Corrective Action Can Be Tricky

I have been saying this over and over and I really want people to take this to heart: There is no slam dunk pattern within corrective wave action.

While we can certainly have a plan, we must remember that corrective wave action is the most variable of all wave action within the Elliott Wave structure. It is for this reason that you see me maintain a general plan, but then watch it through every step of the way to confirm that it is appropriately following through. Being prepared as to how the market moves through the Fibonacci Pinball regions 2-3 steps ahead is what helps you prepare for and avoid whipsaw during corrective action.

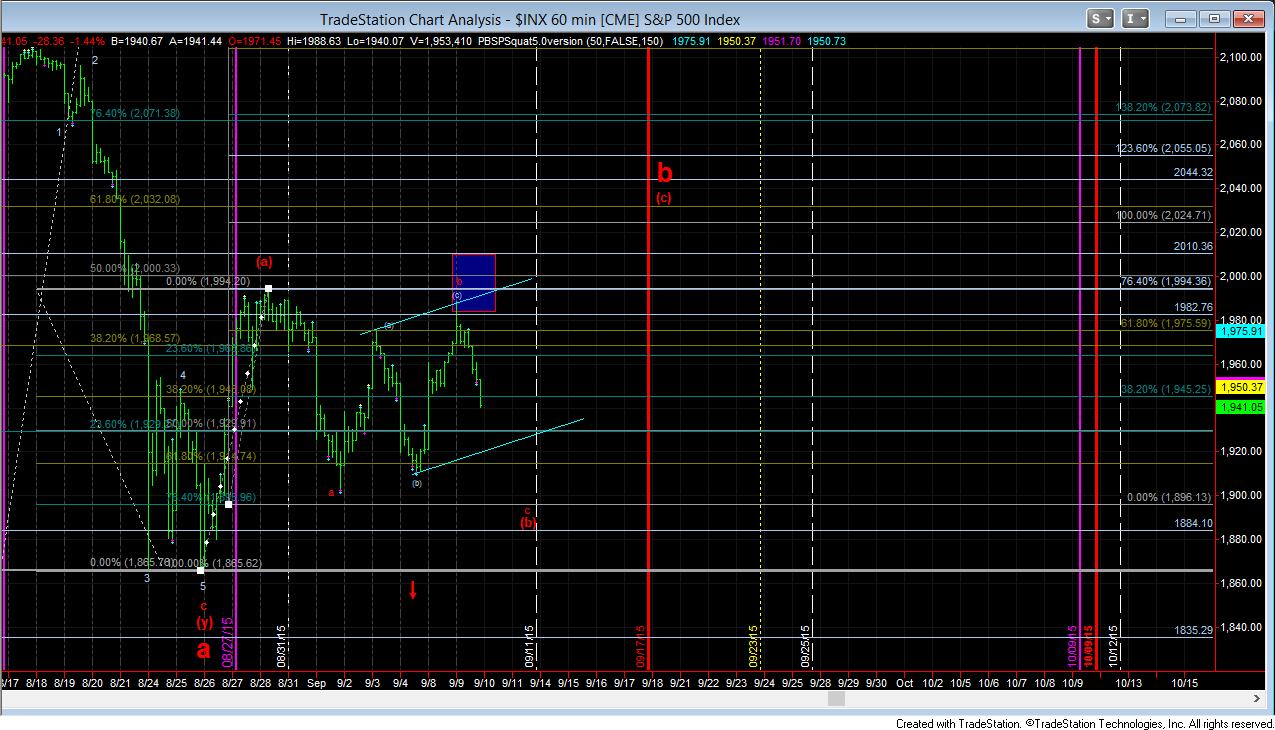

My ideal set up was looking for the market to take us up towards the 1983SPX region to complete the (c) wave of the b-wave of the (b) wave down towards 1895SPX region. Clearly, the market took us a little higher than my ideal target. But the turn down today was suggestive of the start of the drop to the 1895SPX region. In fact, the a=c within the (b) wave targets us right at the 1896SPX level, which also happens to be the .764 retracement of the (a) wave.

But, as I have said many times, I do not trust action within corrective waves. So, we have Fibonacci Pinball resistance levels we watch, which is how we set up and followed the short side today. At this time, the main resistance is in the 1956-1962SPX region. As long as we remain below that level on all bounces, we should continue down towards our ideal target at 1896SPX.

But, again, I am going to be watching this all the way down to make certain we attain our target. Any break over resistance will have me viewing other potentials such as the bigger diagonal for the larger degree b-wave up over the 2000 region being followed by Zac, Garrett and Mike. So, one step at a time.

But, should we maintain this pattern down, and complete it in 5 waves at that level, I will be looking to enter a long position for the 2000+ region from there. But any break down below 1890SPX would put me back into the more bearish perspective on the attached 60 minute ES chart.