How Deep Can We Drop?

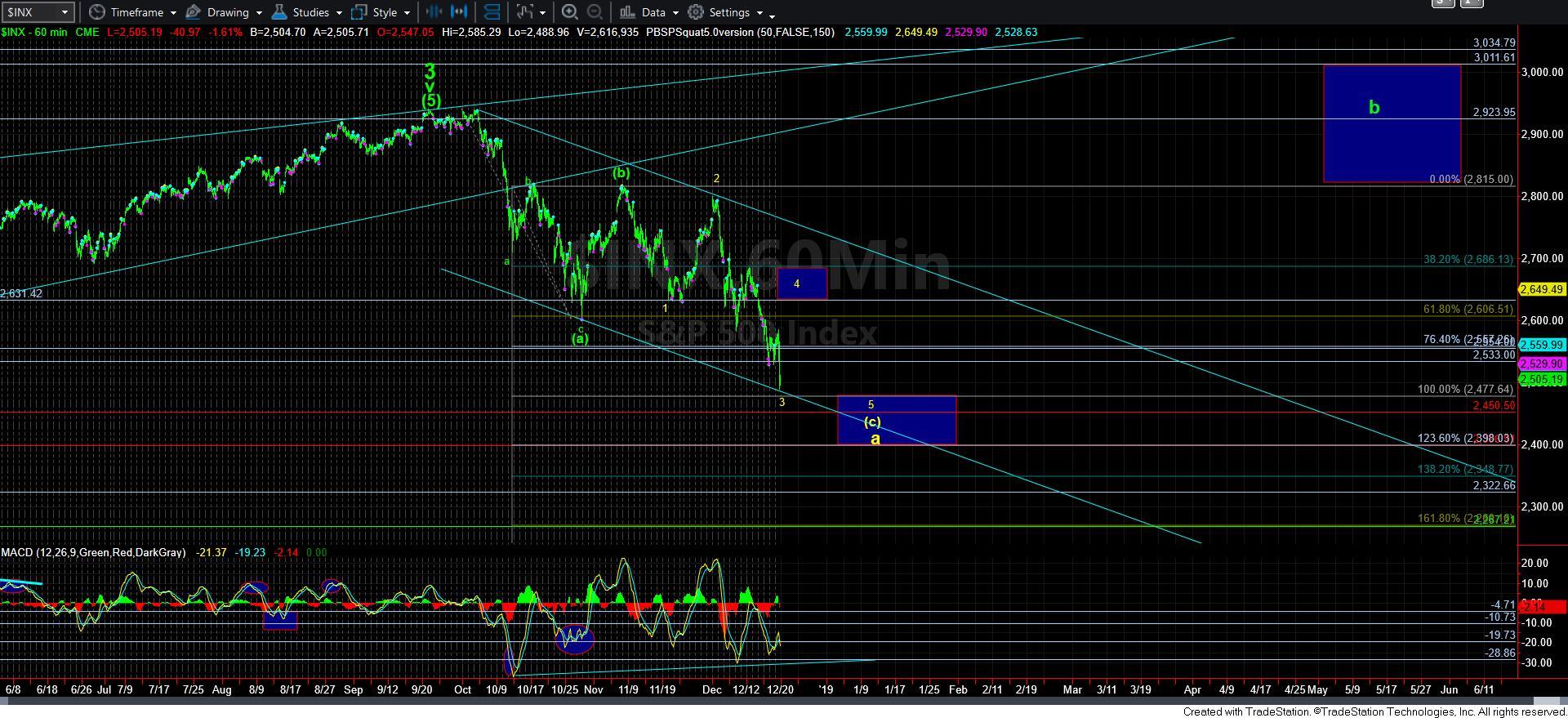

As of yesterday, we were still quite bearish of the market and had no reasonable structure upon which we could rely to suggest any form of bottoming just yet. Most specifically, we expected another drop in the IWM to the lower target box, and the SPX down towards the 2460-80 region.

However, as of today, that COULD change. Clearly, I am not able to “call” for a bottom in here in the market. Rather, I can tell you that we have met the minimum expectations now for a wave 3 in the (c) wave of an a-wave. That means that even if we do strike a bottom over the next day or two, it will likely see a lower low in the 5th wave of the (c) wave of the a-wave.

So, rather than assume a bottom has been struck, let’s work through the analysis.

First, with the break down today, our pivot, which acted as support, now acts as resistance. Most specifically, 2530SPX is now the initial resistance point, and until we are able to move through that level, pressure will remain lower. It would take a break out through 2560SPX now to suggest a larger degree wave 4 is going to take shape, as presented in yellow. But, again, even with that potential, it still suggests another drop to come before this (c) wave of the a-wave completes.

Until 2530SPX is taken out as resistance, there is still much lower potential this market has in store, even in the current drop. So, please do not assume that the market MUST bottom here simply because we have a set up to do so. This market has been extremely treacherous for months now, and we MUST have confirmation that a bottom has been struck in just the 3rd wave here to even assume that we are “bottoming” in the (c) wave of the a-wave.

When it comes to the IWM, we will need to see this (v) of v of 3 bottoming out pretty soon to suggest this is the correct expectation. Most specifically, any breakdown below 129 would likely invalidate this expectation for me at this time. I would prefer to see the 132 region hold as support for wave 3 of the (c) wave, which means we will need to bounce soon.

In the grand scheme of things, the market has been moving to our general expectations. However, the question now is a matter of degree as to where this a-wave will bottom out and begin a multi-month b-wave rally. But, until we begin to see some bottoming signs for just the wave 3 of the (c) wave with a break out back through 2530, immediate pressure will remain down.