Bull Markets Do Bull Things

When the ES/SPX failed to follow through in a larger wave [2] potential set up today, it brings me back to an old saying about the market: When the market does not follow through on a set-up, it is often telling you something quite clear.

In our case, I have been so terribly bothered by the minuscule wave [2] I would have to rely upon to assume we are heading directly to 3900SPX next, I have been giving the market every opportunity to prove us with a more appropriate wave [2].

This morning, I did a live video for the entire membership and went into detail as to how we got to the current wave count off the March lows, and where we stand today. So, I am going to strongly urge all of you to review that view to gain a better understanding of my thought process here.

And, when the market did not follow through on the downside set up it provided us into the close yesterday, it is again suggesting that it may be taking us to 3922SPX in a more direct fashion for wave 3 of [3].

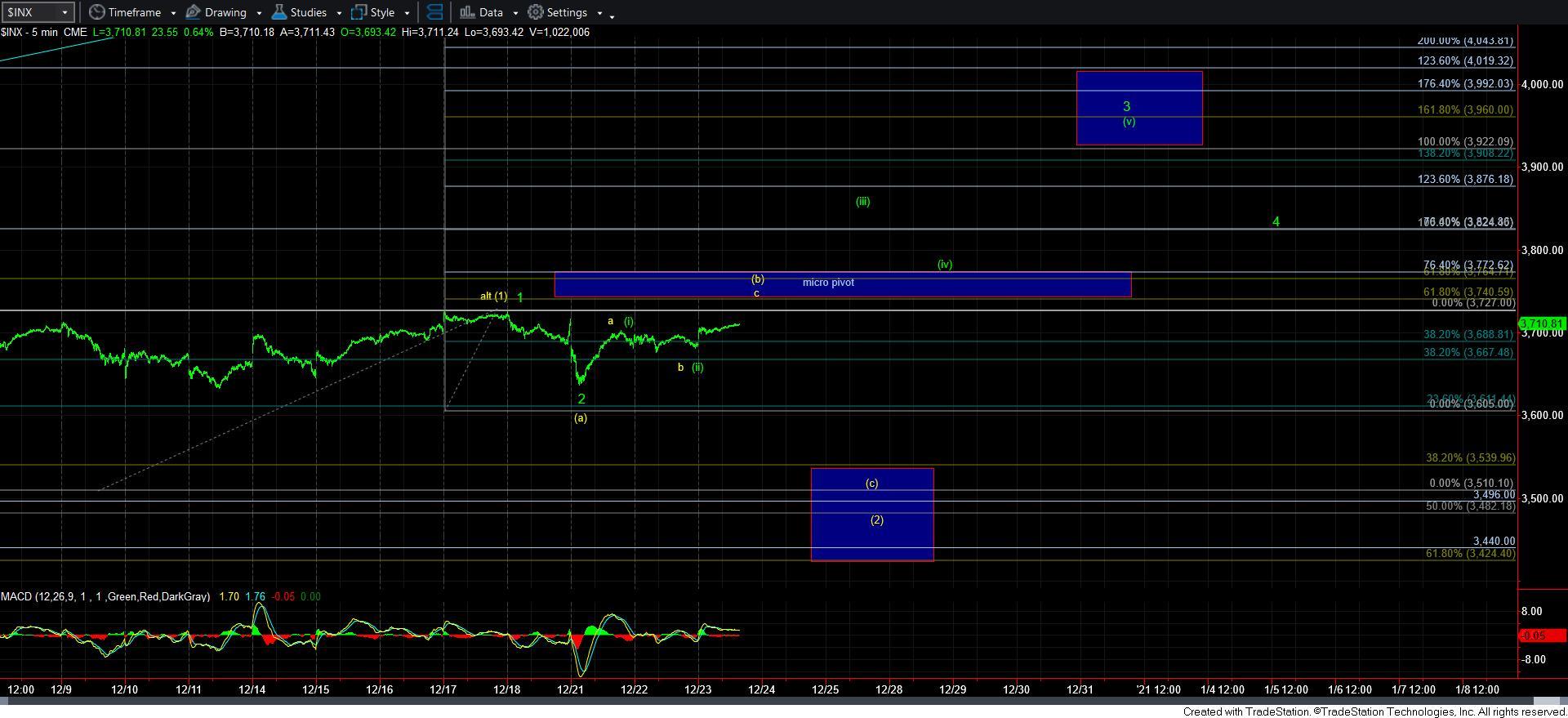

I have since revised the smaller degree wave count to again suggest that the green count is pointing us higher in a more direct fashion due to the overnight action. However, I am also going to note that if we break down below the low struck overnight in the ES, I have to go back to the wave [2] potential, presented in yellow. Unfortunately, I think this has a lesser chance of occurring since it relies upon an expanded [b] wave, as you can see from the smaller degree ES/SPX charts presented. But, what does give it some potential is that the rally off the low struck this past week was terribly overlapping, and I would have to consider it as a leading diagonal if we are counting it in a bullish fashion. And, most of you know how I feel about relying upon leading diagonals until they prove themselves.

I have also attached a new micro pivot calculated based upon the current structure in the ES off the low struck earlier this week. And, remember, in order to put us in a VERY strong bullish posture, we need to break out over the pivot in wave iii of [iii] on the smaller degree charts, and then hold the pivot as support for wave iv. As before, should we fail at any point, then the wave [2] potential again rises in probability.

I wish I was able to simply let go of this potential for a wave [2]. But, as I have been harping on for weeks, the market is going to have to prove that minuscule wave [2] to me by handling this next micro pivot appropriately in the ES chart. So, while I am forced to retain the bullish count to 3922SPX as my primary since the market did not take advantage of the set up for the [c] wave of [2] today, I am still keeping the yellow count on the chart as an alternative until the market proves wave iii and iv action appropriately.

Lastly, despite my "issues" with an appropriate wave [2], your focus should still remains on the long side of the market. It is only a matter of time before the SPX enters into wave 3 of [3] along with sooooooo many individual stocks which are clearly in the heart of their 3rd waves, along with the IWM.