Can The Market Trigger Another Downside Set Up?

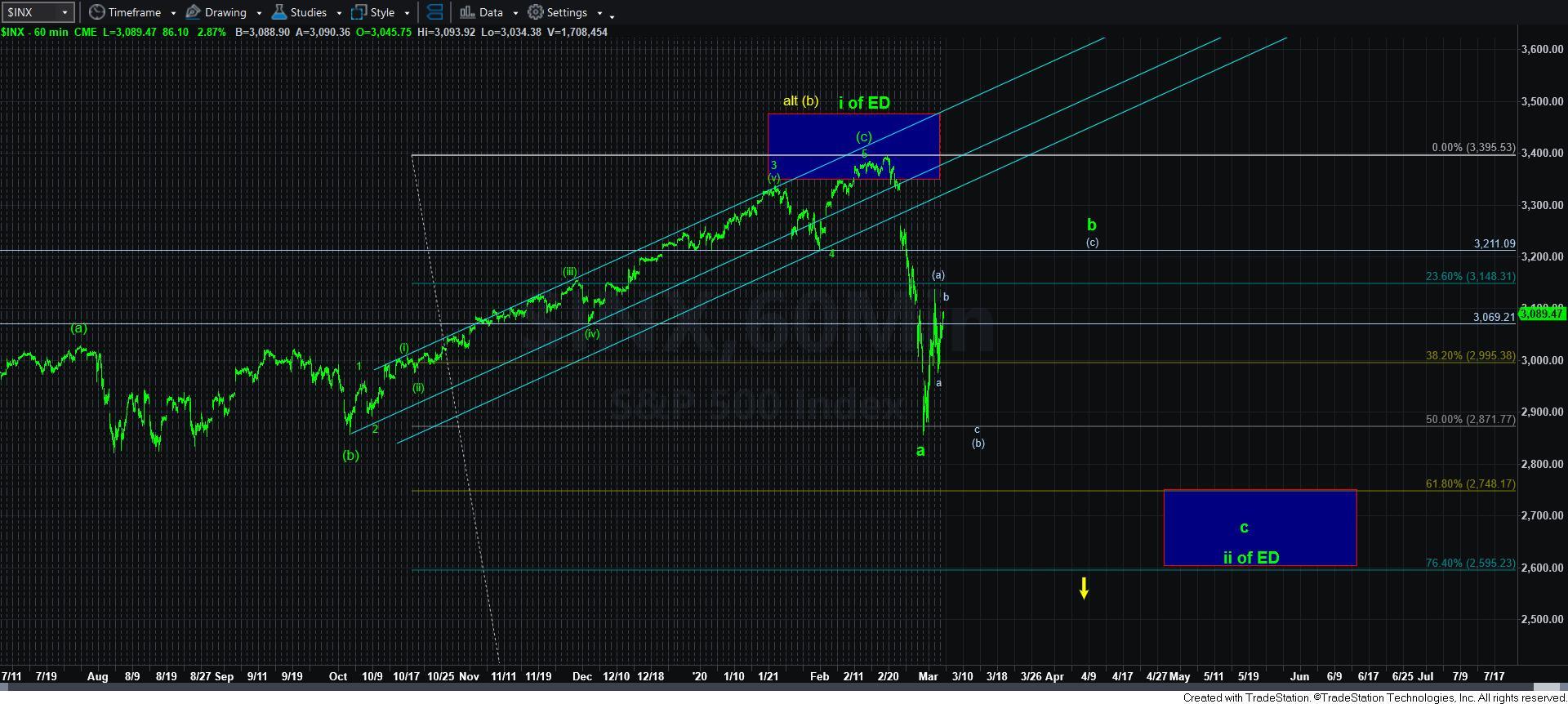

As the market continues to whipsaw back and forth, the action is still quite indicative of larger degree corrective action.

In my updates in the afternoon and evening yesterday, I outlined my expectation for a potential “bounce” setting up in the market. Most specifically, I noted that as long as the 146.50 region held as support in the IWM, which I counted as a leading diagonal down for wave [i] of wave v of 3 in what I am still counting as a c-wave down, then I would expect a bounce in a wave [ii].

The most important point to realize in this set up is that the 152-153 region SHOULD hold as resistance if this set up will trigger. As long as we hold that resistance, this [i][ii] structure is pointing us to the 135-137 region to complete wave v of 3 in the IWM. Again, I must stress that the market must respect resistance and then confirm by breaking down below 146.50 in impulsive fashion. Otherwise, I have added an alternative in yellow in the IWM which will make this structure much more complex.

In the SPX, we should also retain below yesterday’s high to keep pressure down for what I want to see as a c-wave down in a larger [b] wave within a larger degree b-wave of this correction. You can see this most clearly on my 60 minute chart. And, yes, I am not expecting the SPX to see a sustained break of last week’s low, even though I maintain such an expectation in the IWM – again, if we hold this downside set up.

I want to also remind you that we are still likely tracking a much larger corrective structure in the market. For those fearing the same bottoming we saw in December of 2018, I want to again remind you that that bottom structure was quite rare. While it is certainly possible that this can happen again, the probabilities of bottoming structures that are outside of the standards we normally see in the market are low. Again, it is possible, but not probable at this time.

Moreover, since we are likely in a b-wave structure in the SPX, I want to also remind that trying to nail down the path of a b-wave is like trying to throw jello for distance. While I am trying to outline a path which we often see, this can morph and take other paths. B-waves are notorious for their complexity and whipsaw. So, please keep that in mind if you are attempting to trade this movement.

Lastly, while my primary pattern is expecting a c-wave down in SPX (to complete the [b] of wave the green b-wave) and a 5th wave down in IWM, you may want to wait for the next 5-wave downside structure to develop for a strong cue for the next decline. Remember, corrective waves are quite variable, so you want to allow the market pattern to develop to put the probabilities on your side during this type of whipsaw action.

Note: I strongly advise you to listen to my live video posted this morning, as I go into depth regarding my expectations and analysis in that video.