Have We Put In A B Wave Bottom?

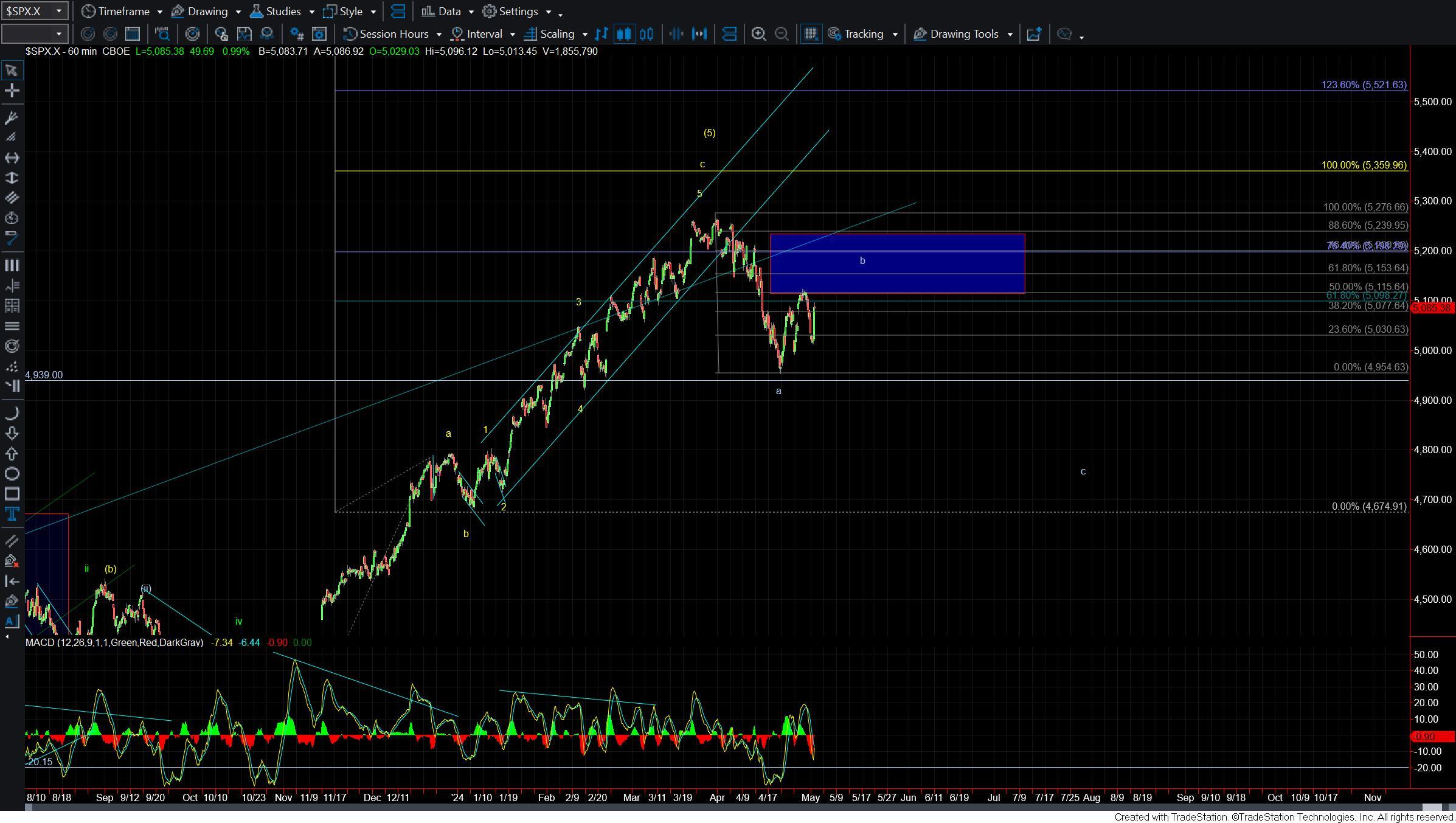

After moving lower yesterday we saw the market move up sharply after the FMOC announcement and we are still sitting near the highs at the time of this writing. While this is certainly opening the door for a bottom of the wave (b) to be in place we still are not out of the woods just yet and will need to push through a few more levels of resistance to confirm that we are indeed pushing higher in a larger wave (c) of b.

Drilling down to the five minute chart we can see that the SPX is currently testing the 76.4 retrace level of the move down off of the 5123 high. If we are able to push through this level at the 5097 level then it will make it more likey that we are indeed going to see a wave (c) of b up under the white count before turning lower once again.

If we are able to hold that level and then turn down of five waves then it would open the door for this to have topped in the purple wave (ii) of a larger wave c down. We still would need further confirmation with a break of the 5013 level and then ultimately under the 4954 level.

Bigger picture nothing has changed and we still are likely following the larger wave b after an initial wave a down as laid out per the 60min chart but there is still the question as to whether we have already topped in all of that wave b or if we still need to push a bit higher before that top is indeed seen.