FOMO Is Going To Grip The Market

I am writing this update early as it seems the market has now pushed to levels which are starting to make things much more interesting.

I have said that the higher this rally goes, the more the yellow count rises in probability. I also noted that until we break a support, we can see the initial move off a low extend much farther than standard expectations when we were as oversold as we were at the 4100SPX region. And, that is still playing out, even though it is beyond the initial expectations we had for this rally. But, that does not mean we are likely going to directly to the 4800SPX region without a pullback.

Moreover, while I had almost given up on the potential for the IWM to provide us with a 5-wave structure off the recent lows, this morning’s action has changed that perspective. We are now just about completing 5 waves up in IWM, albeit with a VERY deep wave [iv]. Therefore, should the market complete this wave [v] (ideally a bit higher), and then provide us with a nice 3-wave corrective pullback, I would view the IWM as a buying opportunity with a target of 200+ still on the board.

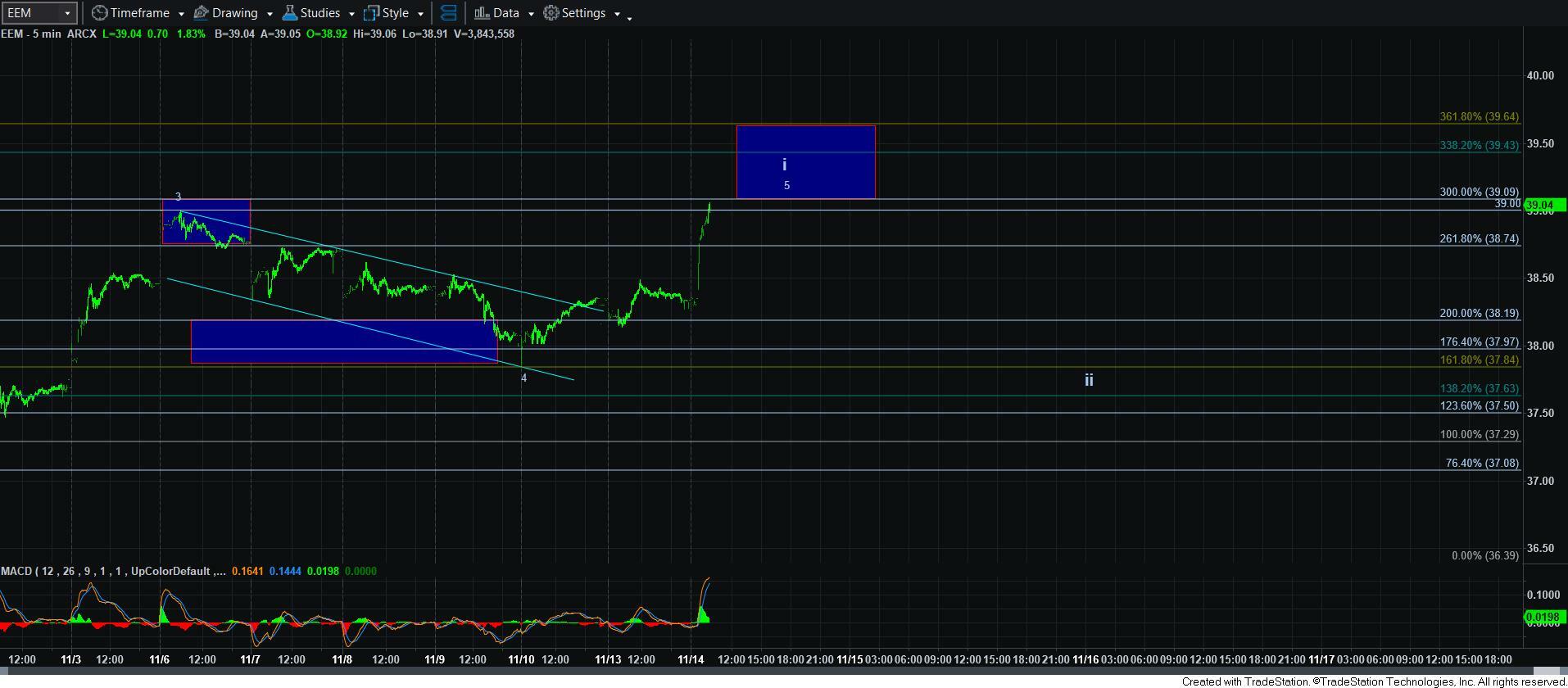

Additionally, EEM is also completing a 5-wave rally. And, if we can see the EEM also provide us with a 3-wave corrective pullback in the coming weeks, it too would be a buying opportunity.

Now, does this mean we are certainly heading to the 4800+ region in the yellow count in SPX? No. But, it certainly raises the probability of that potential.

Therefore, for those that are more aggressive, you can consider buying long positions on the next pullback – assuming we see a clearly corrective 3-wave pullback in the coming weeks.

In the SPX, I am unsure right now if this is going to be all of the yellow a-wave that we are trying to complete in the coming days, or if it is still just the (a) wave rally. The same applies to the green count, as to whether this is all of wave 2, since we have now certainly come up high enough and are large enough to consider it a wave 2. So, the key will be from where the next pullback begins, and if that pullback is clearly corrective. If so, whether it is a (b) wave of the yellow a-wave, or the yellow b-wave will be likely determined by how high this extends.

But, remember, if we see a CLEAR 5-wave decline at any point in time now, that will have me solidly in the green count and expecting that we are setting up to drop the 3500 region and potentially lower.

Risks are higher for those looking to the long side, until we see a break out over 4607SPX. And, I do not ever want to lose sight of that or our risk management perspectives. But, the move today has certainly added to the potential for the move to 4800SPX, baring any 5-wave declines in the coming weeks. And, if you are going to choose to play the long side, PLEASE do not EVER lose sight of that fact.

In summary, the next several months will likely be determined by where we top in this rally, and the nature of the next pullback. If the next pullback is clearly corrective, then I am looking at it as a long opportunity, especially in the IWM and EEM. But, I am going to be watching the SPX VERY carefully to make sure we do not see any 5-wave decline structures, or else we head back into a risk management perspective.