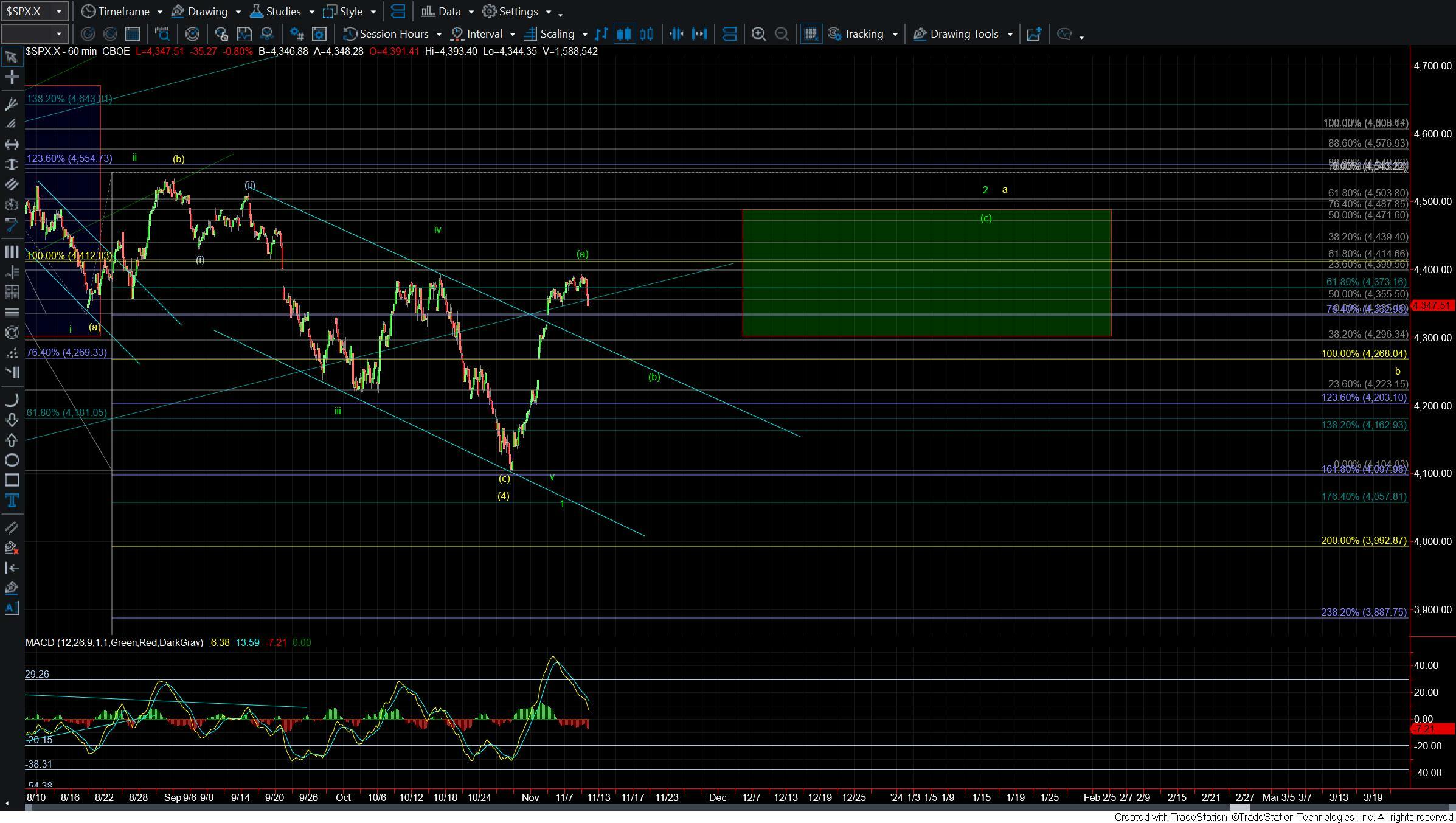

Has The Market Put In A Local Top?

