Down, But Not Out

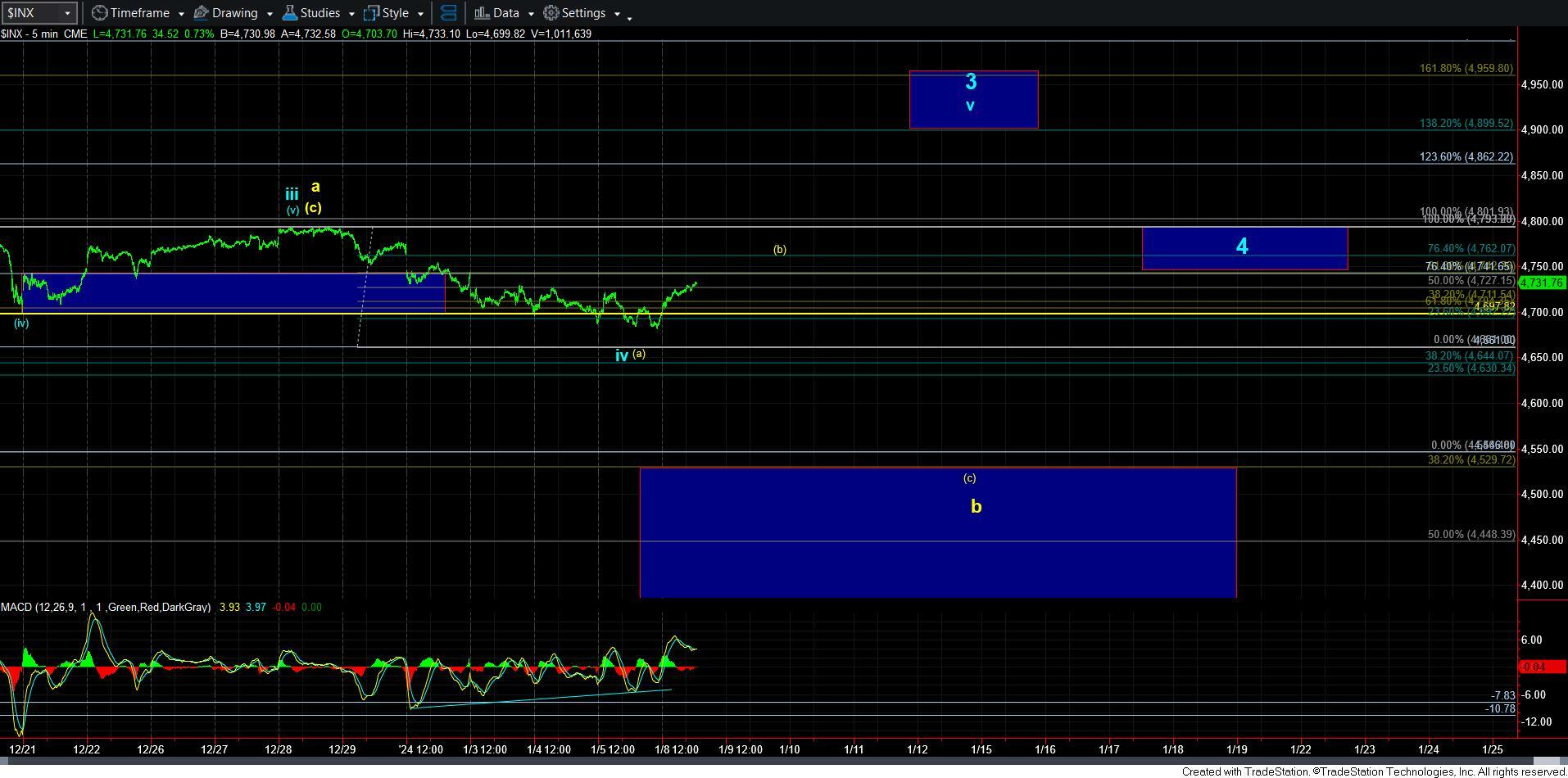

Over the weekend, I surmised from the information that we gathered from the market structure that I was leaning towards the yellow count for various reasons. However, today’s action has me questioning a few things, which I will now outline.

My premise was that due to the SPX breaking below the .618 extension in the blue count, and the move off the low in the futures really counted best as a 3-wave structure to me, it was reasonable to begin to lean towards the yellow count.

So, I have added the two counts I am tracking on the attached ES chart so you can see the difference between the two.

In the yellow count, I am assuming that this is just the a-wave of the (b) wave rally. But, it would mean we should not break out through the a=c resistance at 4774ES region, and see a corrective b-wave pullback.

However, if the market is able to break out through the 4774ES region, then it opens the door for the blue count to complete a wave [i] as a leading diagonal, as also shown on the chart.

So, unless the market is able to provide us with a 5-wave rally that takes us to the 4818ES region, followed by a corrective pullback, I am going to maintain the yellow count as my primary count for now.

But, I am not going to view it blindly as such. Remember, based upon the weekend analysis, I am “leaning” to the yellow count. However, the IWM is also providing me a reason to still consider the blue count again. My original premise was that the IWM would outperform the SPX in this “bounce” and provide to us a much larger [b] wave rally while the SPX provided us with a more shallow (b) wave. This would allow them both to decline in respective [c] waves before the both complete a 5-wave rally to complete this rally off the October low.

But, that is not what we are seeing right now. The IWM is certainly not outperforming. This still leaves the door open that the SPX can complete its blue wave 3 on the 5-minute SPX chart, while the IWM completes its larger [b] wave within wave 4. The only other reasonable assumption I can make from this action is that the IWM may actually pullback in the yellow wave 4.

So, at the end of the day, I am simply trying to listen to the messages provided to us by the various charts we track. While they all suggest we are likely going higher before this rally off the October low completes, I still cannot say one path is a much higher probability than the other just yet. We will need a bit more information before we can make that determination, potentially by later this week.