Has A Larger Pullback Finally Started?

I want to start this update with an issue I am having in the IWM. As we have been tracking it closely, we have seen wave iii of 3 take us to the 1.382 extension of waves 1-2, which is a bigger than standard extension for wave iii of 3. Yet, if we have indeed topped in wave 3, it came up short of its 1.618 extension. This is a bit unusual as it provides us with a relatively small wave v of 3.

For this reason, I am leaving the door open for the blue count presented on the 60-minute chart. This [i][ii] structure would point us north of 215. However, the rally thus far off the morning low is looking quite overlapping and corrective. This has me leaning towards the potential that wave 3 is indeed done. Should I see greater evidence of the blue count, I will post it in the trading room as an alert.

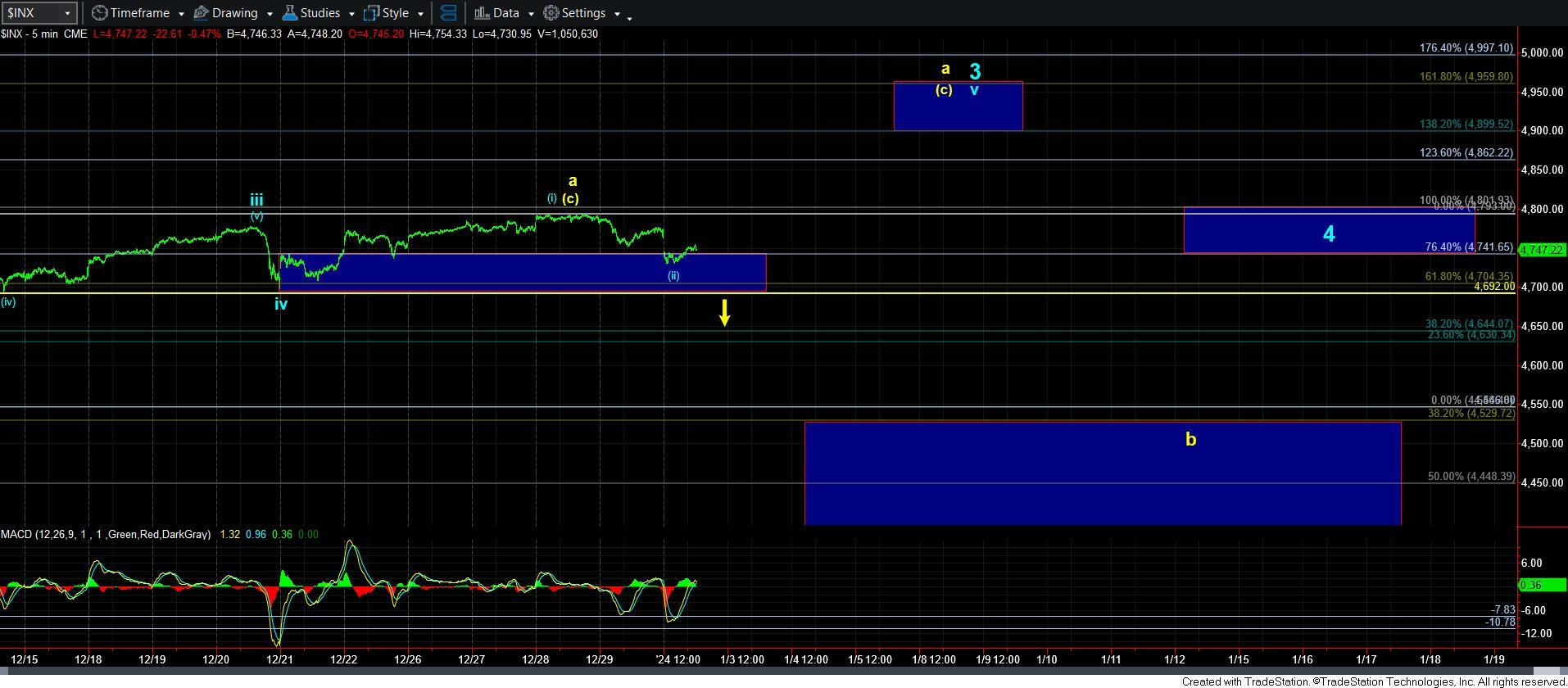

This now brings me to the SPX. And, as I said over the weekend, the SPX must break down below 4694SPX to place us squarely in the yellow b-wave pullback. Until that happens, I am going to track a similar [i][ii] blue structure as I just discussed in the IWM.

As it stands right now, due to the overlapping rally off today’s low in the IWM, I leaning towards the larger degree pullback has begun. That would mean wave 4 in IWM and the yellow b-wave in SPX. However, should I see evidence to the contrary, I will post it in the trading room.