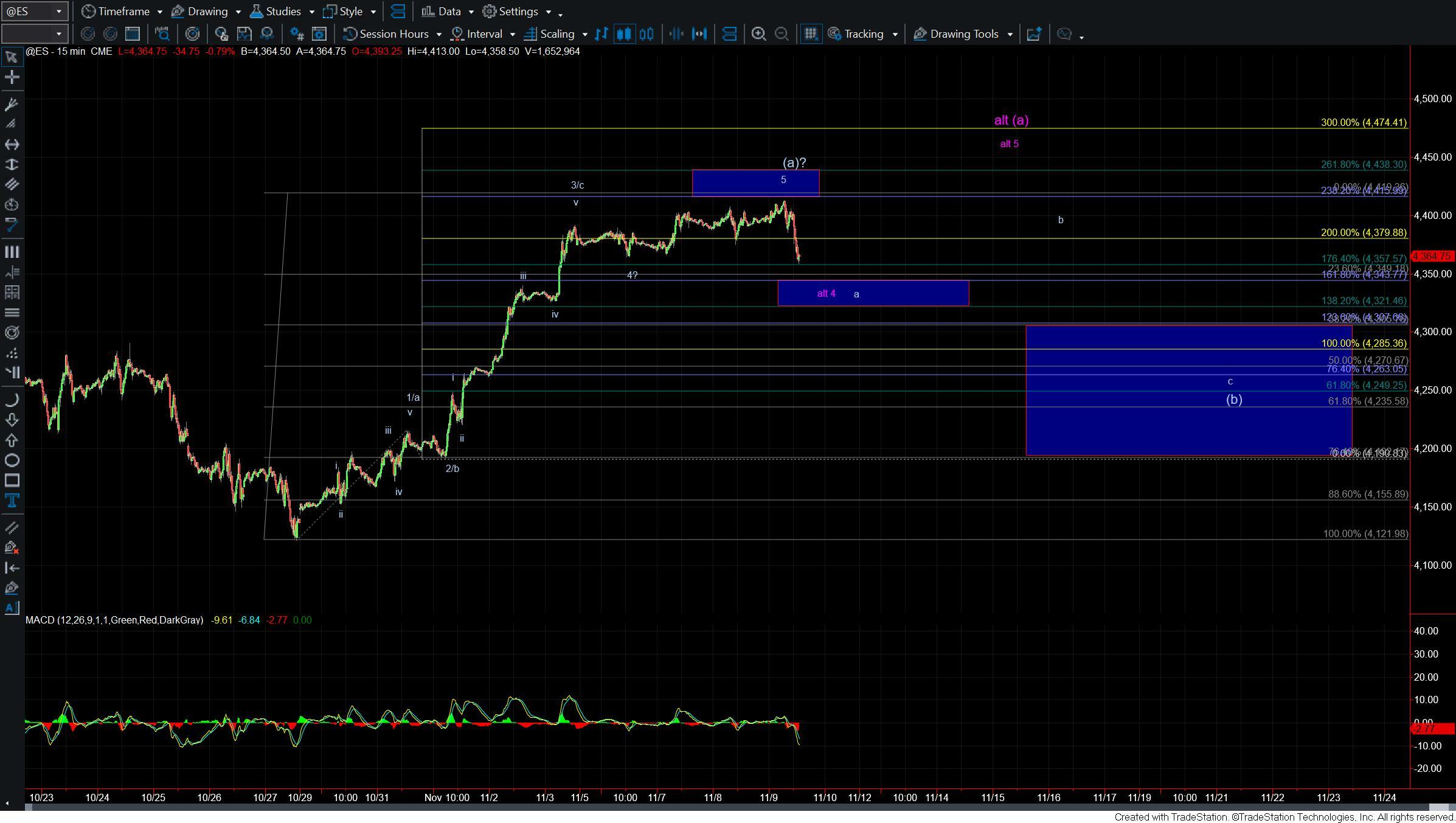

Today we saw the market finally pull back after seeing an extraordinary and impressive push-up off of the lows that were struck on October 27th. At the end of the session, we broke under the upper level of support that I had been watching on the ES for several days which is giving us an early signal that we have likely put in a local top in the larger wave (a). We do still have a bit more work to do to the downside to further confirm a top but with today's pullback and break of the upper support level I am leaning towards the market having put in a local top in the wave (a) which now has us looking for a wave (b) pullback before pushing higher again into the end of the year.

Drilling down to the 15-minute ES chart I am now watching the 4343-4321 zone as the next support/pivot level. So while the drop off of the highs is certainly a good initial signal that we may have put in a top in the wave (a) that 4343-4321 level will act as the next key pivot/support zone to break to give us further confirmation that we have indeed topped in all of the wave (a). If we are unable to break through that zone then I still cant fully rule out seeing yet another higher high to finish off the wave (a) with this move down still being a larger wave 4 of the wave (a) but moving through that zone would firmly put us in the wave (b) down.

Assuming that we have topped in the wave (a) support for that wave (b) would come in at the 4307-4190 zone. As long as that zone holds then we still have the setup for this to push higher into the end of the year for at least a larger wave (c) up and a potential push to new all-time-highs.

So while today's pullback is a good start to a potential top keep in mind that the market was extremely overbought on the shorter timeframes and this pullback is due. We do have what counts as a fairly clean five up so as long as we hold the larger degree support zone below the market is still set up to push higher into the end of the year. We will need to keep an eye on the structure and price levels of that next leg up to give us a better idea as to whether we will indeed see new all-time highs or whether we are simply setting up a larger bear market rally.