Bulls Are Being Pushed To The Limit

While the SPX has been pulling back for the last week, the IWM has actually been in a pullback for the last month. In fact, the IWM has now appropriately back-tested the region from which we broke out in the August rally, and it has been building a lot of potential rally-power with as oversold the IWM is at this time.

Moreover, we have just about completed all of the a-b-c structure off the highs, and have struck these lows on strong positive divergences on the 60-minute chart. All that is now needed is for the IWM to take out the downtrend channel, and we will likely be in wave 5 to new all-time highs in the IWM.

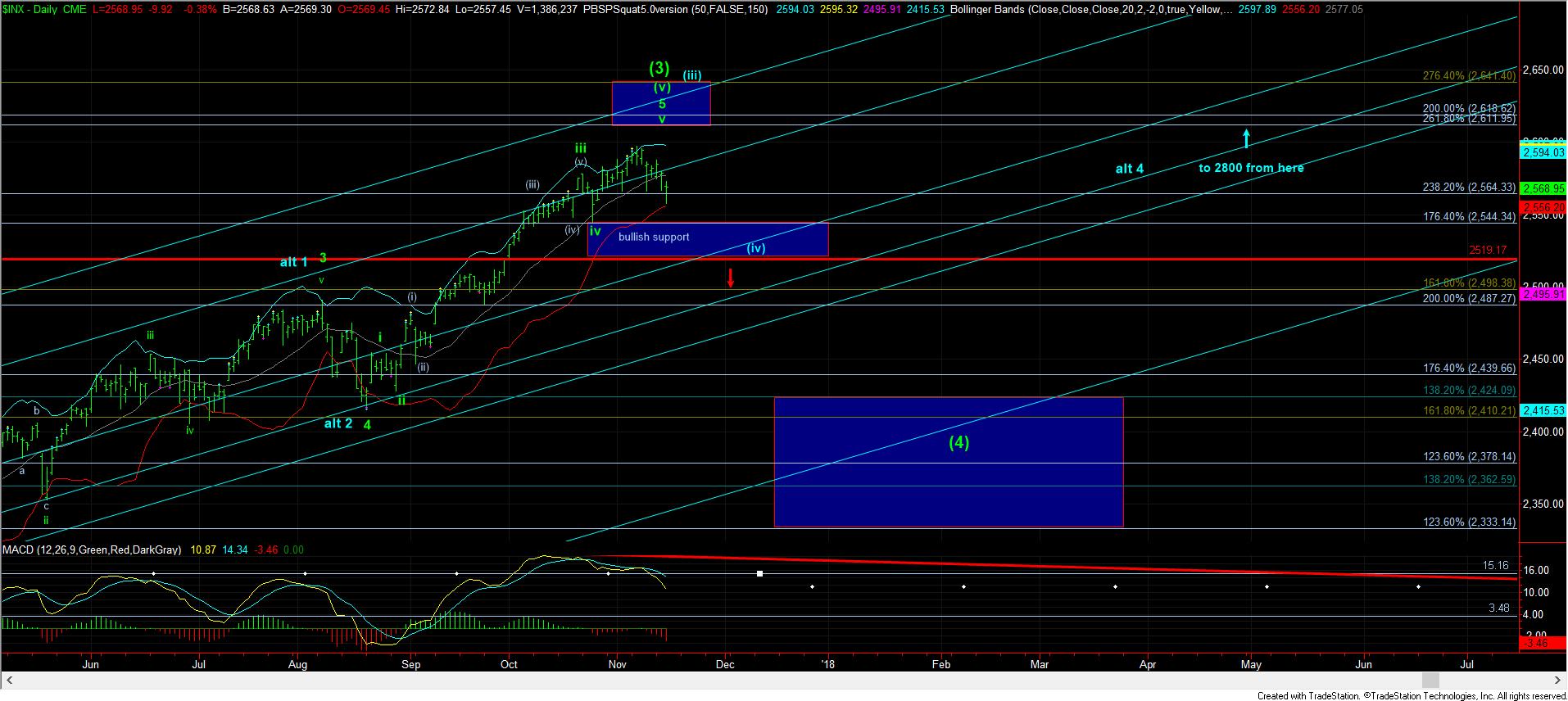

But, at the same time, the SPX has now dropped down below 2566SPX support, and almost touched the lower daily Bollinger Band today. But, due to what can be considered a completed structure off the August lows in the SPX, I still question whether the SPX can reach the ideal target region I have maintained on my daily chart. The jury remains out on that one for me.

Yesterday afternoon, I noted that if the IWM held below the 146.45 level, we had a downside set up in place to take us towards our lower end of support in the 143.75-144 region. The low struck today was 144.50, and we have what looks like a potential 5 waves up off that low. Of course, we can always get that dreaded one more lower low, but it is hard to “bet” on that with a potentially full pattern to the downside now in place.

On the other hand, over the last week or so, we have seen several impulsive structures develop, only to fail within 24 hours. I cannot tell you whether this one will fail too, but should we be able to move through the downtrend channel on the attached 60-minute chart for the IWM, I am looking for the 152 region in 5 waves before I would consider that we have a top in place off the August lows.

Now, many are asking me if it is time to short the market. And, to be honest, I am undecided when it comes to the SPX. But, as long as the IWM is over the 143.75/144 support region, I don’t dare consider a short, as this is set up for a rally to new all-time highs. Should that set up break, then I would be more confident that a top could be in place. But, unless we get that 5th wave up in the IWM, I will be quite skittish to short this bull market until I see a strong break down below the 2520SPX region, which would then signal we are likely on our way down to the 2400SPX region in wave (4).

So, until we actually complete a 5th wave up in IWM, or see a break of 2520SPX (whichever comes first), I am not interested in playing the short side in this market. Even though we have seen a number of bullish patterns break over the last week, the market has still not been kind to the bears over the last year and a half, and I will still give it the benefit of the doubt, at least for as long as the IWM retains its support.