Can We Still Try For Higher?

I am putting this update out a little earlier than normal, since we are just seemingly starting the bounce off today’s low.

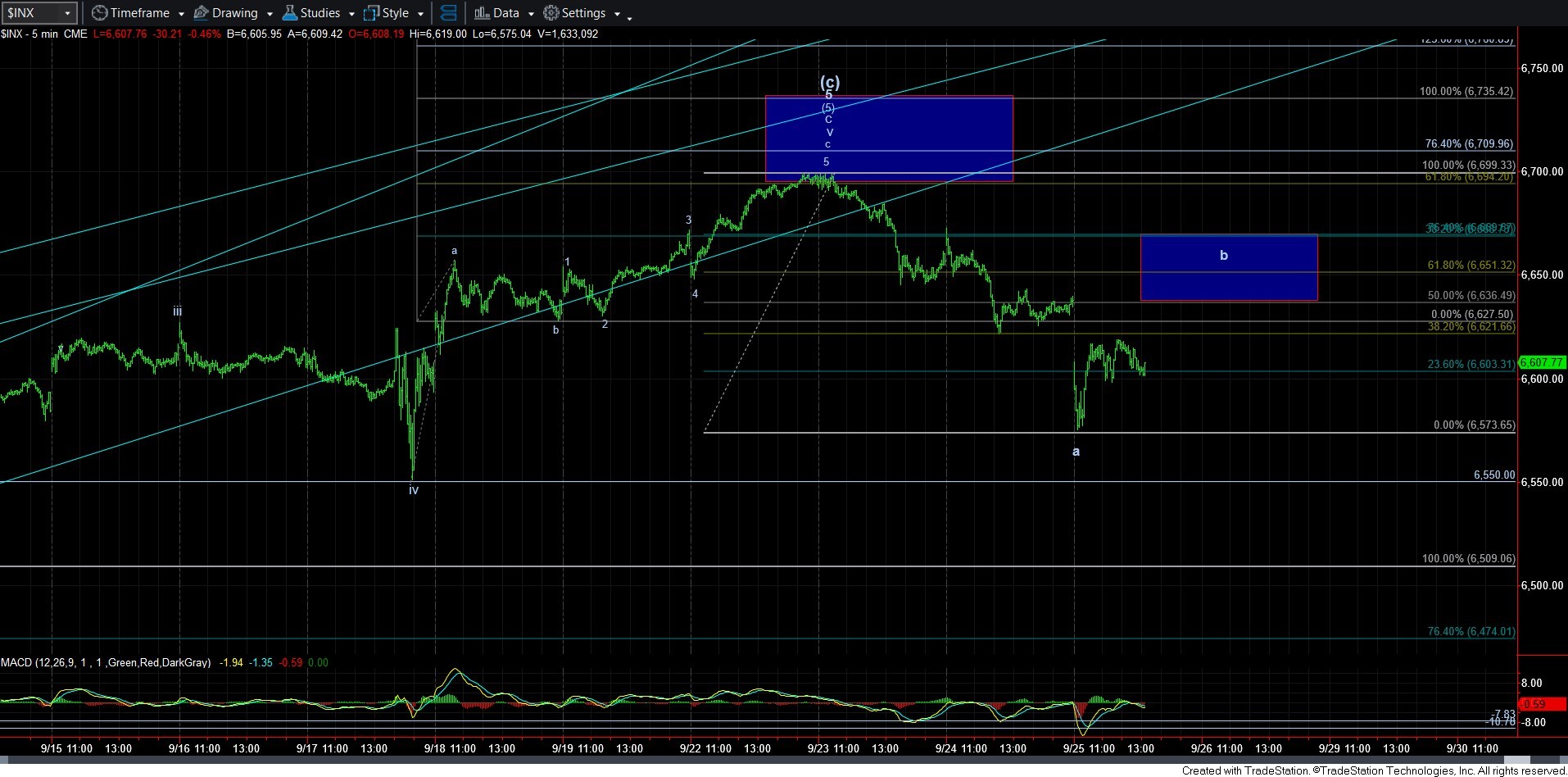

With the market hitting the bottom of my target box on the SPX, it did not even strike the bottom of the target box on the ES before we started to pullback. And, while there is no question about how extended this market is, there is also no question that it has yet to break a meaningful support level yet. Therefore, I still have to keep an eye on the potential for pushing higher one more time to get to the target box on both the ES and SPX as long as we remain over wave iv.

As you can see from the attached 15-minute ES chart, if we view the last rally as the a-wave of wave v, then this deep pullback would be the b-wave of wave v. The issue we then confront is that the c-wave “should” be a 5-wave structure. Yet, the best I can come up with off today’s pullback low is a leading diagonal to begin the c-wave. Clearly, I cannot say that is the most reliable of patterns to make a higher high seem a high probability at this time.

In the bigger picture, I want to repost an alert I put out earlier today:

“I cleaned up the 60-minute SPX chart a bit and added the main supports in bright red. We start with 6550SPX, which also coincides with the uptrend channel. Clearly, this is the first signal of a break down based upon EW and trend lines. The second level is the 6360SPX region, and, of course, followed by the very important 6212. If we drop in a 3-wave structure, I am going to assume 6212SPX is going to hold on the first test, as that is a likely target for an (a) wave, as shown.

So far, nothing is broken on the bigger picture.”