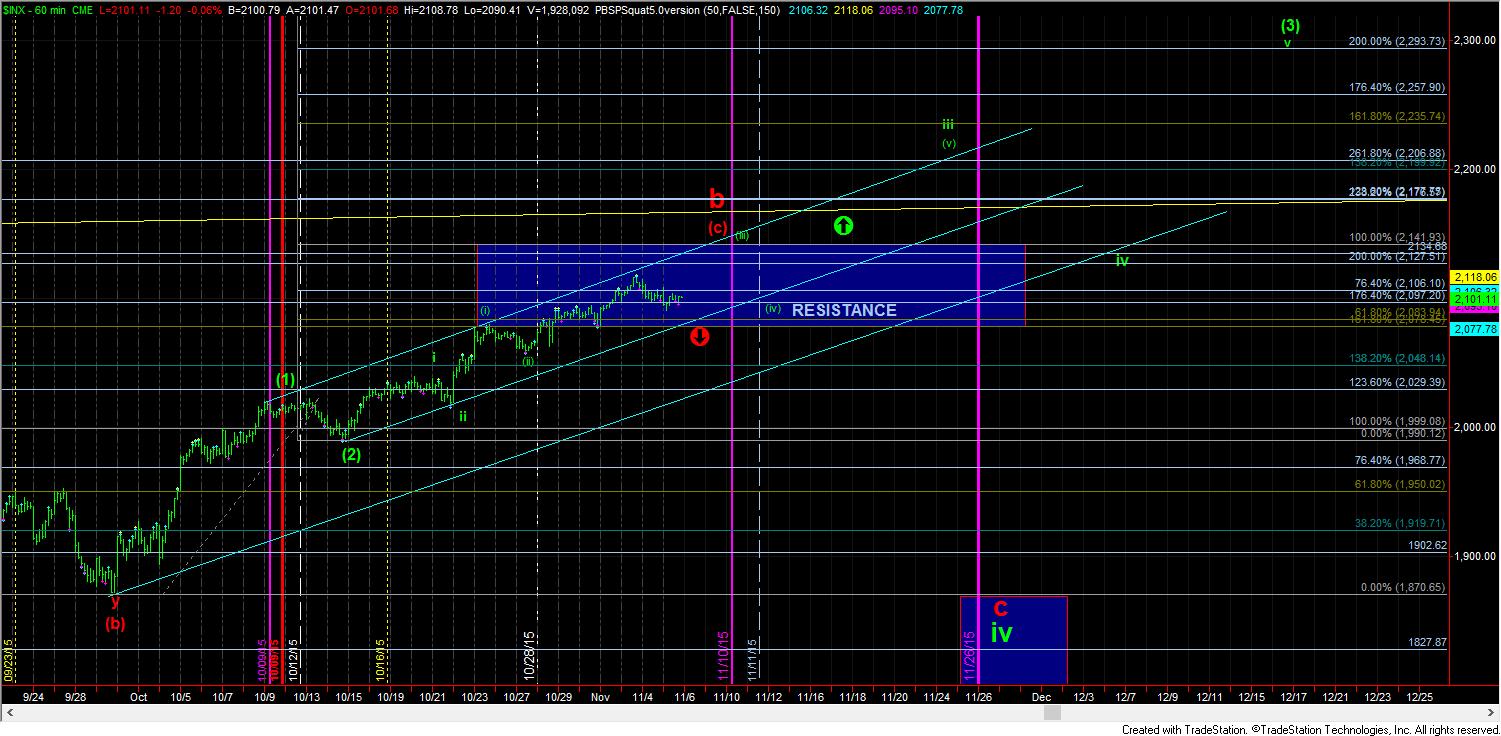

Can We Still Push To Higher Highs?

In short, the answer is “maybe.” Yes, the market broke the ideal support today for the strong green count. In doing so, it has begun to put that green count into question. In fact, I noted today:

The micro count is losing its teeth in the green count due to some of the overlap I am seeing. By no means is the green count "dead," but I am beginning to lose confidence in it. But, until we see a break of 2075SPX, I still cannot call the funeral home. So, I am going to maintain a bigger perspective on this chart, and keep the potential open for 2140 to be hit by our Bradley turn date on the 11th unless the market can provide us with a break down later today.

Right now, at least to me, the upside is starting to look a bit less impulsive from an ideal standpoint, and I am starting to lean to the perspective that any further upside we see over the next day or two will be in the conclusion of an ending diagonal, which can still take us up to the 2140 region into our next Bradley turn date - as shown on the 5 minute chart.

And, as I have said many times today, it will still take an impulsive break of the 2075SPX level to turn this chart back down. Until such time, I cannot reasonably look at the short side in any aggressive manner, as no real support has broken in the market yet.