Correction Is Upon Us

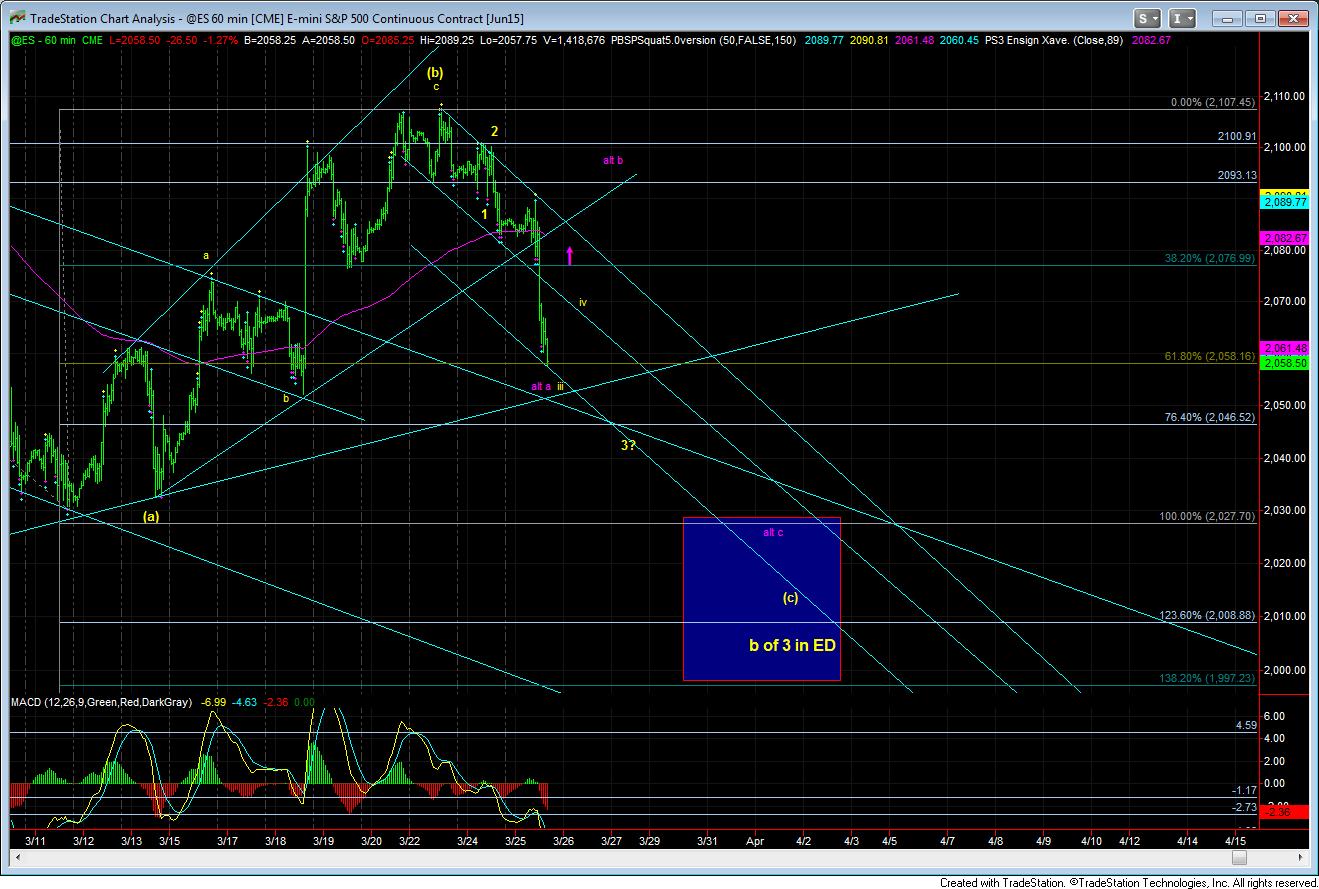

With the 2076ES region taken out today, it has made it quite likely that we are in the larger correction I have been expecting which should take us into next week. That being the case, I do not believe this correction is even close to be done.

