Everyone Hates B Waves

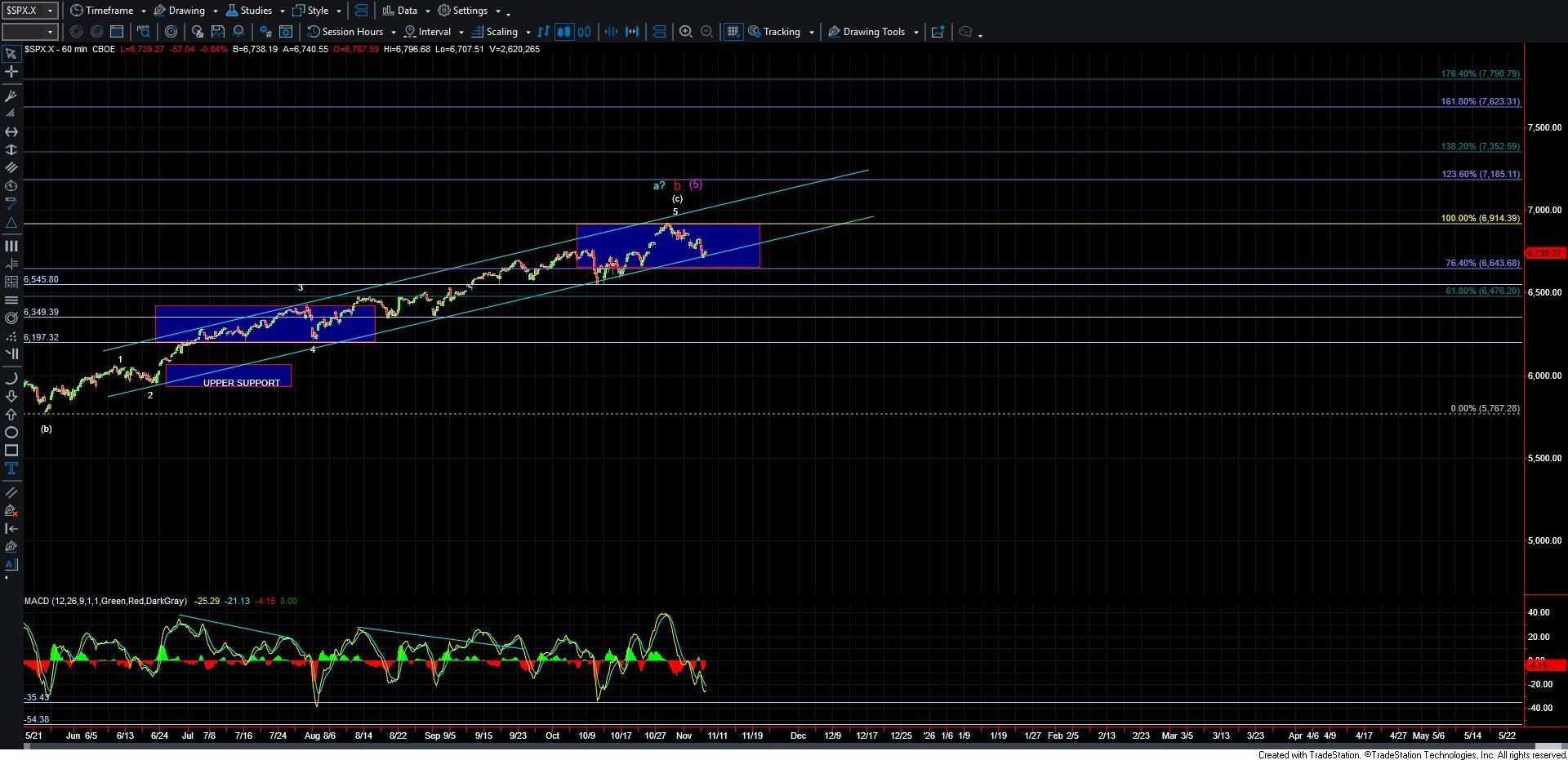

After pushing higher in three waves yesterday, the market turned lower once again today, slipping slightly beneath Tuesday’s low. While a pullback was certainly not unexpected, that minor break complicates the near-term count, leaving us with several potential paths in play.

And that’s the nature of B waves, they rarely stick to the script. They twist, turn, and frustrate both bulls and bears alike, making them one of the most unreliable segments of the Elliott Wave sequence.

