Going Down Sometimes Help Going Up

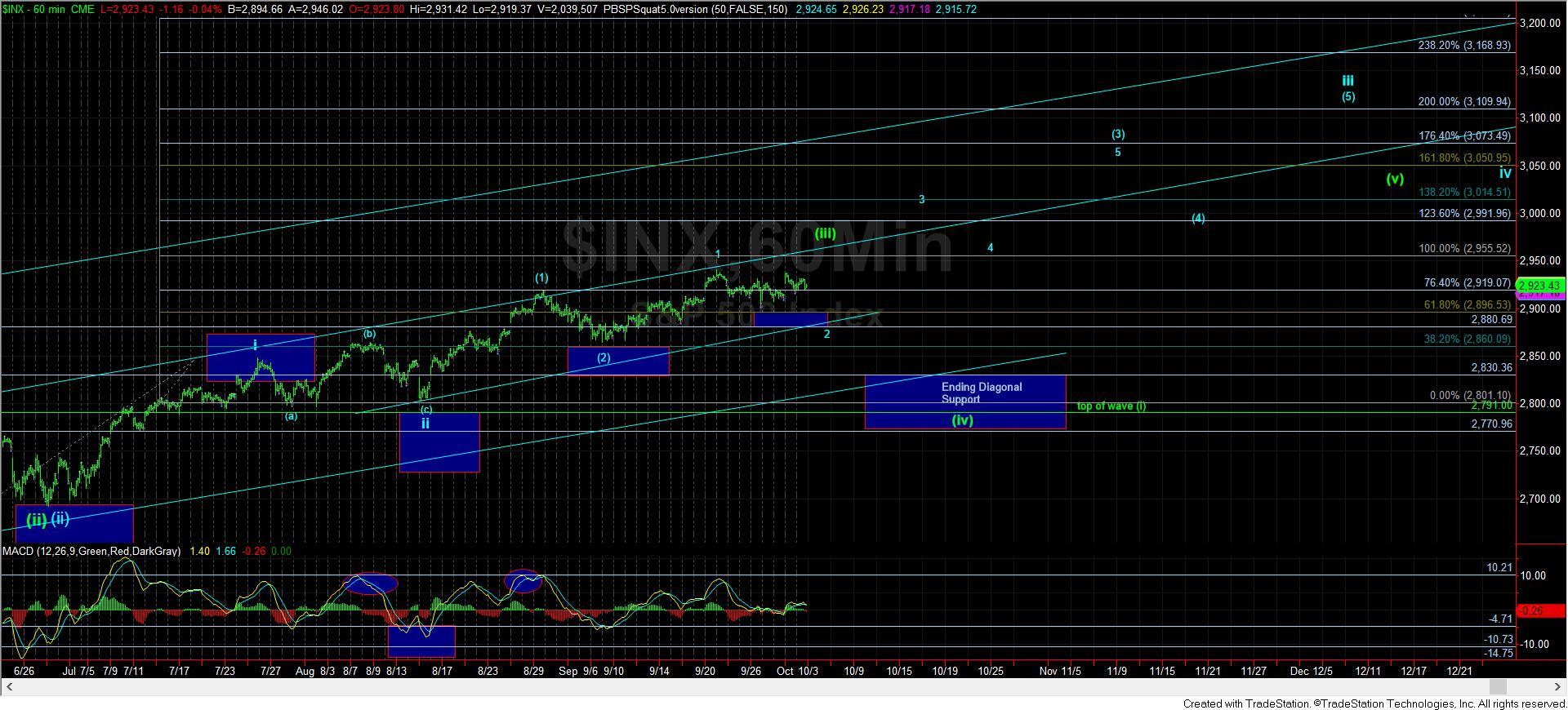

With the market rallying up to resistance and turning down, it still has left the potential for a bigger wave 2 to take shape in the more bullish count. While Garrett still views the ending diagonal as his primary count, the market has still not ruled out the potential to rally to 3225SPX just yet.

In the current structure, should the market continue higher this week off the recent pullback low, it would make the diagonal Garrett is following much more likely. However, if the SPX can pullback one more time in the c-wave of wave 2, it would still leave the door open for the heart of a 3rd wave to take hold in the coming months. But, as I have said several times last week, the market is going to have to carefully thread this needle, as it does not have much room for error in the current set up.

Moreover, it does look like the IWM took the cue to drop in the c-wave of its potential wave (ii) as well, as I outlined last week.

So, I am going to reiterate my perspective again. As long as we remain over 2880SPX, the market can still rally to 3225SPX. However, if it should break below 2880SPX or if it should break out towards 2950+ and then break back down below 2920/30SPX, that would place us squarely in the ending diagonal that Garrett has been tracking as his primary count. Until either of those events occur, I am still giving the market the opportunity to prove itself.