Can We Finally Break Out?

When the market has a strong break out set up (as we had last night), and fails to take advantage of that set up, one has to take notice. When the market develops a secondary break out set up (as we had early this morning), and fails to take advantage of that set up as well, one has to take greater notice. And, when the IWM is lagging as much as it has, then, taken all together, some concern has to be resonating.

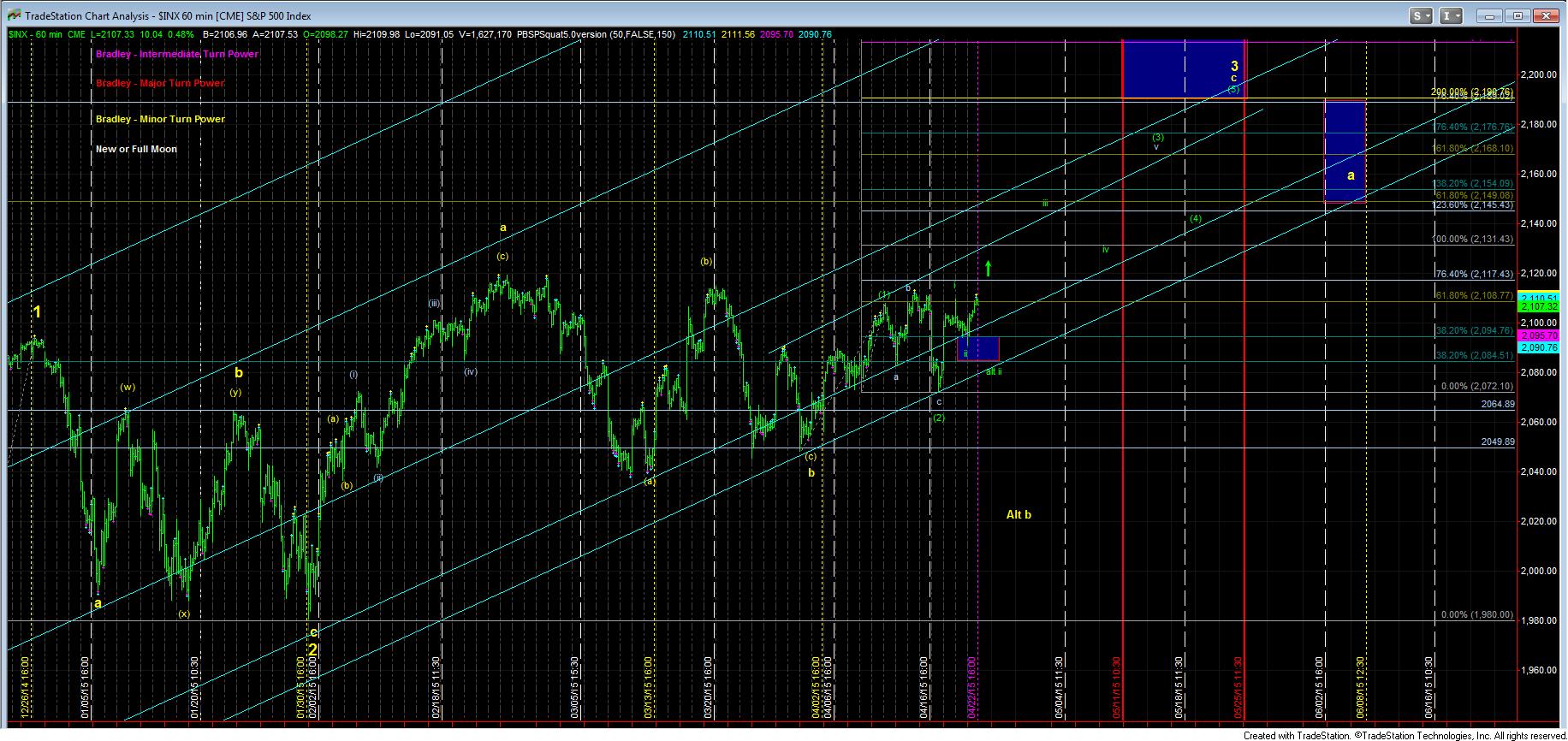

In fact, as I noted this morning, the market’s further drop overnight provided us with a perfect a=c corrective decline, which happened to also coincide exactly with the .618 retracement. That is usually a textbook 2nd wave pullback, which should launch a 3rd wave. However, the market has not made it clear at all that the 3rd wave is upon us, and the lack of upside follow through with a solid 5 waves was truly concerning.

But, recognize that concern and bearish are not interchangeable. While the inability to break out does give me concern, we have not broken any supports yet to even make me neutral the market. Therefore, I still remain bullish. However, that does not mean that further pullbacks cannot or will not be seen. Ultimately, if the market is unable to provide us with a strong gap up by tomorrow to usher in wave iii of (3), I believe we will retest that 2075-2080ES region once again.

And, unfortunately, until we actually see a break out, all alternatives are still alive and well, but remain alternatives for now.