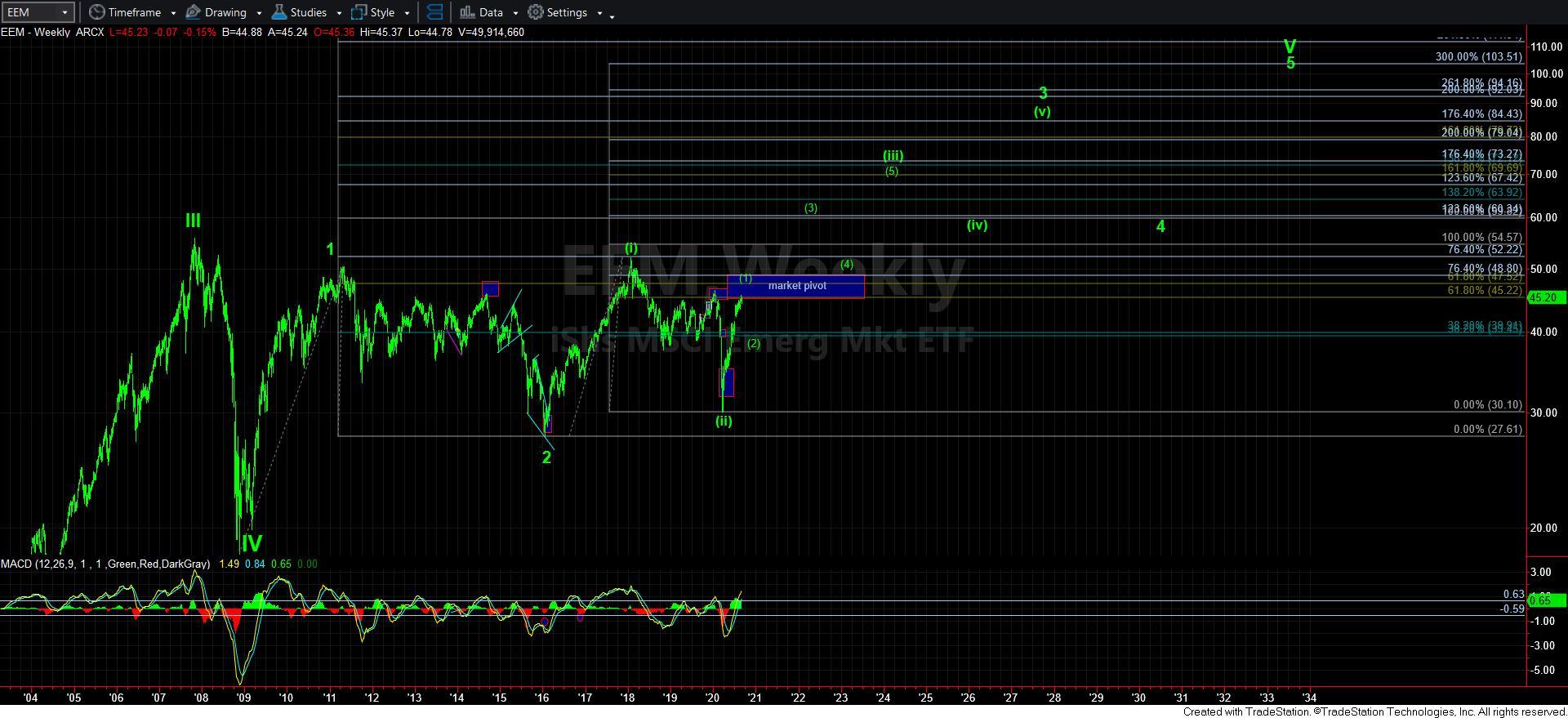

Furthermore, the EEM is also keeping me quite focused on this being on the wave [1] off the March lows. It strongly argues for a wave [2] pullback in the coming months, despite the strong extensions seen in the SPX.

It would take a move through the EEM pivot to convince me that we are in the midst of the 3rd wave higher off the March lows, and support would then become the bottom of the pivot. But, for now, that still does not look likely.

So, while the market certainly “feels” very bullish, I still have a hard time pulling the trigger on an upside addition in an index other than as a short term trade. In fact, I have increased the cash position a little more in the most conservative account I have. And, if you have a desire to add positions, my STRONG suggestion is to do it on an individual stock basis as some stocks are looking really good, whereas others clearly need larger degree retracements.

Let’s try to keep our “feelings” out of our analysis, as my own analysis is still suggestive of a bit higher – as I outlined over this past weekend – but with a greater chance for a pullback in the coming month or two.

Lastly, what I find quite interesting and somewhat funny is that many took me to task for looking at the market with bearish glasses back in January and February of 2020, and then again for looking at the market with bullish glasses when we were down in the 2200/2300SPX region. While I can always be wrong, I am seeing this current region (but with still a bit higher potential) as representing a near topping pattern. I just simply have a hard time adopting uber-bullish wave counts with a maximum of a .236 retracement since the March lows as being the type of base from which we will be rallying to 5000+.

So, while I still expect to head to the 5000+ region, I still reasonably expect to see the market pullback into the fall of 2020. Of course, I can certainly be wrong. But, there are too many factors still pointing to a real pullback before we are ready to head to 5000+ in earnest.