Consolidation Before Higher?

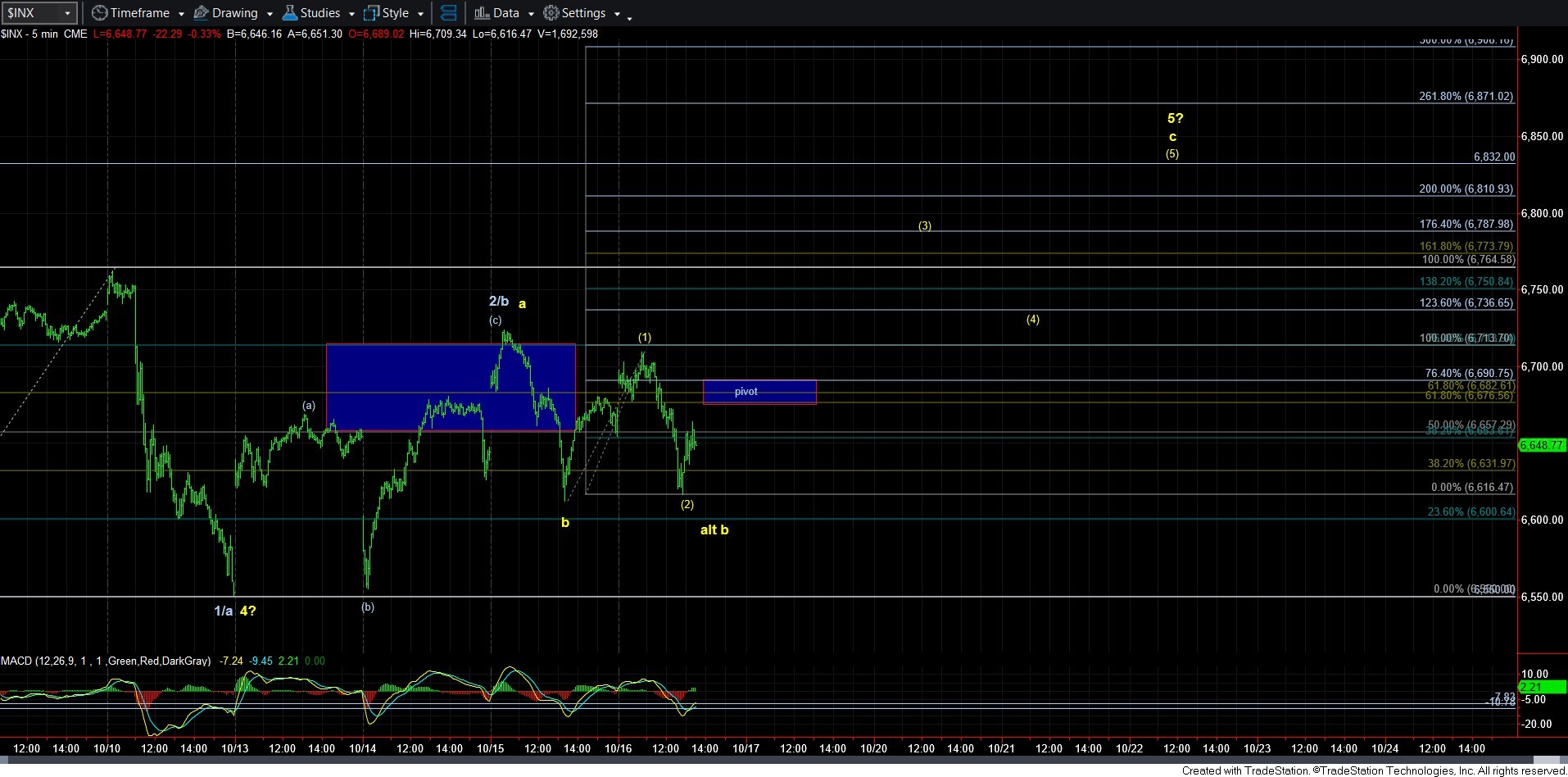

As I said over the weekend, we will have to see how the market reacts to the downside once the bounce we expected this week completed. And, that now refers to the decline that was seen yesterday after the (a)(b)(c) bounce completed. Yet, that decline really counts best as a corrective one rather than a CLEAR 5-wave decline. Of course, I can force a 5-wave count to it with a VERY extended 5th wave. But, I think the more likely and reasonable view is that the decline was a corrective 3-wave decline.

And, as I said in the weekend update, if the decline is not a CLEAR 5-wave decline, then I would have to objectively look higher again. Therefore, I am siding with the yellow path on the 5-minute chart at this time, at least for as long as we remain over 6600SPX region.

As you can see from the chart, we have a potential 1-2 in place for the c-wave. But, that is hard to really trust due to the depth of the wave 2. So, if we see a lower low, then we would have a 5-wave decline today, which would likely be a (c) wave in a more expanded b-wave in yellow, represented by the alt-b on the chart.

But, the main point is that until we see further evidence that a b/2 top has been struck yesterday, I am leaning towards the yellow count point higher first.