Has Wave 5 Down Begun?

With the market striking the lower end of our target zone for a 4th wave that we noted over the weekend (1945SPX), the potential certainly exists that wave 4 has completed. But, I want to re-publish a post I made earlier today, as I think it is very important for an understanding about how it is very hard to trade out of a 4th wave:

Allow me to take a moment to provide you real time perspectives as to how I work within a 4th wave.

In an ideal sense, I have always wanted to see a completed a-b-c structure to assume that a 4th wave has completed. However, most of the time, it is not that simple. Rather, 4th waves are exceptionally complex structures, and take many “unexpected” twists and turns before they complete.

So, my job as an analyst to contemplate those “unexpected” twists and turns so that they are not entirely unexpected.

Right now, while the SPX has struck my minimum target for this 4th wave, I cannot say we have a solid 5 wave structure in place for the (c) wave.

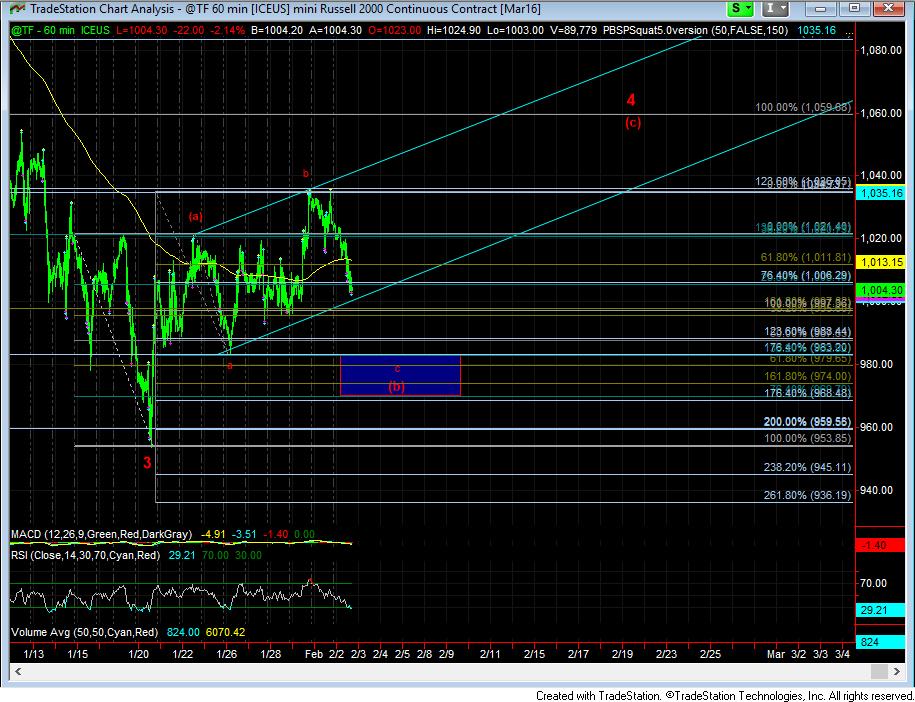

This issue is most clearly evident in the attached TF chart. As you can see, it really counts best as only 3 waves. And, to make matters even more complex, any 5 wave structure would be an overlapping ending diagonal, which does not provide us a lot of confidence that a 5th wave will actually be seen.

But, since we do not have a 5 wave (c) wave completed, a break down MUST have us considering alternatives as to how this larger 4th wave can be more complex . . . ie . . .the “unexpected.”

So, if you look at the TF chart, you will see the expanded (b) wave labeled quite clearly, which can provide us with the whipsaw potential normally seen in complex 4th waves. While it is certainly possible that we simply drop to the lower lows to complete the 5th wave, we really need to be VERY cautious about this type of set up when a completed 5 wave (c) wave does not provide us a clear end to a 4th wave.

So, with today's break below support of 1910SPX, it has opened the door to the commencement of the 5th wave lower. But, based upon what I just wrote, I am going to be staying on my toes in case the market chooses to provide us a “twist” for an extension to this 4th wave.

For now, we need a break down below 1895SPX to open the door to the 1835-1850SPX region, which has been outlined on the attached 5 minute chart. And, 1910SPX is now overhead immediate resistance.