Early Update - Market Analysis for Aug 22nd, 2019

While I provided an update to the entire membership early this morning because we were nearing a critical turning point in the market, I wanted to put the afternoon one out early to outline what I am seeing, so everyone can be prepared.

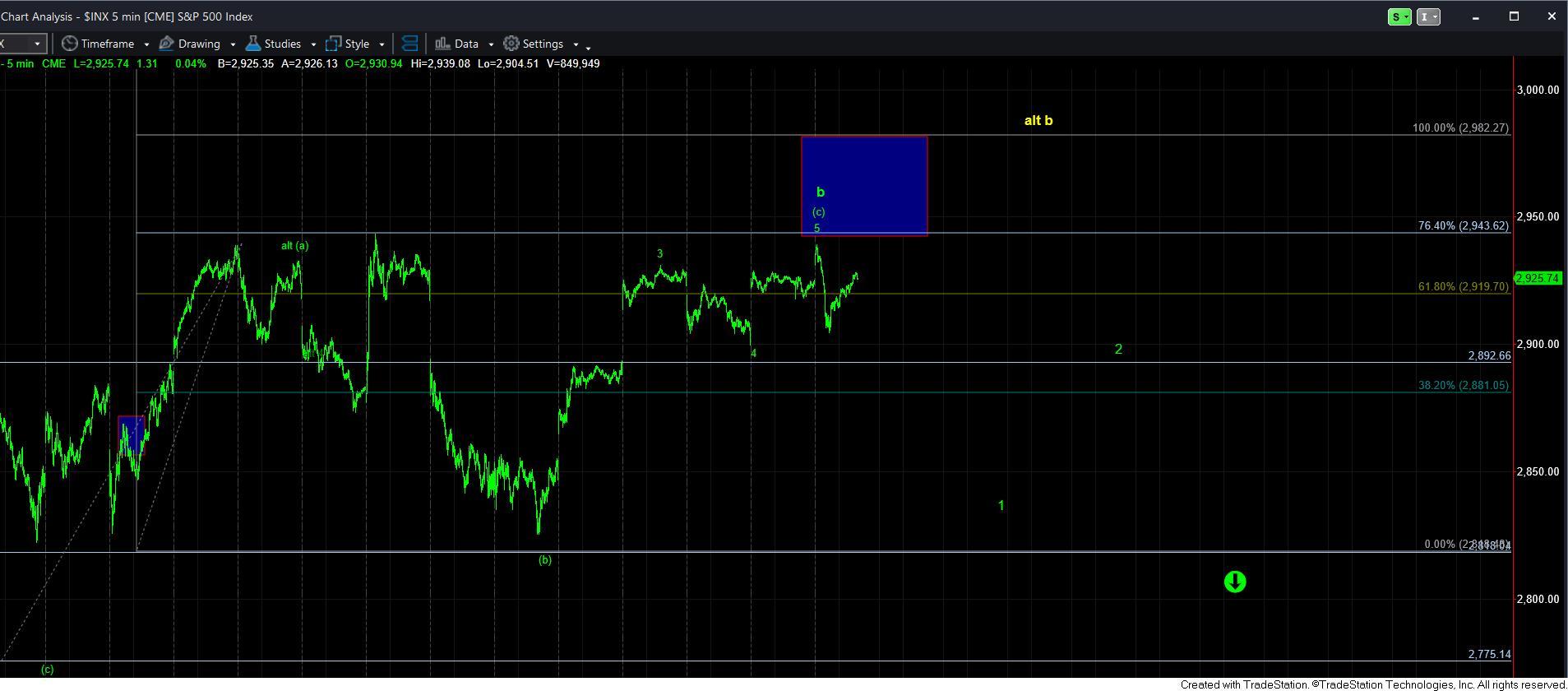

I want to start by noting that I still think we are in a b-wave rally. However, if that b-wave has indeed completed will be determined by the action this afternoon and this evening.

While the market has turned down strongly from the bottom of our resistance, the structure off the high was not a CLEAR 5-wave structure. If we do have a 5-wave structure down, then the 5th wave certainly left a lot to be desired. Needless to say, it is not something I can confidently rely upon until the market actually turns down and breaks below today’s low and this week’s 4th wave low.

As you may recall from my prior updates, we will need to break down below this week’s 4th wave low to eliminate the potential for an extended 5th wave higher in this b-wave. And, thus far, we are still hovering over that support until the market makes its decision.

As you can see on the 5-minute SPX chart, we have now moved into a standard target region for a wave ii retracement. However, if the market is able to continue through the 2932 region, then it makes it less likely that the b-wave has indeed topped. Moreover, if we do have a (i)(ii) structure for a 5th wave extension, it would point us to the 2985-3000 region.

This structure is more cleanly seen in the IWM. You see, the low of the (a) wave on the IWM was actually lower than what is seen on the 144-minute chart. When you take into account the lower lows in the futures, a move higher would provide us an almost perfect a-b-c flat for the b-wave. So, if we do break out over today’s high in the IWM, I have added the yellow alternative as to where I think we will rally to complete the b-wave.

So, the market is now at another inflection point this afternoon, as it must make its decision if the b-wave has finally concluded, or if it wants to squeeze the short traders one more time. I really cannot answer whether it will decide this in affirmative or not, but I have given you the parameters to watch and make your decisions.

For now, we have enough waves in place to consider all the b-wave finally completed. But, with the lack of clear 5-wave structure on the initial decline and the inability to, as of yet, break below the wave 4 low from this week, it is hard to put this rally to bed.

For those that are looking for a cleaner short trade to take, as I have discussed many times before, you can wait for the wave 1-2 to develop to the downside, or even allow the i-ii of wave 3 to take shape before entering a short trade. Until we see that set up, I cannot confidently state that the market is about to “tank” in the heart of a c-wave down.