Has the Market Put in a Local Top?

After several days of upside follow-through, we finally saw the market stall and push modestly lower this afternoon. That raises the immediate question: have we put in a local top, and if so, what does that mean for the bigger picture as we move further into the new year?

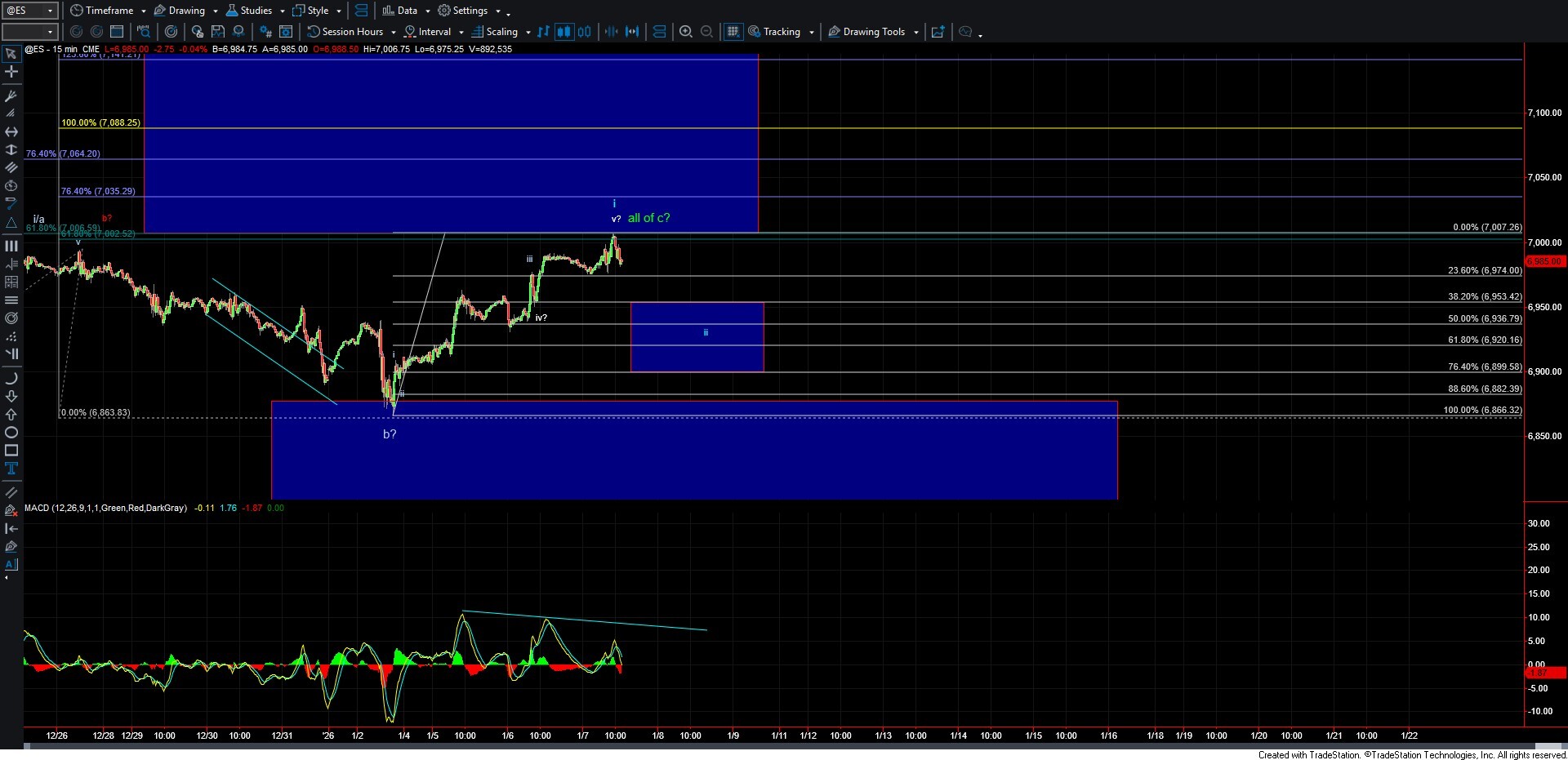

As I’ve been discussing in the room, the first level I’m watching is 6974 on the ES. A sustained break below that level would be our early indication that a local top may be in place. Should that occur, we still have more meaningful support just beneath, coming in at the 6953–6899 zone.

This zone represents the ideal support retracement area for a potential wave ii of a larger wave c, which I currently have marked in blue on the charts. If price holds within this region and we see a clean, impulsive five-wave advance off that support, it would suggest the market still has unfinished business to the upside, with the 7150–7250 region as the next major target in the weeks ahead.

On the other hand, a decisive break below the 6953–6899 support zone would significantly shift the outlook. That scenario would open the door to a larger degree top, consistent with the green count. From there, I would be looking for a break below 6800 to provide further confirmation that a higher-degree top is firmly in place.

For now, there’s no need to get ahead of ourselves. We’ll take this one step at a time and let price guide us. The key is how the market responds as we approach the first support zone below.

At this stage, patience is required. We wait, we watch, and we let the market show its hand in the days ahead.