Holding The Pivot - Market Analysis for Dec 22nd, 2025

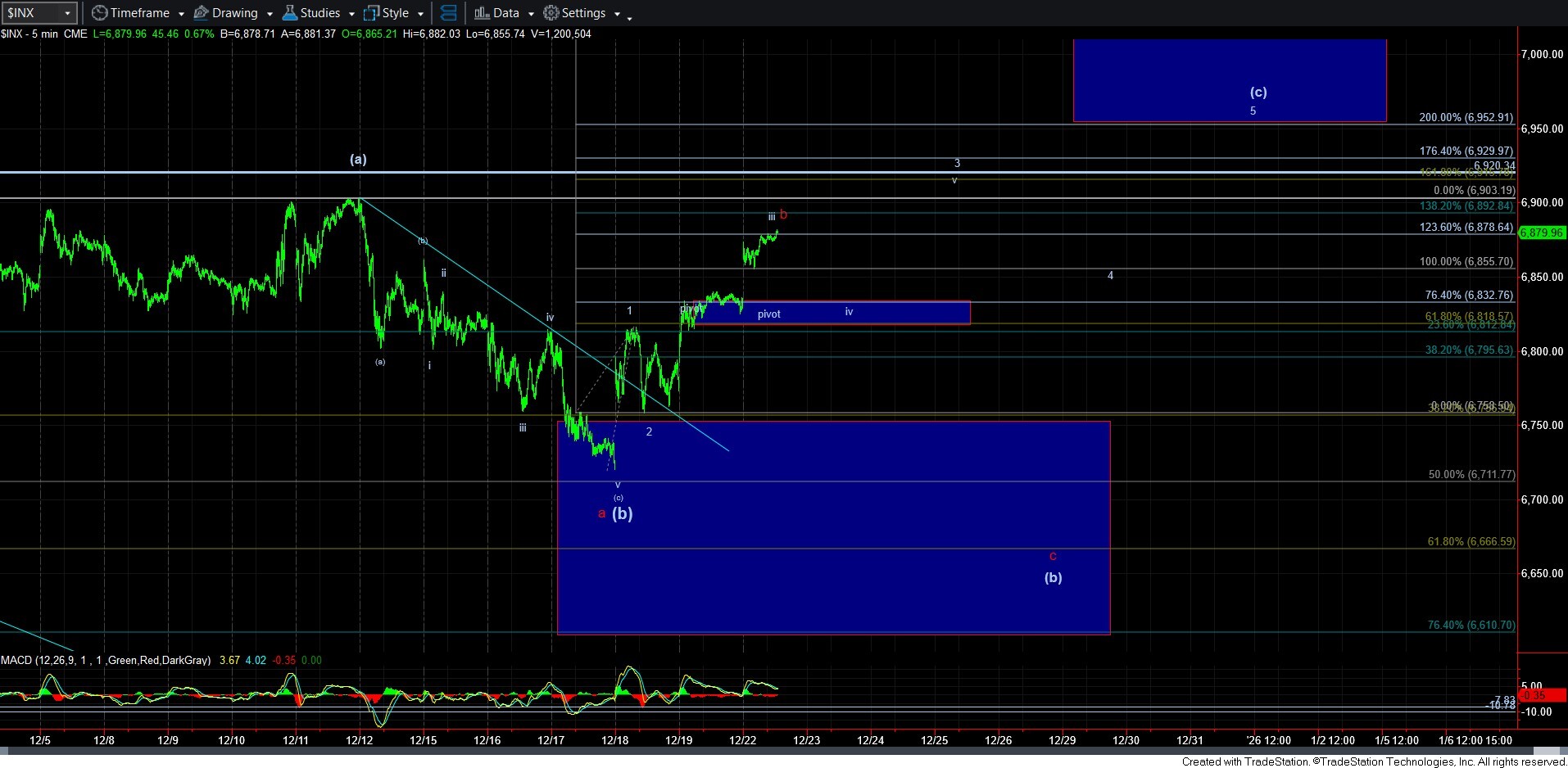

We expected that the market will likely make a decision as to whether it wants to head directly to higher highs early this week. And, the gap up today has now made the pivot on the 5-minute SPX chart our primary focus.

Remember, when the market rallies to the 1.236 extension of waves 1-2, then it is likely that we will hold the .764 extension as support for wave iv if we are in wave 3. And, that is where I believe we are right now within the bullish count. That now means that, if the market has intentions of new highs over the coming week or two, then we will not break back down below the pivot.

So, in the bullish path, I do not think today’s consolidation was enough for wave iv, so I am going to assume we will see a pullback for wave iv. And, as long as it is corrective and we hold the pivot, we continue to look higher back to the prior all-time highs which would be our wave v of 3.

As I also mentioned over the weekend, right now the market is only projecting a marginally higher high based upon the 2.00 standard extension target. However, if this wave iii continues to extend today and into tomorrow, then it will make it much more likely that the market may attempt a push towards that ubiquitously expected 7000SPX region. Remember, we need to see some sizeable extensions within wave 3 to get us there.

In summary, and to keep this really simple, as long as we remain over the 6818-6832SPX region, we continue to look up to at least the 6950SPX region. However, if we see an impulsive break down below that support, then the red c-wave will turn into our primary count, which would mean the (b) wave pullback has not yet completed.