Have The Bulls Stepped Up “Enough?”

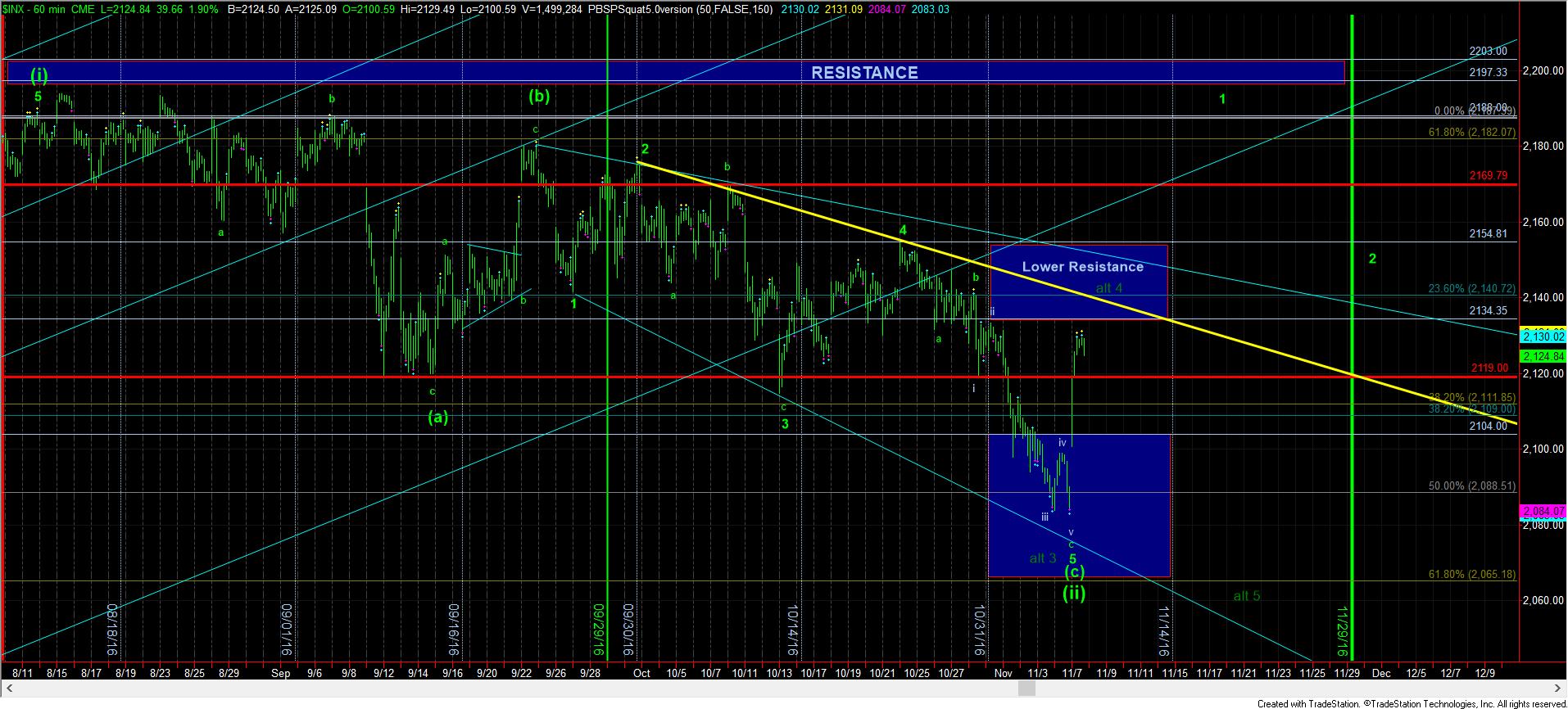

Today, the market did marginally take out the 2125SPX resistance level, but, due to the gap, it has not given us a “wave structure” upon which we can make any reasonable determinations just yet.

Normally, when we see a large gap in the SPX, I will go to the futures to fill in the structure of what occurred in the SPX gap. But, when the ES also gaps 30 points, it leaves us questioning what the structure is within that gap.

Due to the lack of wave structure off the lows, I have to resolve any question by patience and resistance. If the market has truly bottomed already, it has begun a rally in EXACTLY the manner in which the completion of an ending diagonal should. One can certainly consider this reaction as the “violent” type of move in the opposite direction we see at the conclusion of an ending diagonal. But, without the structure off the lows, there are too many questions I have.

So, I am going to be a bit more patient and look towards our lower resistance region. For now, the heart of the resistance seems to be the 2135-2140SPX region next. I would want to see us continue this move through that region as we move towards 2180SPX to complete wave 1 of (iii) off the lows. And, remember, if one goes to the sidelines here, the market will “likely” come back to the 2140-2160SPX region in a wave 2 pull-back once wave 1 has completed. Often, when we break through resistance, the market comes back and tests that broken resistance from above before it continues in its larger degree move higher, and that is what I am expecting right now. It would also set up a very nice inverted heads and shoulders pattern to match that 1-2 structure.

At the same time, I have to note that the IWM suggests that the potential for a lower low is not immaterial. I know that seeing a move like this can certainly suggest that the low is in place, but I am just going to be a bit more cautious until wave 1 has completed. Remember, sometimes these diagonals – just like triangles – can continue longer than we normally expect.

And, isn’t it quite typical of the market to have a major catalyst occurring this week to help us along in our resolution of the count? So, after such a large move off the lows, it may now be time to move to the sidelines and let the market resolve itself in this region. It is not likely that we are heading to 2350SPX by a single gap up overnight. We will have other opportunities to get on the train, so I am going to be a bit more patient right here. And, lastly, anyone that is using options to trade this move, it is advisable to wait until after the upcoming event this week due to the elevated cost of volatility in the options pricing.