Complex Pattern Persists, but a Bounce May Be Close at Hand

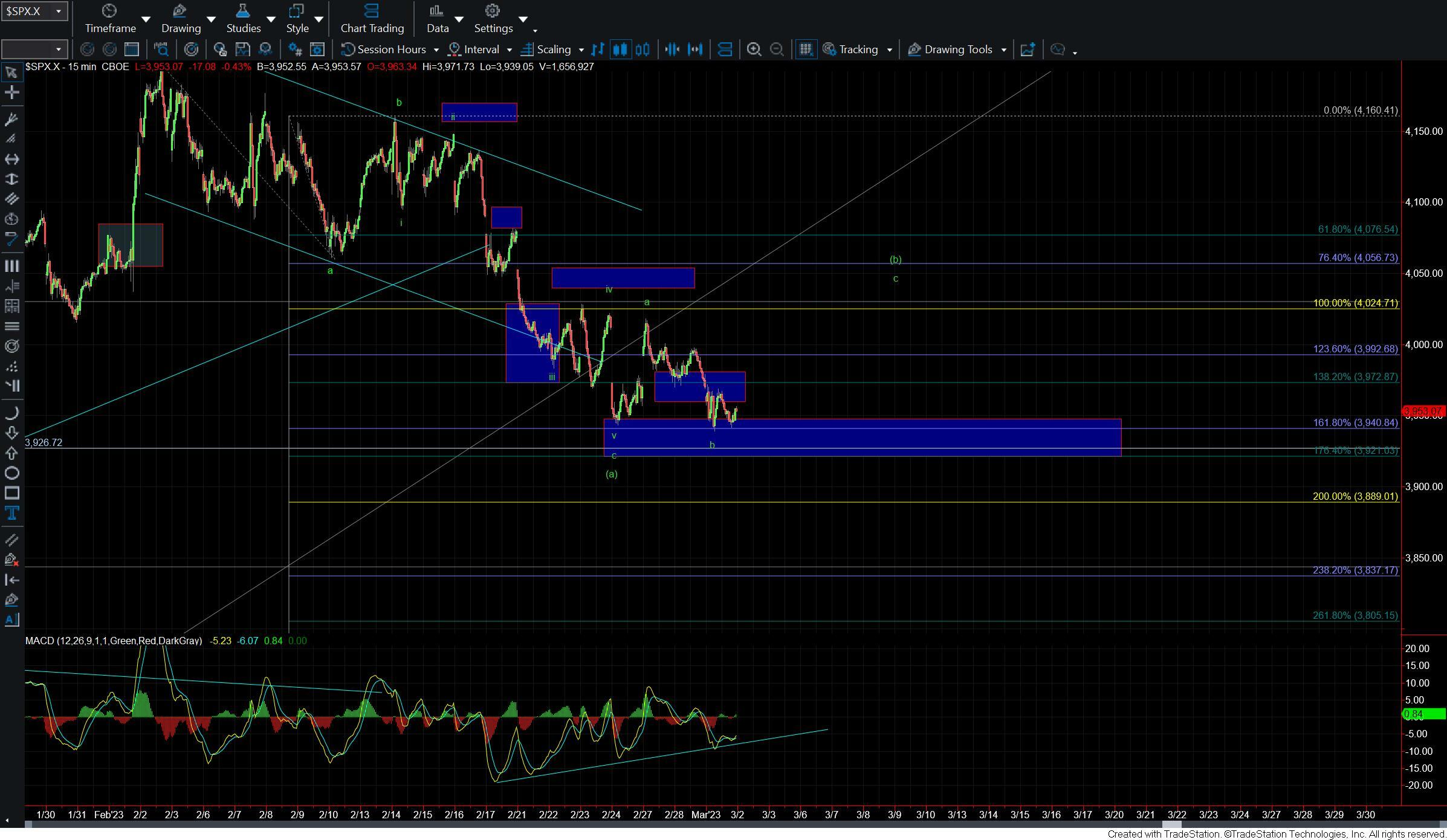

Today's market has been a continuation of sloppy wave action that we have seen over the past several days, making it challenging to track with certainty. We did however se the market break the lows that were struck on February 24th, indicating that it is unlikely to be a fourth wave from the move up off the 3758 low. Instead, it is more probable that the market is tracing out a more complex wxy corrective pattern up off of the lows, adding complexity to the already complex pattern.

When dealing with complex patterns, it is best to zoom out and use the larger degree pattern and fibs to slow things down and allow for whipsaw within smaller timeframes. Zooming out on the 60min chart, we can see that we are closing in on the 38.2% retrace of the entire move up off the lows, and there is also positive divergence on smaller degree timeframes. Therefore, a bounce in the near term is my expectation. However, the exact level of the bounce is uncertain as there are two possible paths that this can take.

The green count suggests that we are following a standard wave (a) up off the October low, followed by a wxy in expanded form, and this move down off the highs is part of a wave y of a larger wave (b). The blue count suggests that the entire move up off the October lows is a complex wxy corrective pattern, and the top of that wave (a) was at the February high. Under the green count, the ideal target zone for the wave y of (b) is in the 3858-3761 zone below.

If the market maintains under 4038, the push lower should be somewhat direct. If it breaks over that 4038 level, it would open the door for a higher wave b retrace that could take this back up towards the 4073-4170 zone overhead. This also opens the door for the blue count to be in play as a bounce from around current levels would align with the 38.2 retracement level of the entire move up off of the lows.

If the market pushes higher and breaks over the 4170 level, it would open the door to seeing a direct move to new highs as part of the wave (c) of the larger wave b as shown in green. However, it is going to take a bit more time for this market to get out of the range that we have been in since the October low and February high.

While this range-bound market has been frustrating, some tradable opportunities are likely ahead in the not-too-distant future. However, right now this is not a market to get overly aggressive in, and traders need to be nimble in their approach to taking on this market in its current stance.