Bulls Trying To Hang On

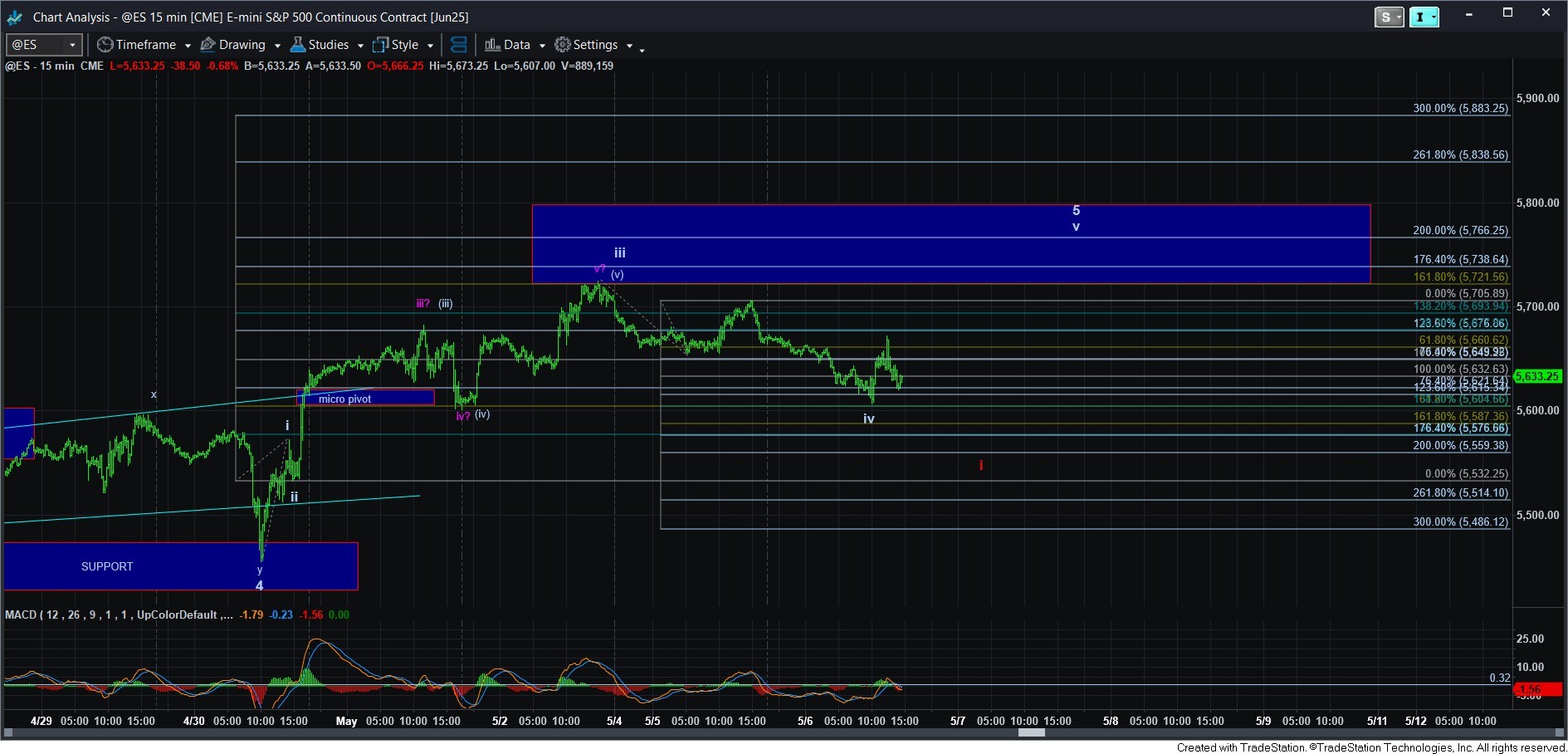

In the overnight action, the ES broke down below the initial signal line of 5649ES. And, thus far, it has held to the 2nd support in the region of the waves iv/(iv). If this support holds, then we can still see one more rally before this [c] wave tops out. But, do take note that once we break down below the 1.00 extension during a pullback from the 1.618 extension it means that it will not recover in the great majority of instances. So, probabilities are increasing that a top is in place for now, but we do need to break down below today’s low to make it likely.

Should we break down, we will then turn our focus on the nature of the decline. And, thus far, the only way to consider this decline as “impulsive” is as a leading diagonal. And, as many of you know, I do not see that as a strong trading cue. So, I would want to see all 5 waves down completed in the bigger degree wave 1, of which a lower low would only be wave i of 1 (and maybe even potentially wave [i] of i of 1).

So, for now, support is today’s low. As long as it holds, one more higher high is certainly a reasonable probability. But, once it is broken, we are likely in either the red wave 1 decline, or the blue b-wave.