Gonna Keep This Simple

While I am not a fan of how we got here in the micro structure, as the structure for the series of 1’s and 2’s to this point was quite less than ideal, the market has pushed us into a Fibonacci Pinball structure for a potential waves 3, 4 and 5 to complete the rally to 4300+ we have been expecting ever since we bottomed in October.

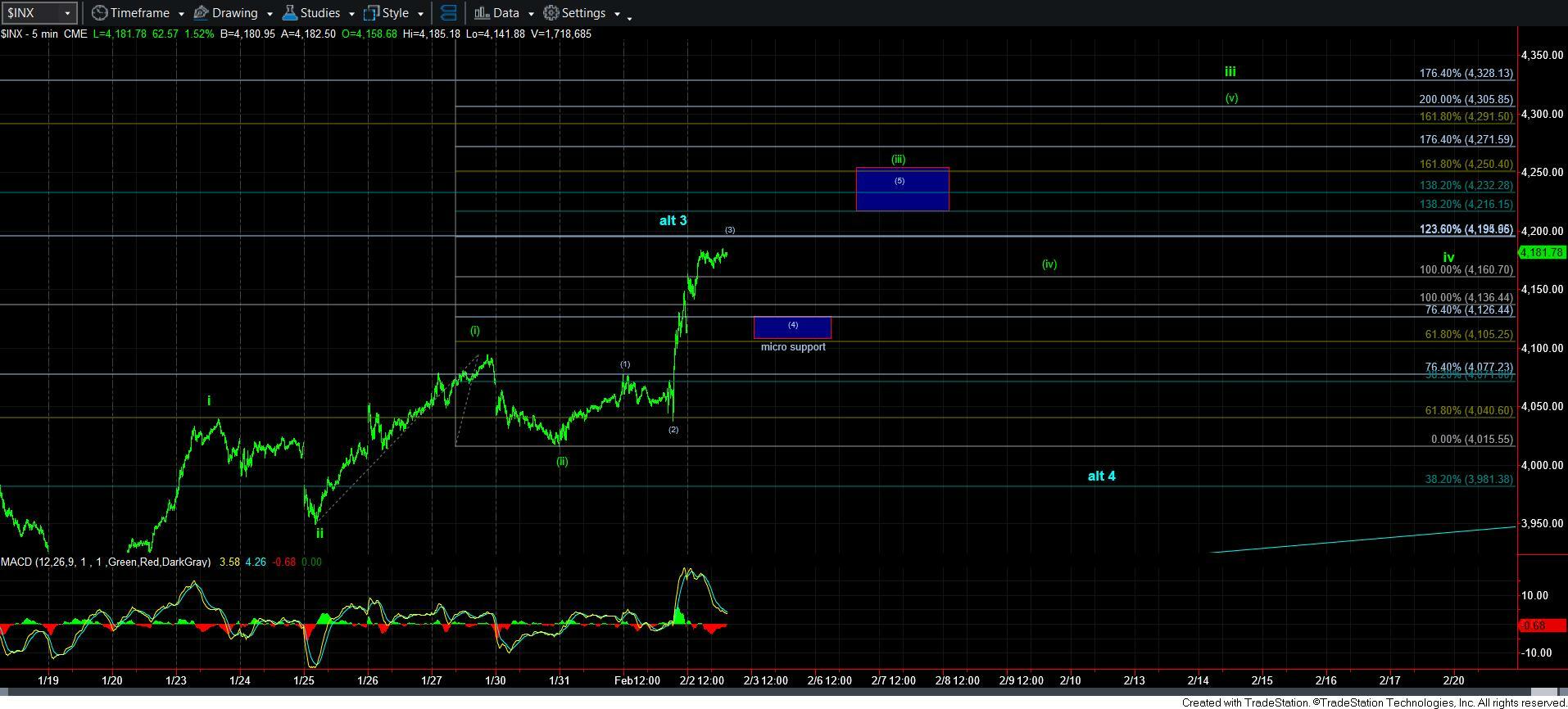

So, let me make the current analysis very simple. Assuming we are in a larger degree wave 3 within the [c] wave, then the structure breaks down that we are now completing wave [3] of [iii] of iii of 3. If you look at the 5-minute SPX chart, you will see that annotation.

If you remember, wave [3] of [iii] often targets the 1.236 extension of waves [i] and [ii]. That is the 4195SPX region. So, as long as the market continues to respect that resistance, then I am expecting a wave [4] pullback towards our micro-support region note on the 5-minute SPX chart.

Clearly, a break out through that resistance would suggest that I may be one wave degree off on my micro-count, and that we are already heading to our next higher target box for wave [5] of [iii].

As the market continues higher, we will continue to adjust our support to represent the appropriate region for that particular wave degree. For now, that is 4105-4126SPX, the .618-.764 extensions of waves [i] and [ii].

If you take note as to how these extensions will develop in this structure, it is actually pointing us to the 4290-4328SPX region to complete just wave iii of 3. This would also suggest that wave 3 can extend towards the 4387SPX region, with potential that we may still rally up to the 4400-4500SPX region to complete the [c] wave.

In the bigger alternative potential noted in blue, should we break down below our support, then I am going to have to assume that the [c] wave is taking shape as an ending diagonal, with the break down being a wave 4 in that diagonal. Keep in mind that a traditional target for a 3rd wave in a diagonal is the 1.236 extension of the first two waves, which also points us to the 4195SPX region. For this reason, should we continue to extend beyond that level, it makes the potential for this alternative count lesser and lesser likely. But, should this alternative take shape, then it will likely top us out just north of the 4300SPX region.

There is another point I would like to make to those that follow technical analysis. I know many of you think we are overbought on a number of indicators. However, I want you to remember that the primary count is a 3rd wave. So, I want to highlight a mistake MANY make. Just because indicators go into "overbought" territory does not mean we will certainly see a pullback. The hallmark of a 3rd wave is that overbought REMAINS overbought. The relevant point you have to track is support during a 3rd wave . . nothing matters more IMHO.

So, please continue to focus upon whether pullbacks continue to hold support. And, this wave iii proves itself, you can choose to buy a wave iv pullback for a 4-5% rally in wave v of 3. Also, those that are more aggressive can even buy a wave [4] and wave [iv] pullback, with the appropriate stops set at just below our support regions as we move through this progression.

The main point of this update with which I want you to walk away is that as long as the outlined supports hold on pullbacks, this market is likely heading to 4400+. Should we break a support, then it would suggest we can top out in the 4300SPX region in an ending diagonal to complete this [c] wave rally.

Lastly, once we do complete this [c] wave rally, I am going to strongly suggest raising cash again. You see, if this is a [c] wave completing a larger b-wave, we will be setting up for a potential c-wave decline later this year which could be quite devastating. And, if the market begins the decline after the completion of the [c] wave with a CLEAR 5 wave impulsive structure, then that is going to be a strong confirmation that this is what we will see later this year.

However, if the market declines from the completion of the [c] wave in a corrective manner, then we can begin to consider the potential for the larger degree yellow count pointing us to new all-time highs.

I am simply writing this now to mentally and emotionally prepare you for what I foresee because many will likely become VERY bullish during this rally. And, I want you to keep your emotions in check to remember the next bigger step in the process.