Honey-Badger Market Rallies On

Have I wanted to see a standard pullback in a [b] wave before we would rally to 2800+? Heck yea. Is that what the market has given us? Heck no!

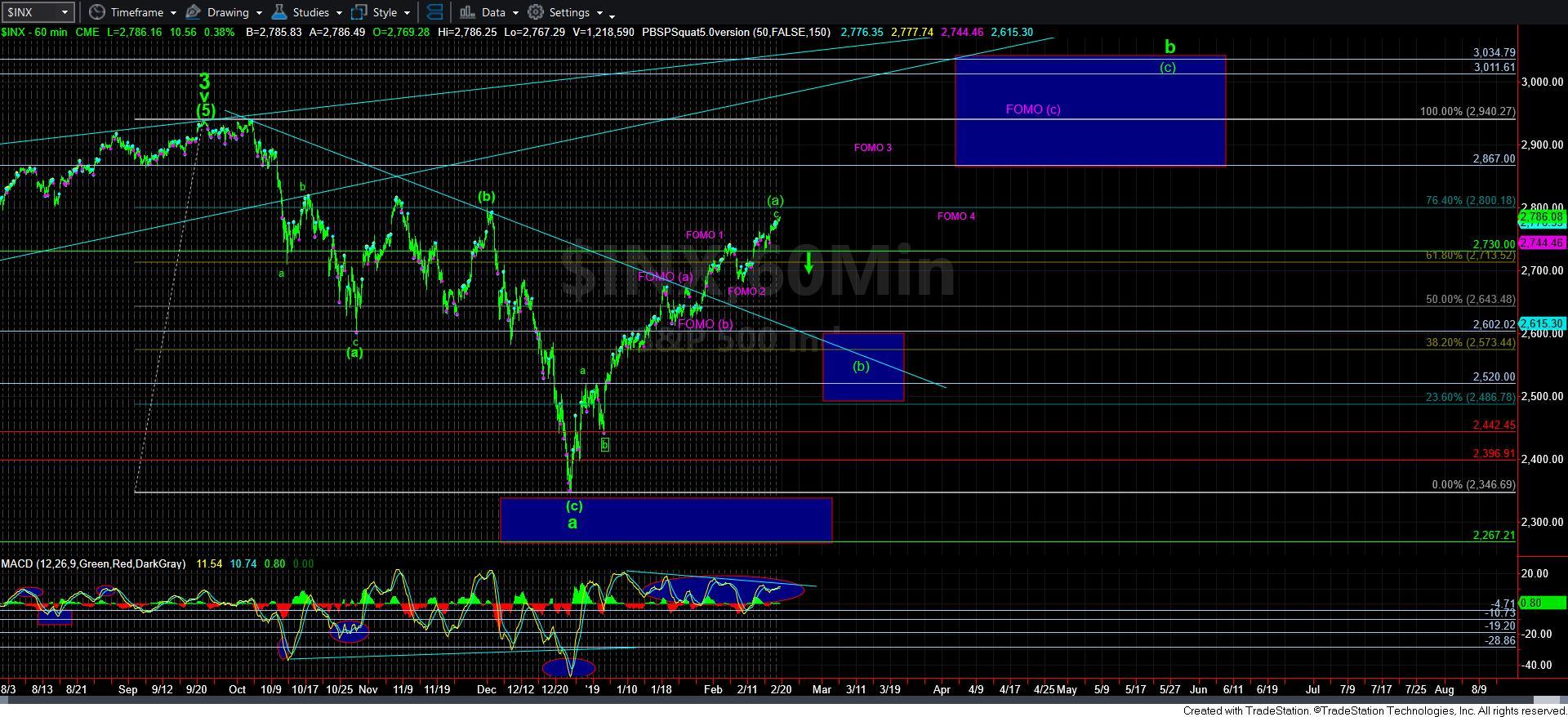

Unfortunately, it is looking more and more likely that this bigger b-wave rally is taking a more direct path. And, it is just about at the point that I am going to toss the green count to the side, and change my alternative to the yellow count presented on the daily chart.

