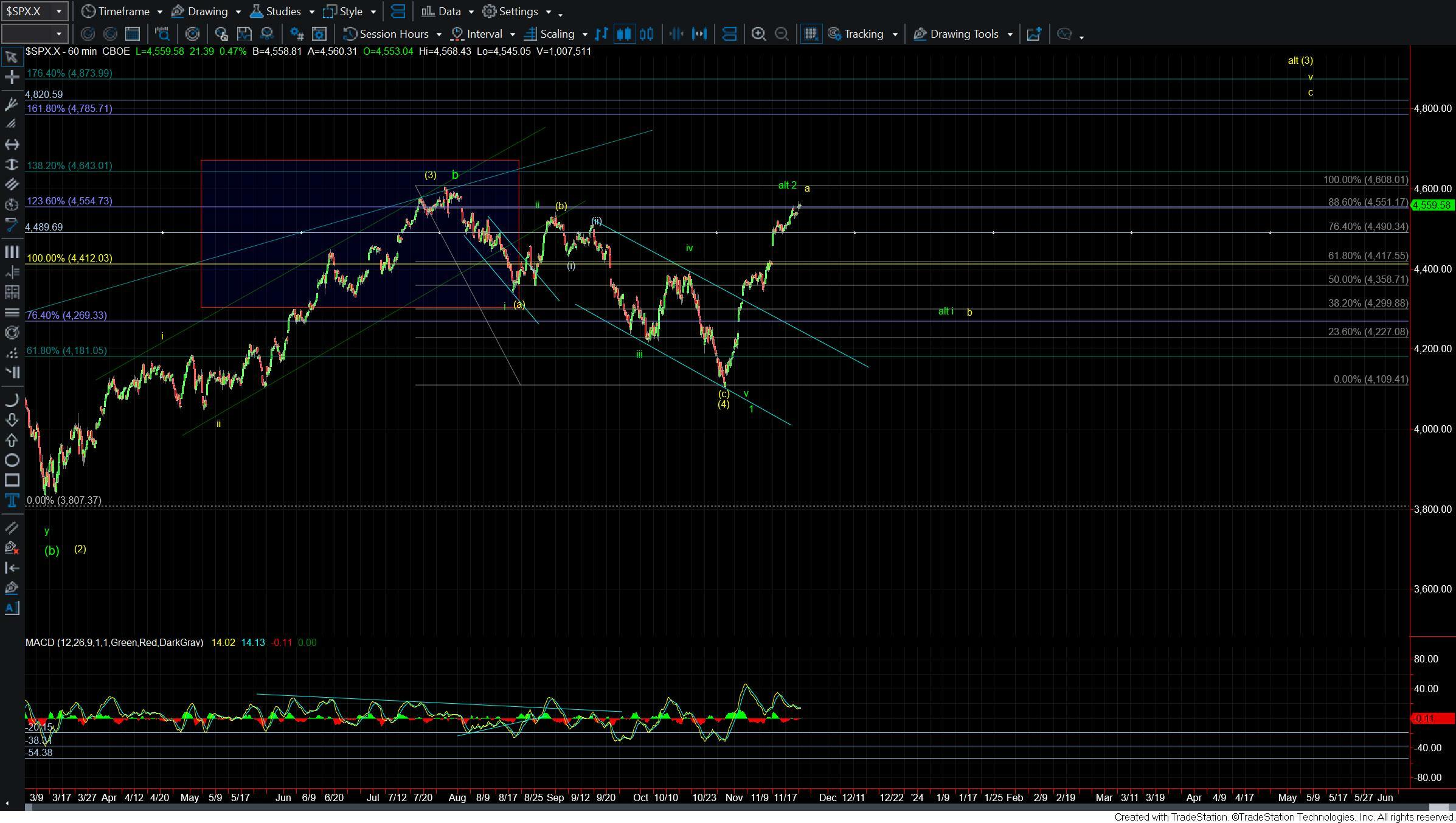

Filling Out The Pattern

Today the market pushed higher after holding micro support over the past several days. This push to new highs has given us a potentially full count, down to the most micro of levels. With that potentially full count, the market is now in a position in which we can see at least a local top at any point in time. We do however still need to break some key support levels to give us initial confirmation that a top has indeed been struck.

