Bullish Pattern Morphs Again

I can no longer count how many good impulsive patterns invalidate at this point in time. Today, the series of 1’s and 2’s I discussed last night invalidated with a move below 1973ES, as we noted in real time in the trading room. This leaves me only with an ending diagonal potential.

In this ending diagonal count, we have a 1-2 set up in place for a c-wave of wave iii in this diagonal. While there are counts that also have this next high as the completion of an impulsive pattern, I would not suggest being long the market beyond us hitting this upside target, assuming we do not break 1969ES support.

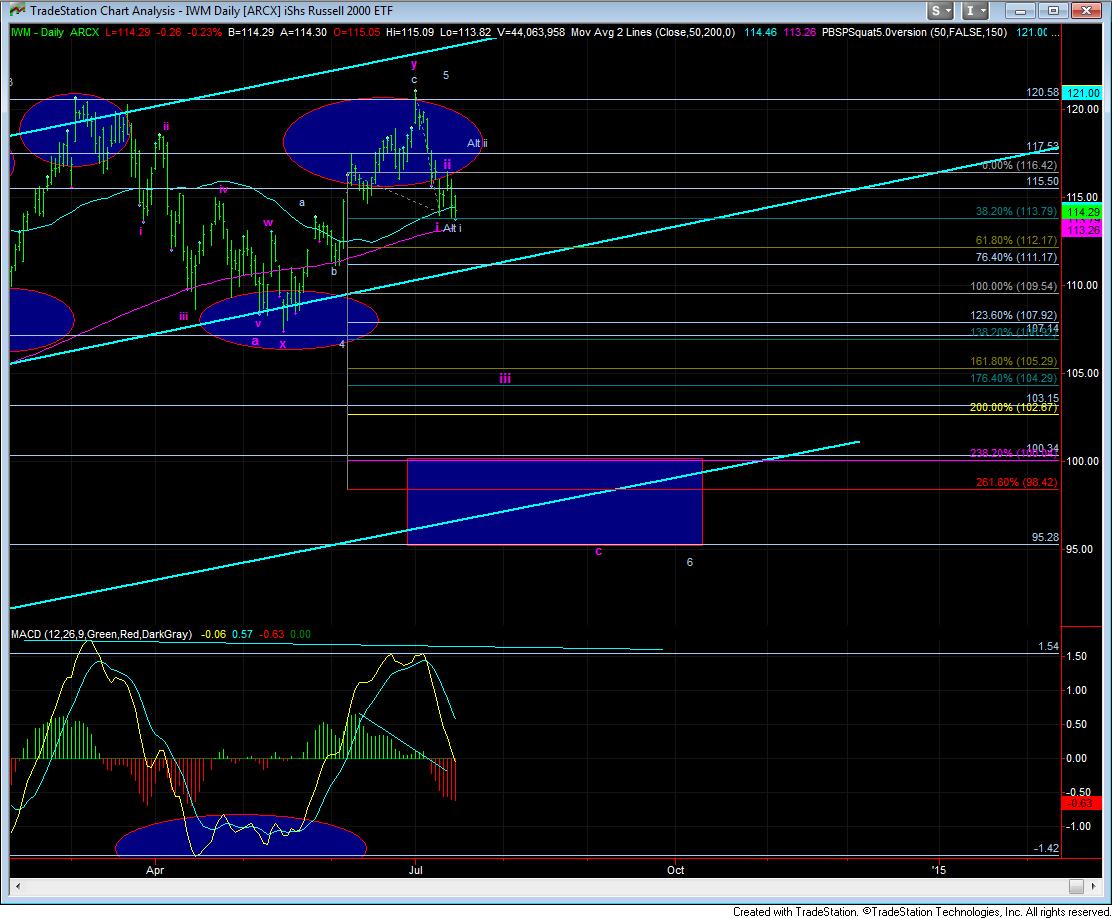

And, as I noted last night, and over the weekend, the most bearish of all charts is the IWM. The most bearish pattern has us already in wave iii down, with wave (1) of iii completing today as a leading diagonal and wave (2) still looking like it needs a c-wave higher.

As I mentioned before, should the IWM take out the 112 region, I would be looking for a minimum target of 105, with the potential for the entire pattern to take us into the 95-100 region in very quick fashion. Please keep your eyes on this chart, as it is quite ominous. Clearly, the alternative on this count is that we only completed wave i down into the lows, and we are now working on a wave ii which would take us back to the 117/118 region.

But, for now, it really seems like the ES is trying to “feel” for a top and it is doing so in a very disjointed fashion, in 3 wave structures, which is not conducive to confident trading set ups. But, it certainly feels like it is trying to create a top of some sort, especially with how bearish the IWM is now set up. Longs must still be cautious.