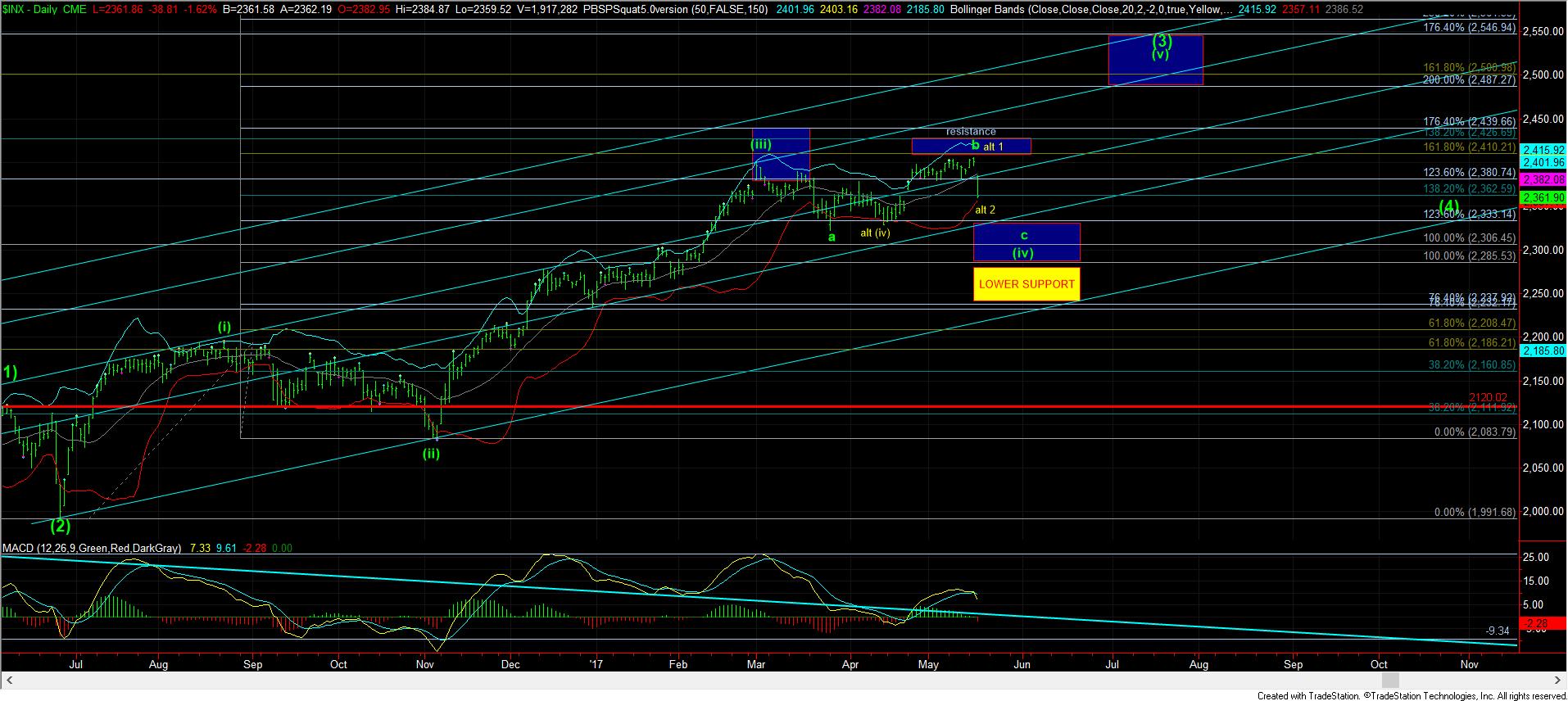

C-Wave In Progress

While the market did not provide us with those smaller squiggles higher, there is no doubt that we have been preparing for this type of action for weeks now, as I have been warning about the high risk at the highs. In fact, I have warned many times that the c-wave “should” be a strong decline, and can even feel crash-like. And, today certainly kicked it off in a meaningful way.

But, the issue I have with the top we have struck is that it “looks” and counts more like a 3 wave structure into that high in the SPX (but can be counted as 5 in ES), so it puts me on warning for the potential yellow count, as discussed below.

From a micro standpoint, there are a number of ways we can proceed from here. The MOST bearish would be if we hold over 2357SPX, and see a corrective rally, as presented by the purple waves 1-2. Personally, I would much rather see the market maintain below 2372ES (as attached on the 5 minute ES chart), and simply head lower in a direct fashion to make it feel much more crash-like, and scare many out of the market. But, since the market has been hiding its micro-intentions quite well of late, I am going to maintain an open mind to this end.

As I just noted, if the market can move directly below 2357SPX, then it would suggest we could be heading directly to the a=c target in the 2327SPX region. However, if we see that 1-2 set up, it easily opens the door to my more ideal target in the 2285SPX region.

This now brings me to one more item I must address. If the market should hold the 2357SPX region, and bounce in an impulsive fashion, I will begin to strongly consider the alternative count in yellow. You see, we must remember that the market is only setting us up for a rally to the 2500SPX region. And, should we see the market bottom in the 2357SPX region, we would have an a-b-c structure down to the .618 retracement of yellow wave 1, as presented in yellow. Again, this is only my alternative at this time, but I want to prepare you for this potential should it play out into next week.

Again, I want to remind everyone that the market is still quite likely in a bull trend, and all we are seeing is a drop in a larger degree corrective structure, which we have outlined months ago. Please make sure you remain focused on the forest rather than the leaves.