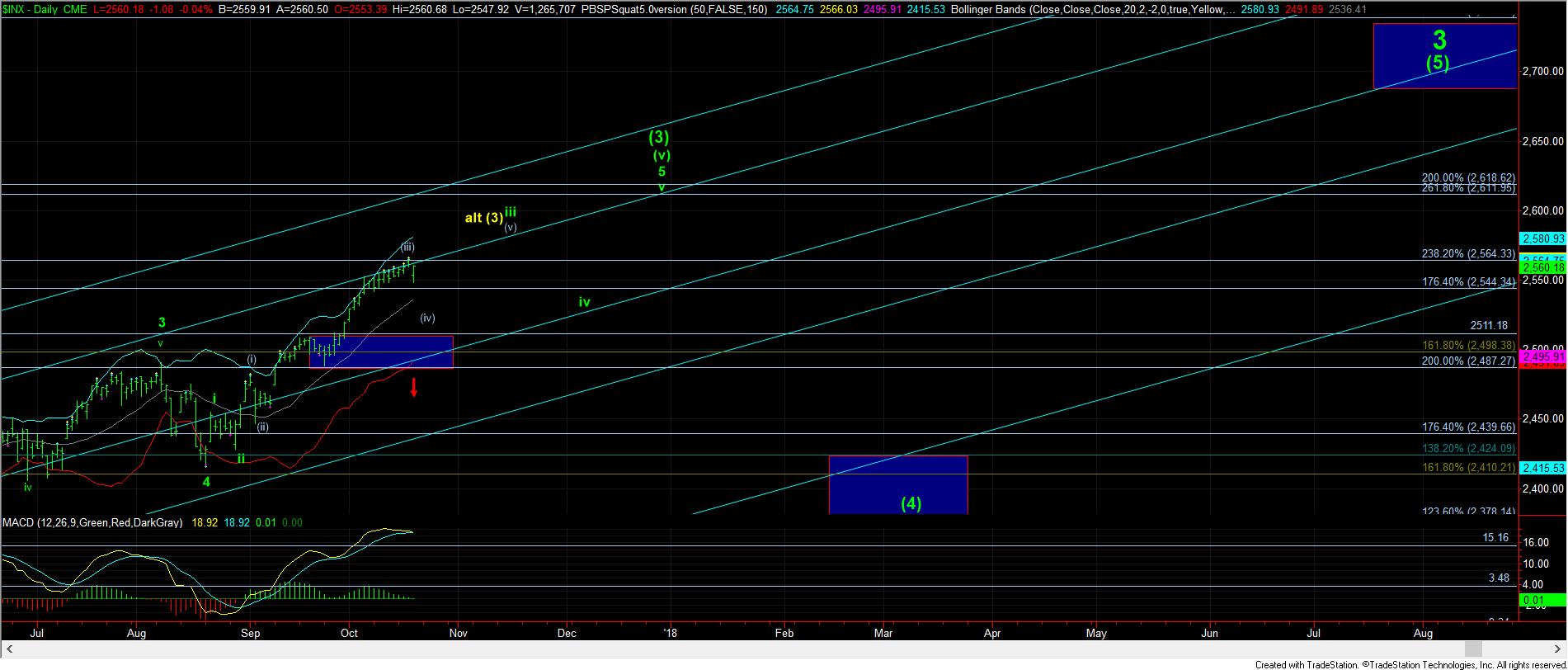

Can We Finally See A Respectable Pullback?

With the market dropping quite strongly overnight and then following through in the morning, it provided confirmation that wave (iii) is done.

As I noted yesterday:

“As we stand today, we have another micro “topping” potential, with what is normally viewed as an ending diagonal completing grey wave (iii). . . One of the hallmarks of an ending diagonal is that, once it completes, it reverses quite strongly back down to the point from which it began. In our case, that is the 2540SPX region.”

Since we struck a bottom this morning at 2548SPX, we certainly fulfilled what one would expect to see once an ending diagonal completes. But, the question now is if we are done with the downside, and on our way up towards the 2575-80SPX region to complete wave (v) of iii.

While I recognize it is hard to look down during a strong bull market, I still have to follow the standard patterns we normally see, unless the market tells me otherwise. And, as long as we remain below the high we struck yesterday, I have to expect that this wave (iv) can potentially take much more time, and strike lower levels.

But, that does not mean one should be aggressively shorting up here expecting a “certain” downside target of 2520. The market has not been kind to short traders for the last two years, and pullbacks should still be buying opportunities until we complete this larger degree wave (3), with a target still potentially in the 2611 region.

As I noted yesterday, the ideal ultimate target for a 4th wave is generally in the region of the .382 retracement of the prior 3rd wave. That places us in the 2520SPX region if we were to see a full .382 retracement.

So, as long as we maintain below yesterday’s high, my primary perspective is that we struck an a-wave bottom this morning. As we were striking those lows, I posted that we should get a b-wave rally back up towards the 2555-2560SPX region. And, as my writing of this update, we are now pushing our resistance region.

As long as we hold below yesterday’s high, we are likely setting up a c-wave down to test the upper bullish support region on our 5-minute chart. But, I want to reiterate that most of you should not be trading aggressively for downside follow through, especially since we do not have a 1-2 downside set up for a c-wave down yet. That is the only way I would consider a more aggressive short trade here, and, it is not there as of the time I am posting this afternoon update.

And since this is still a bull market with higher targets, and downside follow through has been quite rare, keep in mind that if we are able to continue up through yesterday’s high in impulsive fashion, it suggests that we are on our way up to the 2575-80SPX region to complete wave (v) of iii much sooner than I would normally expect under the standard patterns we follow. PLEASE keep reminding yourself that this is a bull market and surprises often come to the upside.

In summary, I am trying to present you with a balanced perspective of where we stand right now. While my preference is for further downside resolution in this wave (iv), we have to always be mindful that this is a bull market, and we still have more sub-waves to complete, which are still pointing us higher over the next month or so.