Corrective So Far - Market Analysis for Aug 26th, 2021

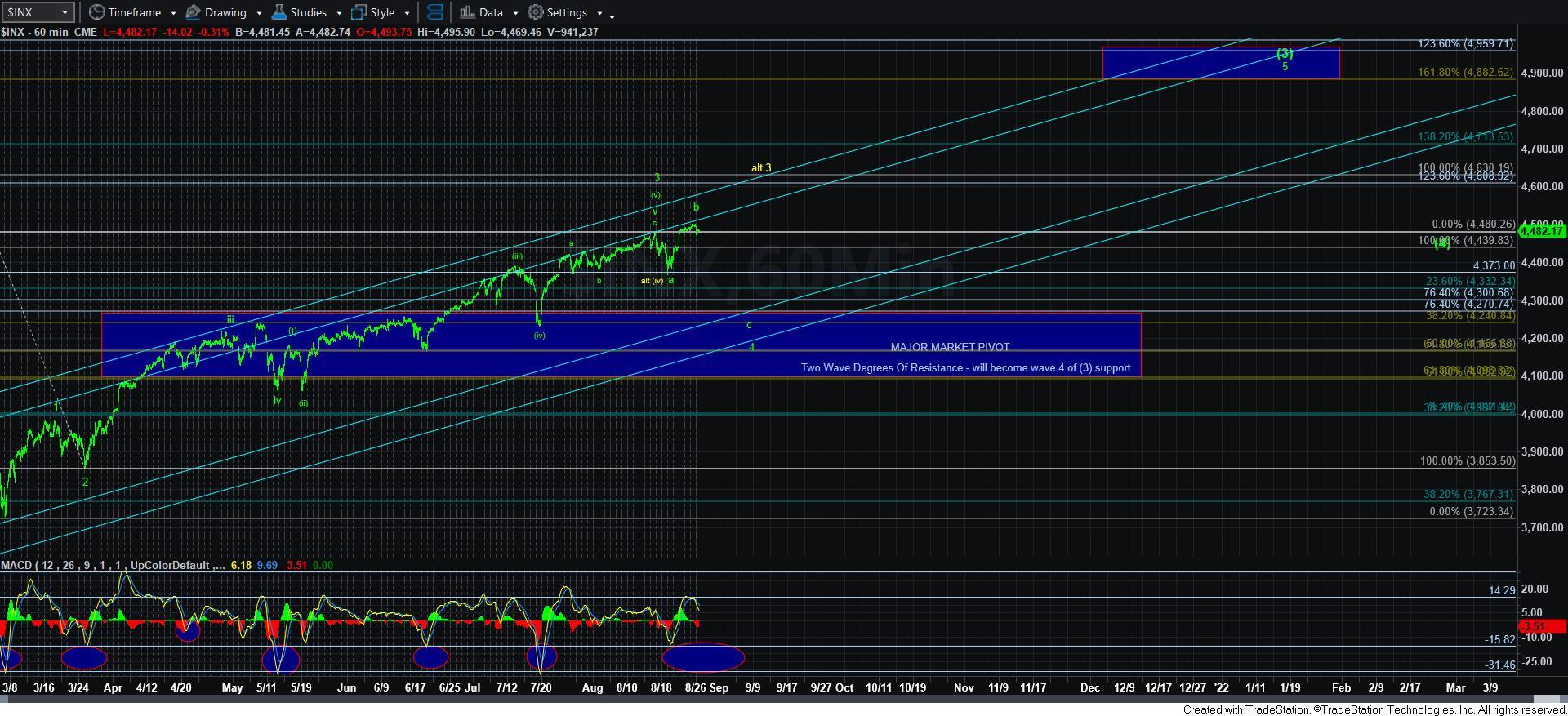

With today’s downside move, I simply cannot count a clear 5-wave structure. That leaves us with a corrective pullback. And, that begins to make the bullish case a bit stronger, and that wave 3 has not yet completed.

