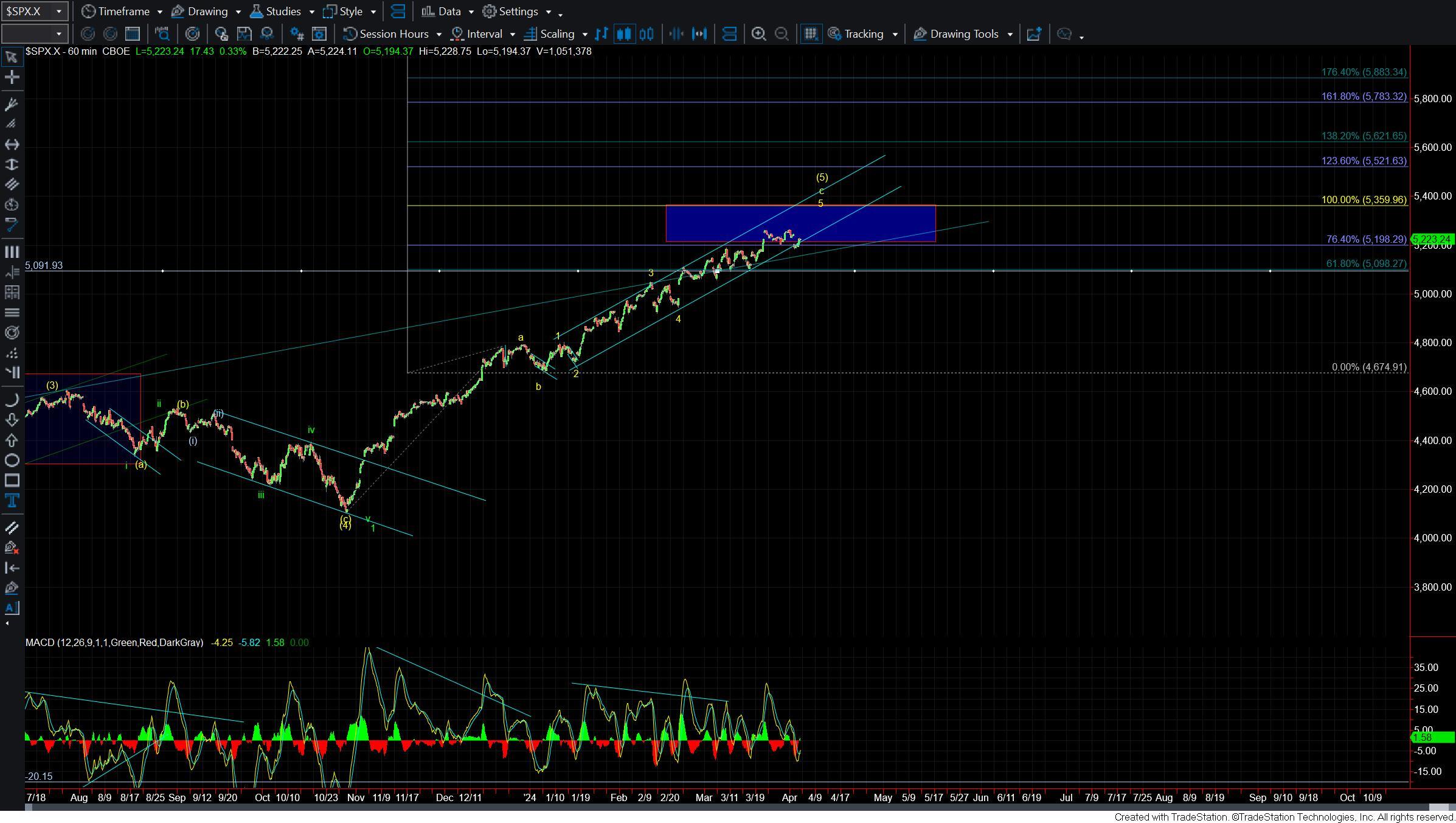

Can The Market Push Directly To New Highs?

Today we saw the market move higher after seeing a multi-session pullback. We have moved over the lower resistance level thus giving us an initial signal that we have put in at least a local bottom. The question we have at hand at the moment is whether we can see a direct push to new highs or will the market see yet another turn lower before finding a more sustained bottom.

The answer to the question above is going to be a bit challenging to answer from a structural perspective as both a push to new highs and a corrective move higher will likely take the same three-wave form. This is due to the fact that we are likely dealing with a larger ending diagonal pattern under which case both a push to new highs and a corrective move higher would form a three-wave structure. So with that, I am going to be keeping a close eye on the next key overhead resistance which currently comes in at the 5234-5256 zone on the SPX.

If we are able to move through that 5256 level on the SPX in the days ahead then it would give us initial confirmation that we have indeed bottomed in all of the wave iv and are heading directly to new highs. If however we see that resistance zone hold and then turn down of five waves it would give us the initial signal that we are going to see a wave (c) of iv lower before a bottom is seen. Under the latter case support for the wave (c) of iv would come in at the 5173-5090 zone and as long as we are able to hold over that zone another higher high is in the cards. Should that zone break it would give us the initial signal that we have indeed formed a larger degree top.

So while the price action remains somewhat sloppy on the shorter-term timeframes as we navigate the final stages of this ending diagonal we do still have some parameters to work with. Those parameters will be key in helping to answer the question of whether the market can indeed push directly to new highs or if we still need to turn lower before a bottom is seen.