Divergent Markets - Market Analysis for Jul 12th, 2018

While the pullback has certainly continued in the IWM, the SPX has squeezed higher today to make a higher high in the a-wave. But, overall, I cannot say that it changes my perspective much.

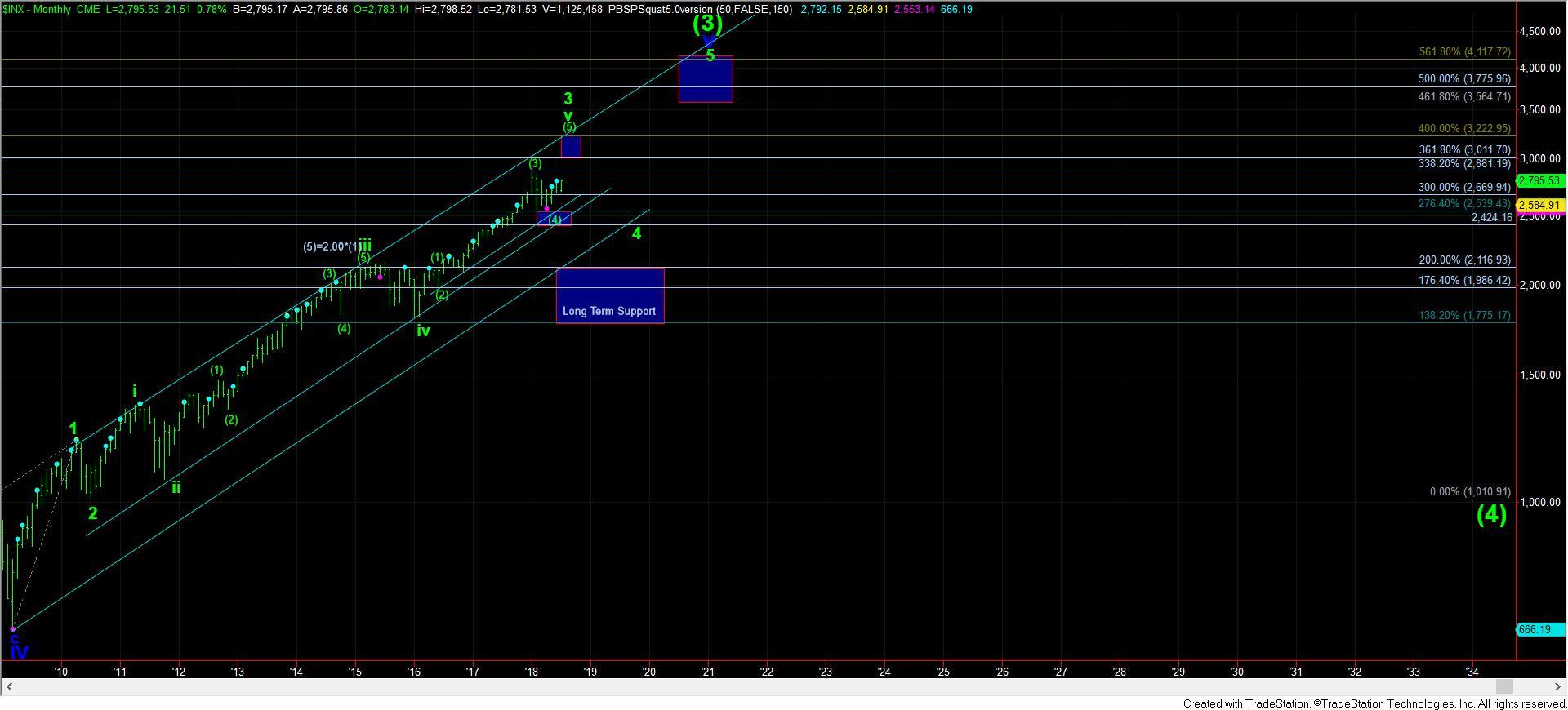

On the larger degree scales, I still view the market as being in wave v of its 3rd wave off the 2009 lows. And, the manner in which we have been developing over the last few months suggest we are in wave (i) of wave (5) of the wave v of 3.

That means I still expect a wave (ii) pullback later this summer (shown on the 60-minute chart), but it means we have to still complete this wave (i) over the coming weeks. In the SPX, this wave (i) seems to be taking the shape as a leading diagonal, which still needs a b-wave and c-wave to complete the 5th wave of wave (i).

In the IWM, it would seem as though we still need a c-wave down to complete wave iv of wave (i), meaning that it, too, needs to see a rally to complete all of wave (i). This would also present us with a pullback going into later this summer.

So, despite these smaller degree machinations, which will become much more complex as I noted last night, the overall perspective remains the same. I am looking for a pullback beginning imminently in the SPX for a b-wave, whereas the IWM is likely within that pullback already. That should set us up for another rally potentially starting by next week, and when that rally completes, we will likely see a much larger pullback into later this summer.