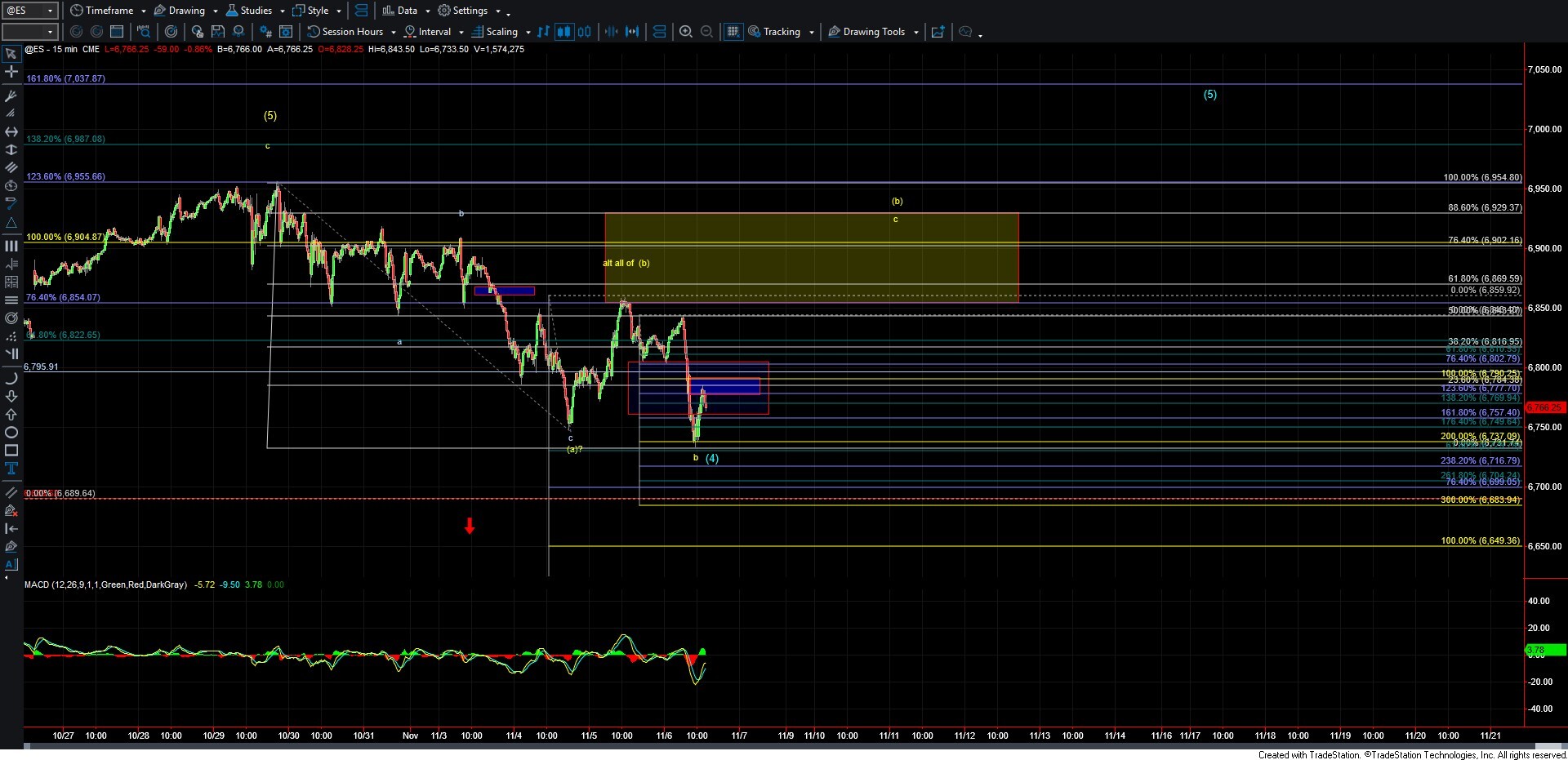

At the time of this update, price is still testing the micro resistance zone. A break above that level would suggest a local bottom may be in place, but for now, I can’t yet say with confidence that the decline off the 6869 level has completed. For now, I will lay out the parameters that I am watching into the close, and we will simply have to allow the market to give us a bit more price action before we have a better idea as to which path this is indeed following.

On the ES chart, I’m watching micro resistance at 6790. A sustained move over that level would favor the idea that we’ve bottomed in a yellow wave b of (b), likely in an expanded form. However, if we fail there and head to new lows, the move down from 6869 could unfold as a five-wave structure, which would then open the door for either a completed wave (c) off the highs (as part of a larger wave (4) in the blue count) or the start of a deeper decline.

If we can reclaim 6790 while holding today’s low, that would point toward the start of either wave c of (b) up (yellow count) or wave (5) up (blue count). Should we continue higher, the next area of resistance comes in at 6850–6929, where we’ll look for a reaction. A decisive break above that zone would likely confirm the blue wave (5) is underway.

That said, because we’re still likely trading within a larger diagonal pattern, price action will probably remain choppy and difficult to track with precision. This phase requires patience and flexibility, staying nimble and ready for quick shifts until the market clearly confirms a larger-degree top, either through a sustained break of the larger degree support levels as laid out in the weekend update or a clean five-wave decline.