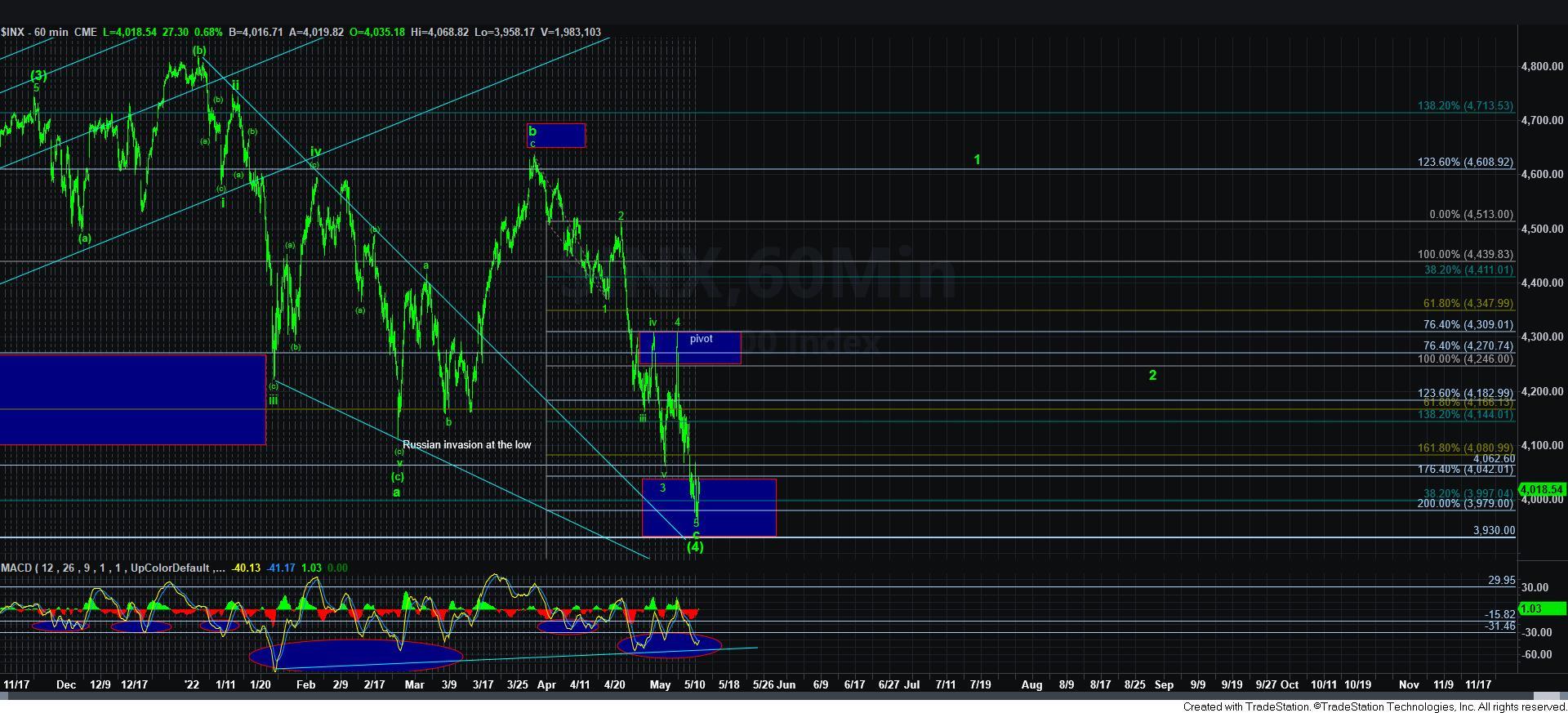

Good Try - Market Analysis for May 10th, 2022

Today, the market gave us to two good tries to break out off the lows. But, we have yet to be successful, as we continue to test support below.

While I provided you with the yellow count potential, I cannot say that the current up/down action we are seeing would support that pattern. But, as I said, if we see a break down below 3900, I have no choice but to adopt it base upon price.

In the meantime, I am now considering whether this entire structure in wave 5 is an unusual form of an ending diagonal. It certainly is not standard in form considering the larger initial move down off the 4310SPX region, but the rest of the structure does support that potential.

In the meantime, if this has not yet completed testing support, we still could see one more test of the 3930/50SPX region. And if this is an ending diagonal, then it should hold and turn us back up. If it is not, well, then the yellow count will certainly rear its ugly head.

As I was writing this update, I was watching to see if the market could complete 5 waves up off today’s low. And as of my publishing this update, it has not. So, without 5 waves up, I have no clear initial indication that the bottom has indeed been struck. And, I still am forced to hold my hedges where they are.

In the meantime, I am still trying to retain a bullish stance as long as this support continues to hold. But, if not, well, then the door opens to a potential drop down to the 3700SPX region. While it has not been even within my radar until recently, I have to be honest with the potential based upon where we now stand. But, for now, I am still maintaining an immediate bullish bias as long as we hold support.