Hitting Our Head On Resistance Again

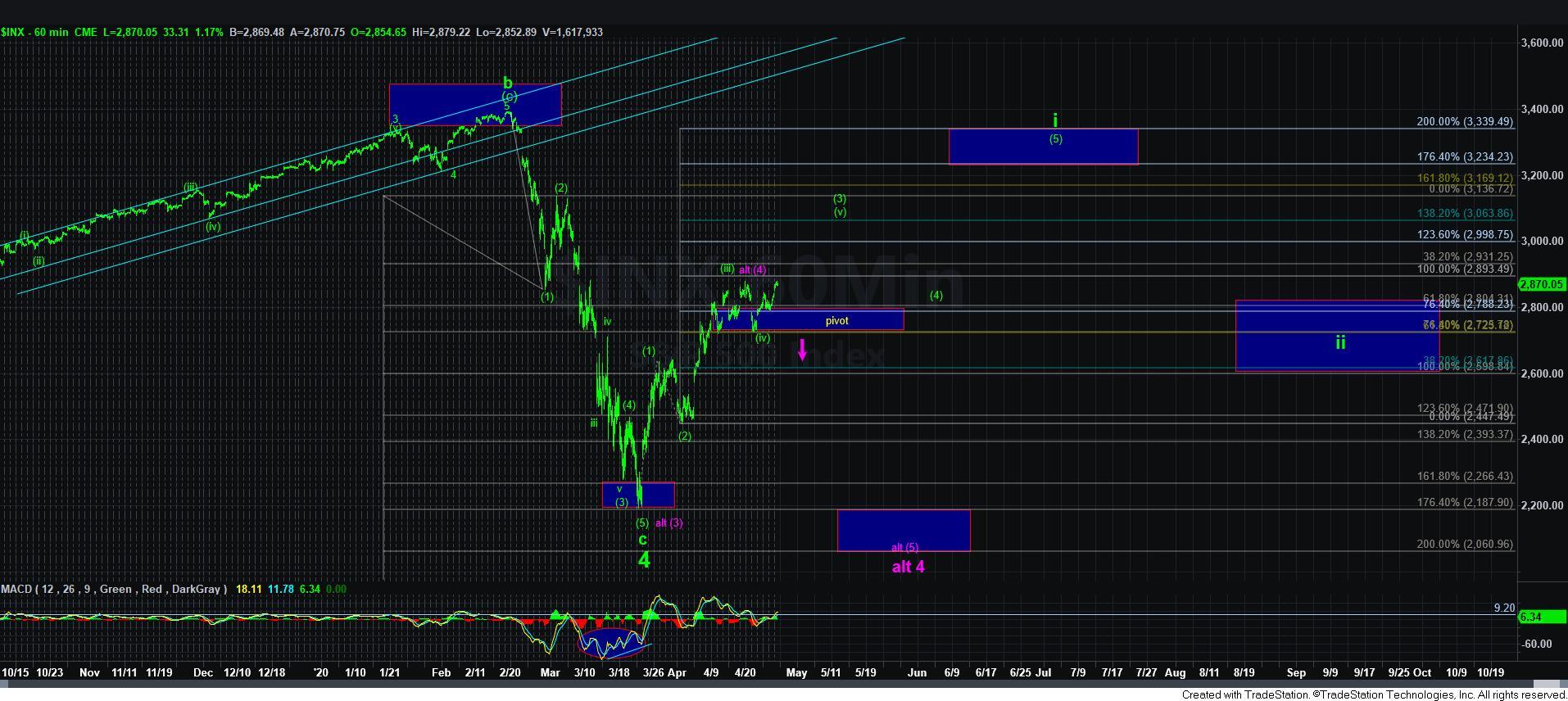

With the market continuing to rally today, we are fast approaching the 2900 resistance region.

But, the main gist of this evening’s update is to highlight the issues I am having with the micro count. If you look at the attached charts of the ES and the SPX, you will see that they both represent resistance overhead, however, the micro counts are a bit different in each chart.

The ES chart suggests we are in wave 3 of iii of [v] of [3]. However, as you can also see, we hit our head on the micro 1.00 extension in that count, which means that the micro pivot must hold for this count to be applicable. And, as long as that micro pivot holds up in the next pullback, then we should be setting up to break out over the 2900 region sooner rather than later.

However, the SPX micro count would suggest the high struck today was wave 1 of iii within wave [v] of [3], and the next pullback is wave 2 of iii. Yet, such a deep pullback would break the micro pivot in the ES, which could be problematic. You see, the ES can also count as a 3-wave rally, and that is presented in the yellow count presented on the ES chart. Should that count take hold, it can open the door to drop back down to the 2707ES region, where a=c, as shown on that chart.

So, I am trying to show you the good, the bad, and the ugly in this outline of the smaller degree count. And, due to the varying structures in the two charts, I am really unsure how it resolves. But, overall, as long as the ES does not break the micro pivot, I have no reason to view the immediate structure other than bullishly. Below that support, we can see something a bit more bearish take shape this week.

In summary, the bulls certainly have a nice set up with which they can choose to break out from our battle-zone this week. But, for most people, there really is no reason to play this aggressively on the long side, as there is going to be plenty of room after we break out to play the long side to the 3060SPX region.

Moreover, even if you choose not to play the long side just yet, you will still likely have the opportunity to add long positions once all 5 waves of wave i complete in the coming months during a wave ii pullback later this year. And, since that potential pullback can take us even below the levels we are at currently, you really should not be missing out on much, as the true opportunity on the long side in the market will be for wave iii of 5, which will not likely begin in earnest until later this year, and take us well into 2021. So, one really does not have to take a tremendous amount of risk while the bulls and bears battle this out.