Enough With The Extensions

Well, this is a bull market. And, bull markets certainly like to extend. And, until a support is broken, extensions have to kept on the charts. But, it certainly seems like we have gotten to the point of “bullish fatigue.” Maybe Trump was right about us becoming sick of winning. (smile)

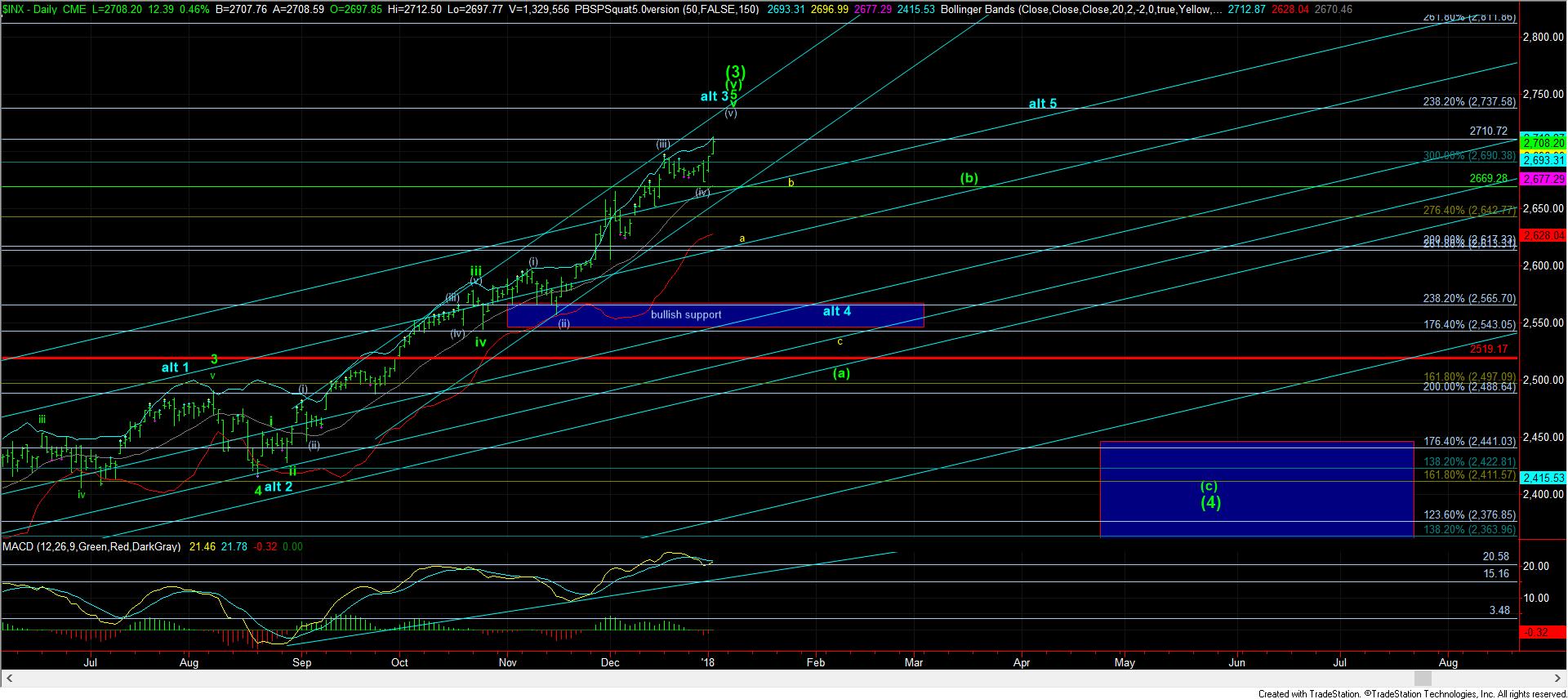

So, with the market now pushing higher after completing a smaller degree 4th wave, which seemed to take most of last week, we are now in what I count as wave (v) of v, with the question being if this is the last 5th to complete wave (3), as presented in green, or if we have one more 4-5, as presented in blue, which aligns with the XLF. Unfortunately, we will not know until we break down and test support much lower.

For now, I cannot view us as having begun that corrective decline to lower support until we take out last week’s low. But, I have taken the liberty of applying a yellow a-b-c to outline how I would expect such a corrective decline to play out. My expectation would be we would challenge the lower Bollinger Band and the Fibonacci support in the 2620-30SPX region for the a-wave of the next decline, assuming we top out within the current resistance region between 2710-2737. I would then expect that we re-test the 2670SPX region from below in a b-wave, before heading down to test the support region between 2545-65SPX in a c-wave.

While I am trying to prepare for how I believe the next pullback can take shape, I want to caution again about getting too aggressive on the short side in a bull market, especially as long as we remain over support, as represented by last week’s low. Remember, during bull markets, you goal should be looking for buying opportunities, rather than attempting aggressive shorting opportunities.