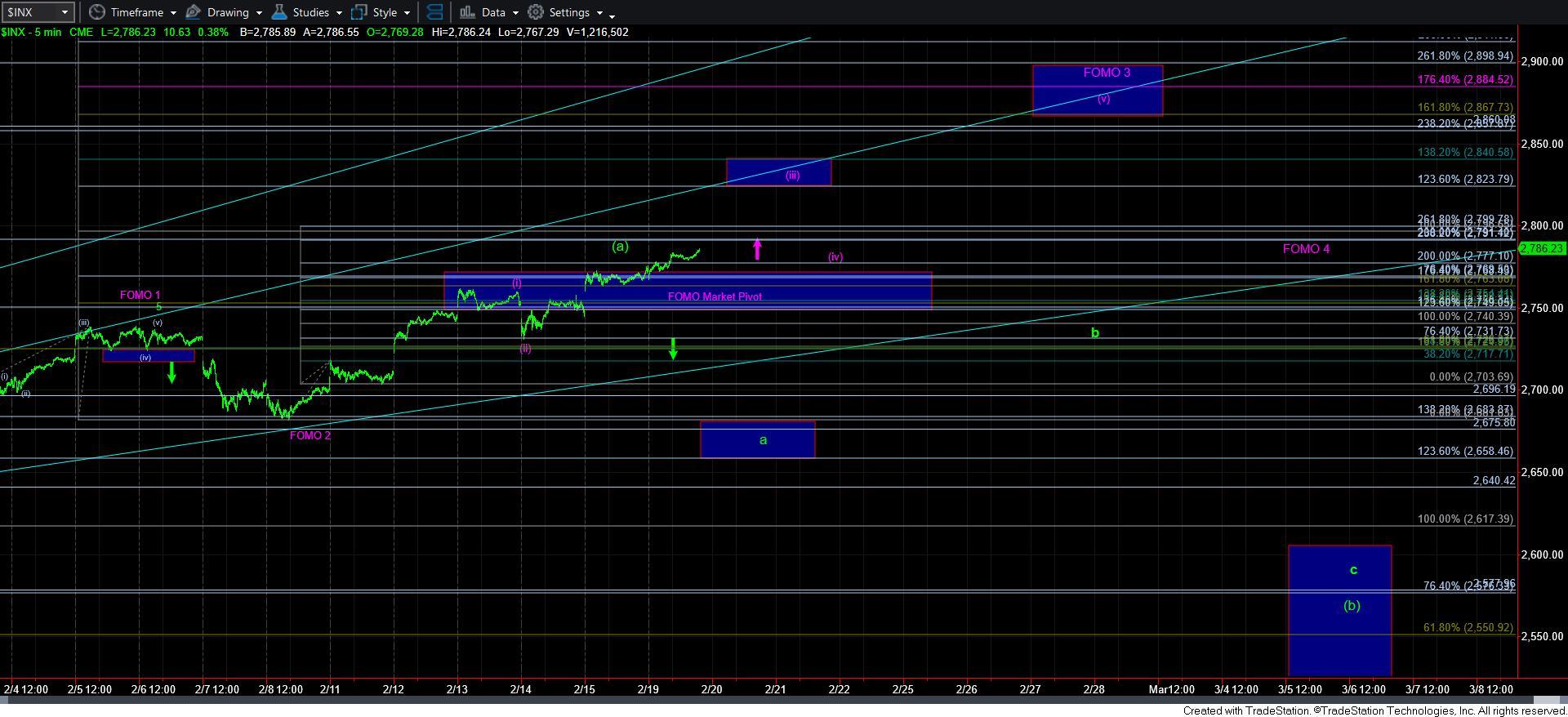

I have tried to be as transparent as possible during this rally, and noted the purple FOMO count several weeks ago as the market started presenting it to me as a stronger potential. And, with the market moving through 2740SPX last week, as I said at the time, it is something I had to adopt despite how distasteful it was to me. Until it actually breaks some support, I have to still view the potential for the market to rally up to the 2900 region in direct fashion as a strong potential at this time.

However, I must warn you that should we continue to rally to the 2900 region in direct fashion, and follow the micro purple count structure until we get there, it would strongly solidify for me that this is a b-wave rally, which will have given us an [a]=[c] structure into that region, despite the [b] wave being so shallow and small. So, in that way, a direct rally to the 2900 region may be a gift, and make it a much more confident b-wave rally. That would be pointing us back down to the 2100-2200 region for the c-wave, as presented on the daily chart.

But, we all know how difficult the market can be. That means I have to constantly be vigilant for a twist or turn the market may provide us rather than making it a much easier b-wave determination with a direct rally to the 2900 region.

For now, the micro support is moved up to today’s pullback low in the 2766 region. And, as long as we hold that level, we continue to look higher to the 2800SPX region, with the more ideal target being the 2820-40SPX region to complete wave (iii) of 3 in the FOMO count.

But, there are two things we are going to do should the market be able to reach the 2800SPX region. First, we will raise support to the 2750SPX region, and, second, we will adopt the yellow count on the daily chart as our alternative to the FOMO count, and toss the [a] wave count. At that point, we will have rallied high enough, and have reached my minimum target set months ago for this b-wave rally. But, in order to adopt that yellow count before we reach the 2900SPX region, we will have to see an impulsive 5 wave structure break down below support to signify wave 1 down for the c-wave.

For now, 2766 is upper micro support, with 2730 support below there. And, if the market is going to 2800SPX, it certainly has a pattern in place right now to be there as early as tomorrow. Should that occur, the floor to the market will be moved up to 2750SPX as highlighted before, and upper micro support will be moved up to the 2770/80SPX region. As long as we remain over 2770/80, we are still in a strong uptrend count pointing to as high as the 2910-40SPX region.

But, as we know, the higher we go, the greater the risks. Unfortunately, due to the direct move higher, we have to continue to analyze the market in the same manner in which we did back in the fall of 2018, which means it will take a break of support before the market makes it clear that higher levels will not be seen before we drop strongly in the next phase of weakness we expect.