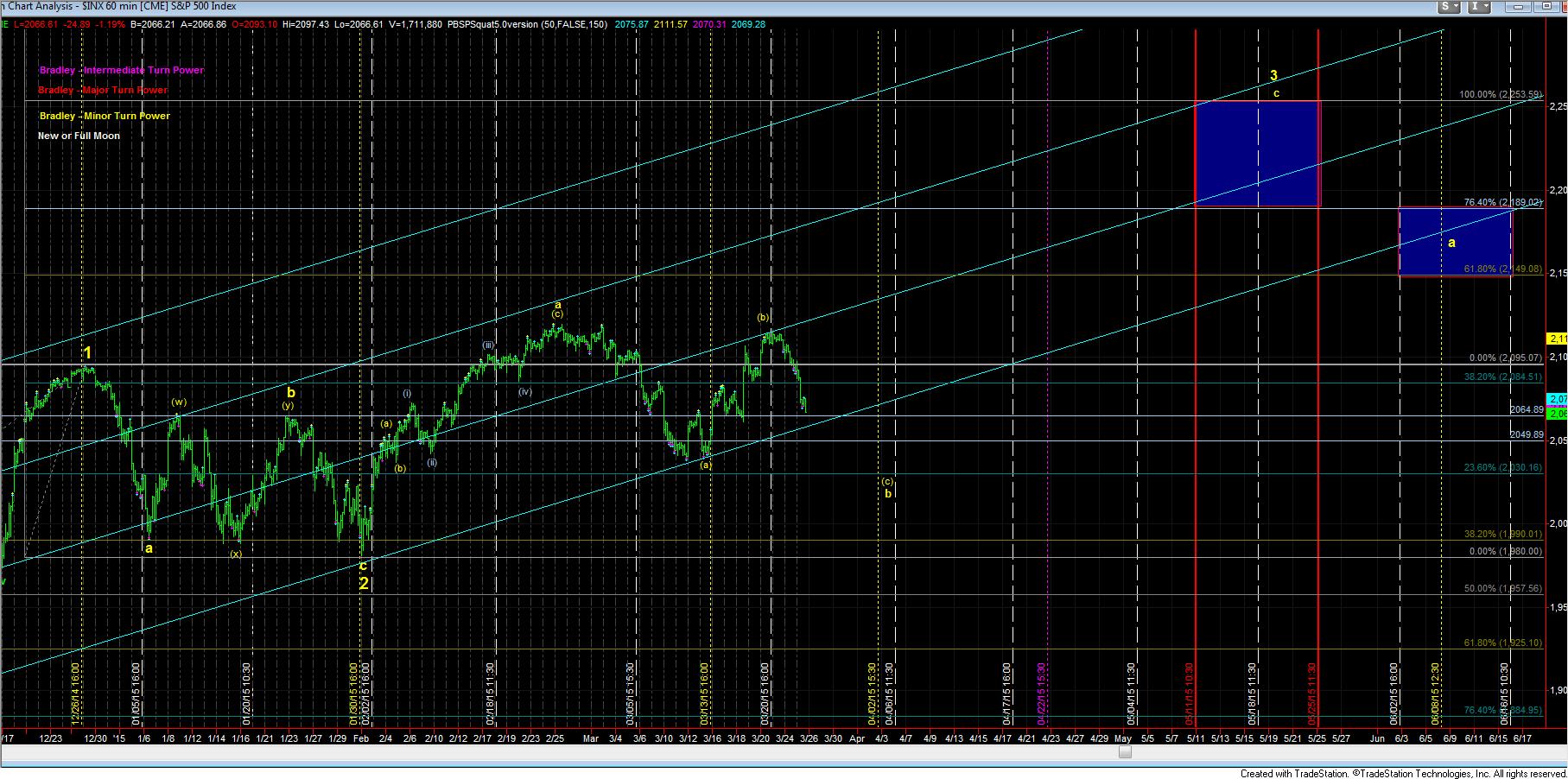

There are two paths this correction can take. First, it can take my primary path, of which I have been noting for some time, of the (c) wave down directly to the 2020ES region. That places us in the wave iii of 3 today, with waves iv and v of 3 to take us towards the 2045-2050ES region. As long as the market is unable to move through the 2074-2077ES resistance level, we will continue to subdivide lower in this (c) wave.

