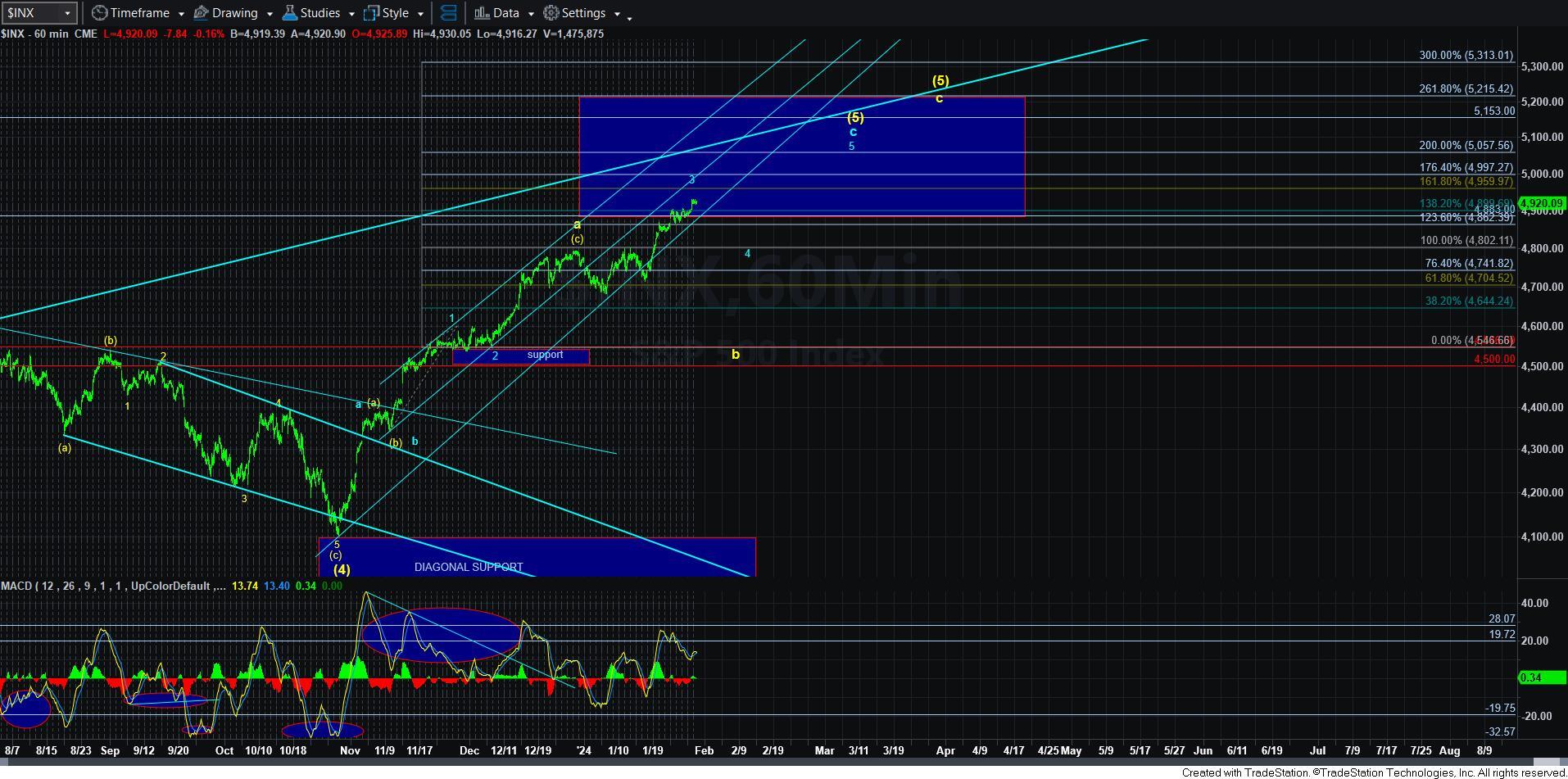

Getting Closer - Market Analysis for Jan 30th, 2024

With the break-out yesterday, the market seems to be well underway within what I am counting as wave [v] of v of 3 in the blue count. Support is now moved up to the 4899SPX level, and as long as pullbacks hold that support, I am still targeting the 4955-4960SPX region.

The one thing that may cause us to come up a bit short of that target is if this morphs into an ending diagonal for wave [v]. And, that would mean we would test the 4900SPX region again in a 4th wave within the ending diagonal, and overlap with the first wave within wave [v].

But, for now, I am trying to look higher in a more direct fashion, rather than the ending diagonal, which I am only viewing as an alternative.

I have also cleaned up the 5-minute SPX chart so that you can see the bigger picture a little more clearly. Once the market completes this wave 3 after the current rally completes, I the standard expectation is for a return to the 4800SPX region for wave 4. And, of course, should we break the support box on the 5-minute chart on the next pullback, then we will have to move into the alternative yellow count.

For now, the market seems to be attempting to complete this c-wave of wave [5] (as can be seen on the 60-minute chart) in a more direct fashion. And, until the market tells us otherwise, this is the path I am following. And, 4740-4800SPX is going to be our guiding support.