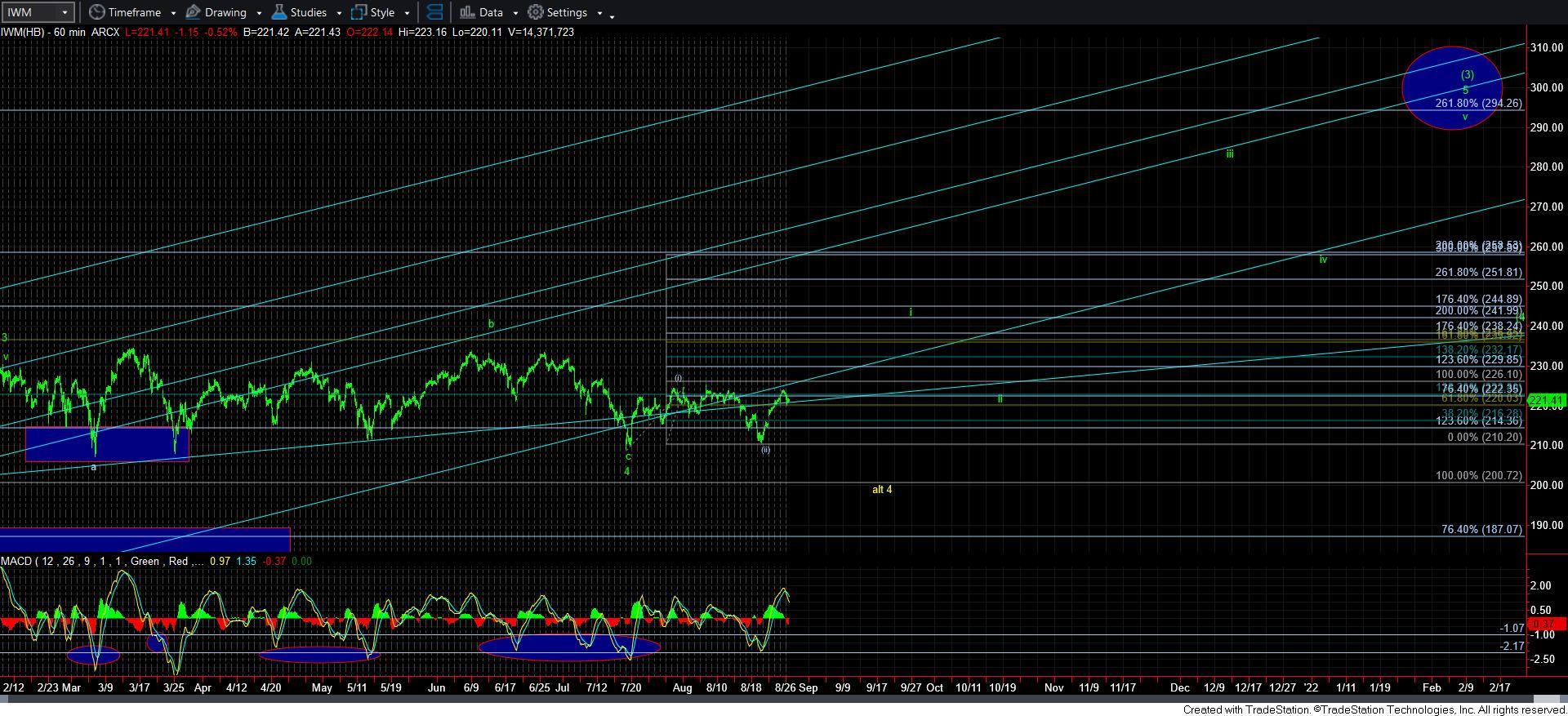

But, before I am willing to jump into that came, I want to again highlight the IWM. If you remember what I said the other day, the 226 region is an a=c point off the recent lows in the IWM, and it is a level of utmost importance right now. That means that, from a Fibonacci Pinball structure, the market has to reach the 226 region (for which it has a set up as long as we hold today’s low), and then hold 220 on all pullbacks thereafter, and then head higher through 226 to suggest we are heading higher to complete wave i. However, if the market is unable to hold 220 on the next pullback after hitting 226, then the more immediate bearish potential remains front and center.

This means that as long as SPX is able to hold today’s low, I see strong potential for a higher high in the SPX, pointing us to 4515-4530SPX. From there, I would expect a pullback, and as long as that pullback is not impulsive, then we will have to look towards 4600 for an extended 3rd wave.

However, if the market is unable to hold today’s low, then we seemingly are in a [b] wave pullback in the SPX, and I still would expect us to rally towards the 2600SPX region in the coming weeks, as the downside structure is not impulsive as it stands right now. Of course, it can morph into a diagonal, but I never count on those until they prove themselves, as they are not reliable trading cues, and I am surely not going to rely on it even before we see signs of it.

So, as it stands at the moment, the market is starting to lean towards the yellow count, but I am going to maintain a cautious stance and allow a bit more of the price structure to complete. You see, even if the SPX does hit a higher high, I still think there is strong potential for us to see a [b] wave pullback. But, it would solidify the target for wave 4 in the 4240-4270SPx region, as the .764 extension of waves [1] and [2] is the ideal target for wave 4 if wave 3 strikes the 1.236 extension, which is the 4600SPX region.

For now, I think it is reasonable to look higher, as we do not have a clear downside impulsive structure on the table. But, I am not going to re-order the counts until I see the pullback in IWM from 226, and how the SPX pulls back should we make a higher high.