I Think I Can . . . I Think I Can

The market was acting like the little engine that could today, was it not? For most market participants, this was an impressive move by Mr. Market. But, it has yet been able to get to the top of the hill.

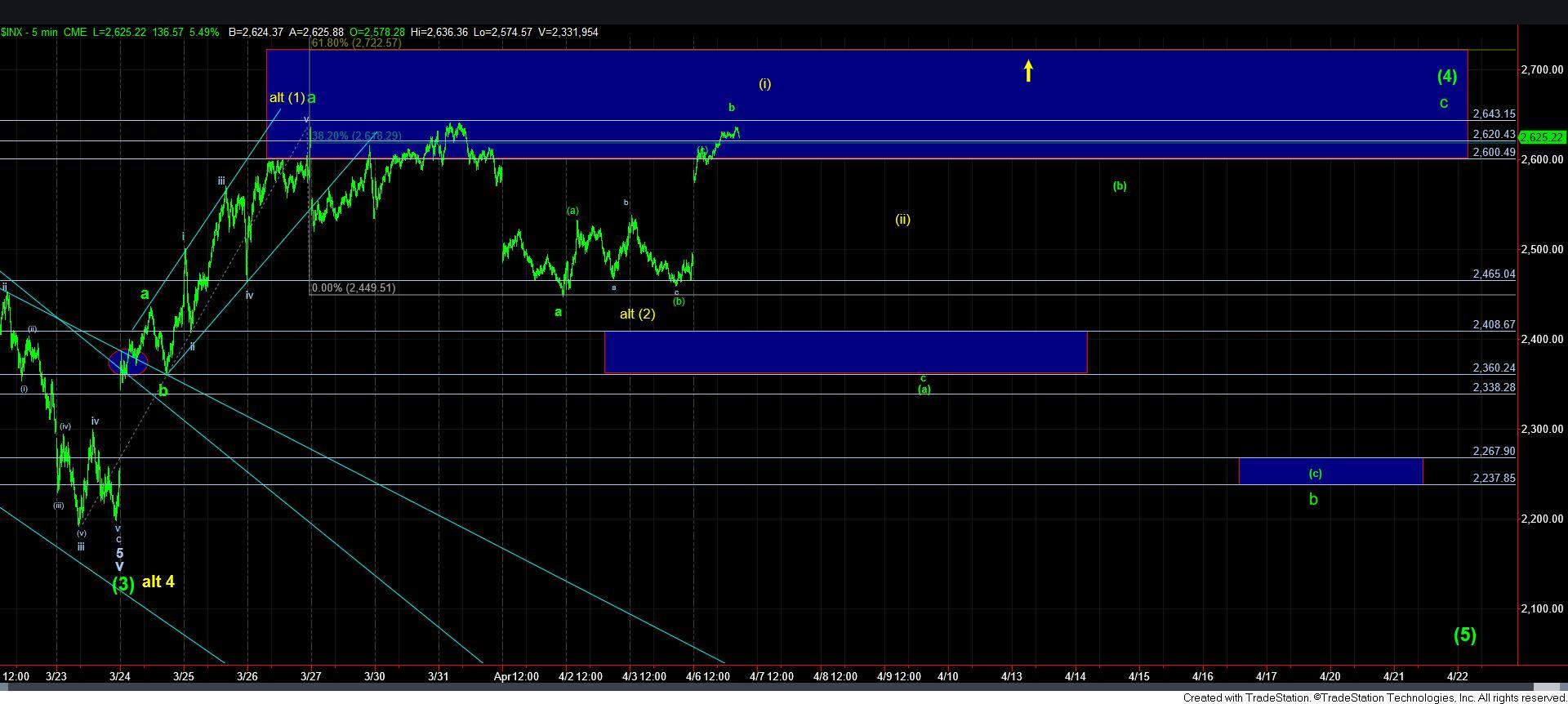

You see, as I outlined in my weekend analysis, the market must complete 5-waves up for wave [i] of [3] if the bottom has indeed been struck. And, I cannot say that this has CLEARLY been the case. But, what I can say is that I can count the minimum number of waves needed for 5 waves up to be completed, with the minimum levels of Fibonacci Pinball struck in the futures for this to be the case. Moreover, we have also struck the minimum target for wave [i] of [3] in the .382 extension region of waves [1] and [2] in yellow.

But, consider this. The market has been more oversold than I can ever remember, yet impulsive structures are only getting the bare minimum extensions off those lows? It just does not “smell” right to me. Yet, we do have the minimum number of waves in place off the low and we have hit minimum targets, so I am forced to go on YELLOW ALERT.

What does that mean?

Well, it does NOT mean that I am changing primary count yet. Rather, this is my way of letting you know that the probabilities are beginning to shift that may cause me to change to my alternative count in yellow if the market does what is necessary in the next few days to confirm that to be the case. But, until such time, I remain in the green count as shown as my primary perspective.

So, let me take a moment to discuss what is needed to be seen to change counts, and how do we handle it from a trading/investing perspective.

First, I will ideally want to see a corrective pullback in a wave [ii] in yellow, thereafter followed by a rally over the high that wave [i] ultimately strikes. In the bigger picture, the 2725SPX region is the .618 extension region off the 2187SPX low based upon the alternative [1][2] in yellow (and if you remember, that was my upper resistance for a wave [4] for quite some time now). That means that once we break out through that region, we will likely be heading to the 1.00 extension in the 2900 region.

Therefore, once we break out strongly through the .618 extension in the 2725SPX region then it becomes support for the bigger potential rally in what is still now the yellow count. And, as long as the market continues to follow through and hold Fibonacci Pinball supports along the way to complete all 5-waves up in wave i in yellow in the 3200-3300SPX region, we will have a solid 5-waves up off the lows, and we can expect a wave ii pullback, likely to the 2600-2800 region. That will offer you the last buying opportunity below 3000 before the market sets up to rally to 4500+.

So, you will likely have several opportunities for buying during that uptrend – assuming it follows through – with very defined Fibonacci Pinball support levels along the way. And, as we move through the structure, I will continue to point out the relevant support levels at which you can choose to buy long positions, and appropriately set stops. But, again, I am really getting way ahead of myself at this time as this is still far from confirmed, yet I still need to at least outline the alternative game plan if the market has indeed bottomed.

In the meantime, I am still going to treat the market as a b-wave rally for as long we are remain below the 2650SPX region. And, if the next drop takes on a clearly impulsive shape (ie. 5 waves down), then I am going to continue to target our box below in the 2360-2400SPX region again for the c-wave of the [a] wave in the larger degree b-wave. Yet, a clearly corrective looking drop off the high we strike in our current region will move me into HIGH YELLOW ALERT, as that will begin to support the drop as being the yellow wave [ii]. If you remember from my last updates, c-waves are 5-wave structures, so unless I see a clear 5-wave structure, we may not be dropping in the c-wave of the [a] wave as presented by the green count.

So, I hope I have been relatively clear regarding the parameters I have outlined in the market.

In the larger degree perspective, I still view the most likely outcome is that we either have completed or will complete primary wave 4 off the 2009 lows, and I still expect primary wave 5 to take us to the 4000-6000 region in the coming years. The only question that I have been addressing of late is whether or not primary wave 4 has completed. As of this moment, I have to still side with an expectation of a lower low with the ideal target of 2060SPX, and that the market has not yet provided strong evidence that primary wave 4 has completed. But, I am placing you on alert that the market may provide us with indications over the coming week that this may not be the case.