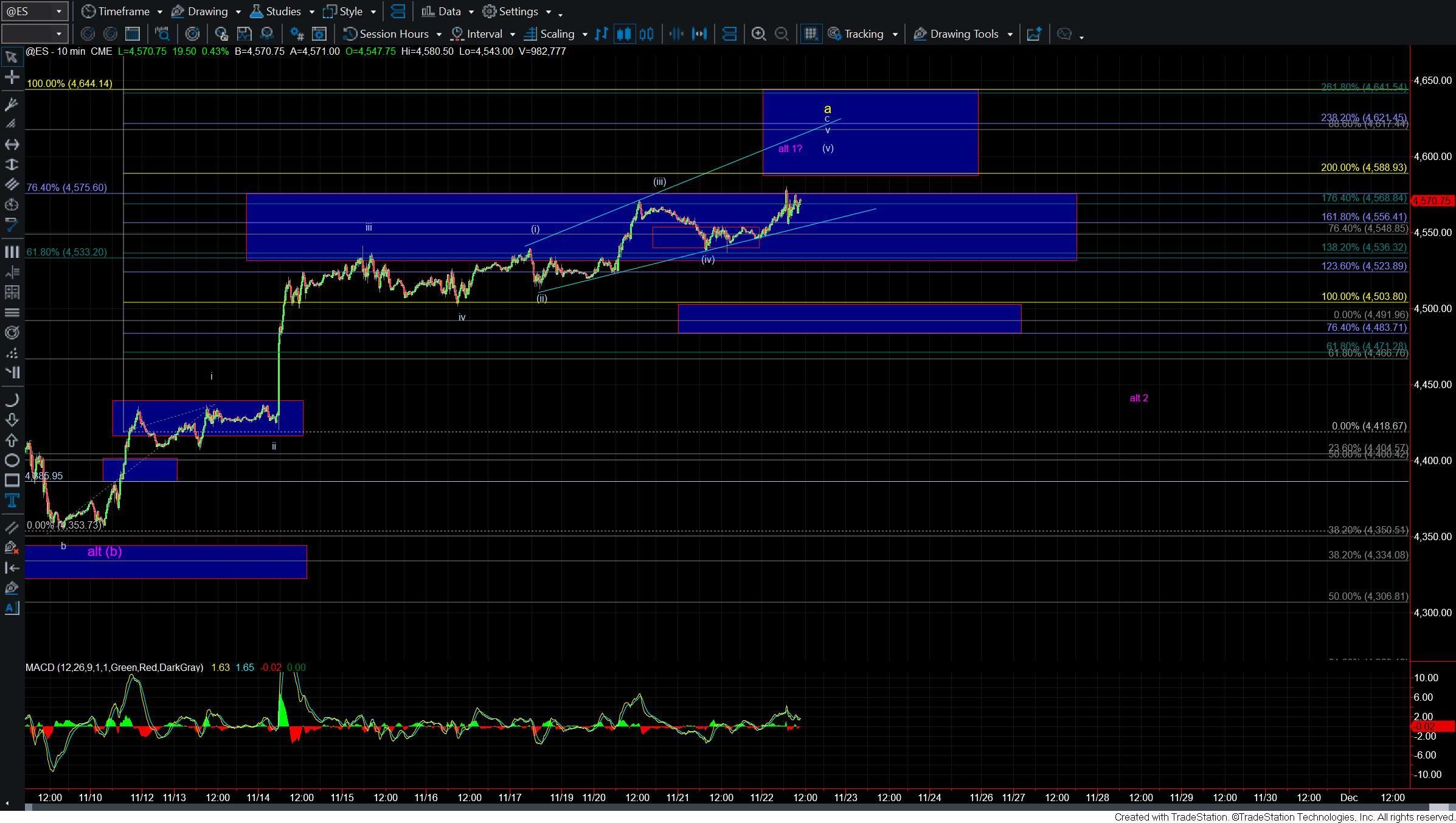

Bigger picture I really do not have much to add to what we have laid out over the past several days and in the weekend update. Zooming into the smaller timeframe charts however, I do want to note that the move up off of the 4503 level on the ES chart does look to be taking the shape of an ending diagonal. With what is looking like an ED up off of that low I would expect that once this tops to see a sharp reversal back down to the origination point of the ED at the 4503 level. We do however first need to see a break under the 4538 level to confirm a local top of the ED.

If we can make it down to the 4503 level then the next larger degree support level that would need to break to confirm a larger top in the wave a or 2 comes in at the 4483 level on the ES. Moving through that zone should then firmly put is in the wave b/2 retracement zone. At that point, we will need to keep a close eye on the structure of the next leg down to help us determine whether we are indeed following the green or the yellow counts.

So overall bigger picture there is not too much change with today's push higher we should be getting closer to a top. From here it really is simply a matter of watching the key support levels below to help give us guidance as to whether that top has indeed been struck.