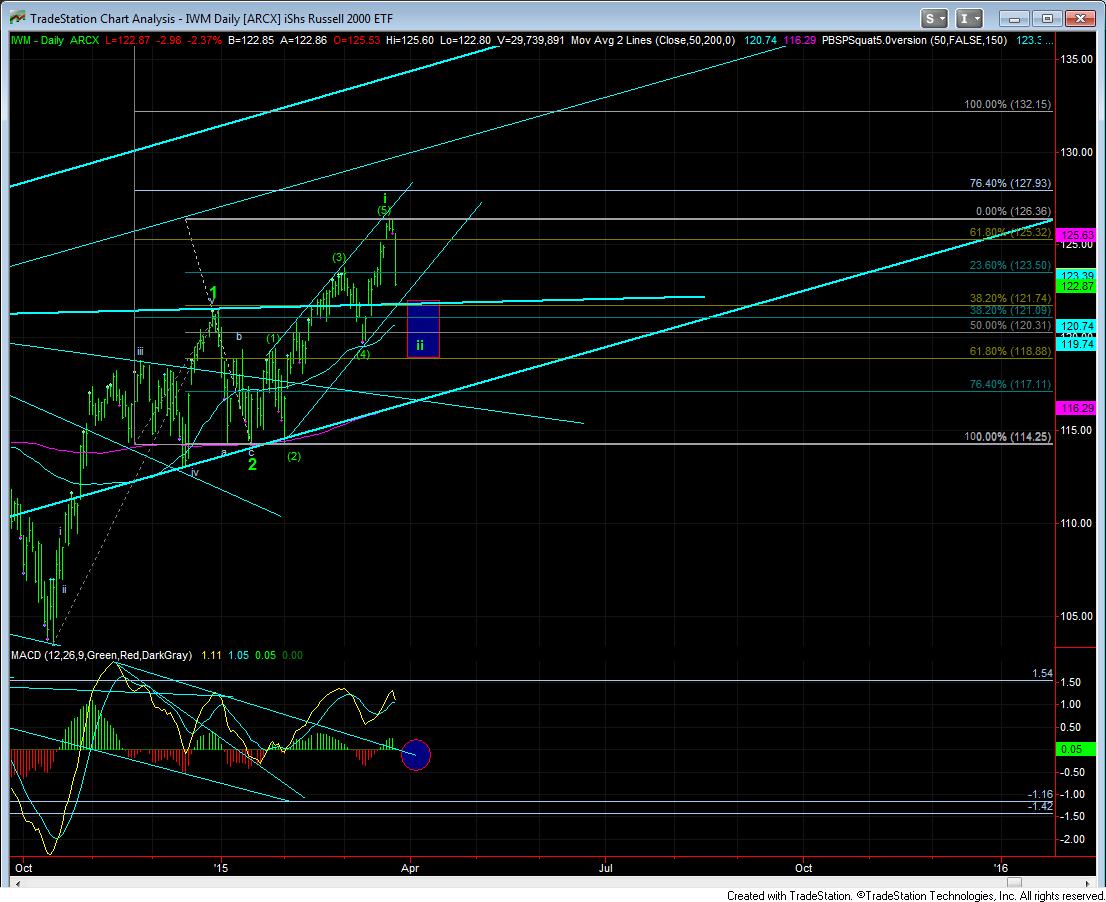

However, should the market be able to overcome the 2077ES level at any point in time, I will view the more yellow count as a more complex (w)(x)(y), with any rally over the 2077ES level being a b-wave in the (y) wave, which is noted in purple. This also works well with a potential a-b-c for wave ii in the IWM.

For now, I will continue to focus lower within the yellow count unless it tells me otherwise. The larger degree targets are the 2027ES level (a)=(c), 2021ES level, .618 retrace we have been mentioning for quite some time, and as low as the 1997ES level, (c)=1.382*(a).

And, remember, this will not be a straight line down, as we have just about completed the strongest decline segment of this move off the highs.