Breaking Set Ups Is Not Good For Bulls

Yesterday, we went home with the market having developed a really nice bullish set up. And, towards the later afternoon, I posted my expectation in the chat room regarding how a pullback in an a-b-c wave ii should take shape overnight.

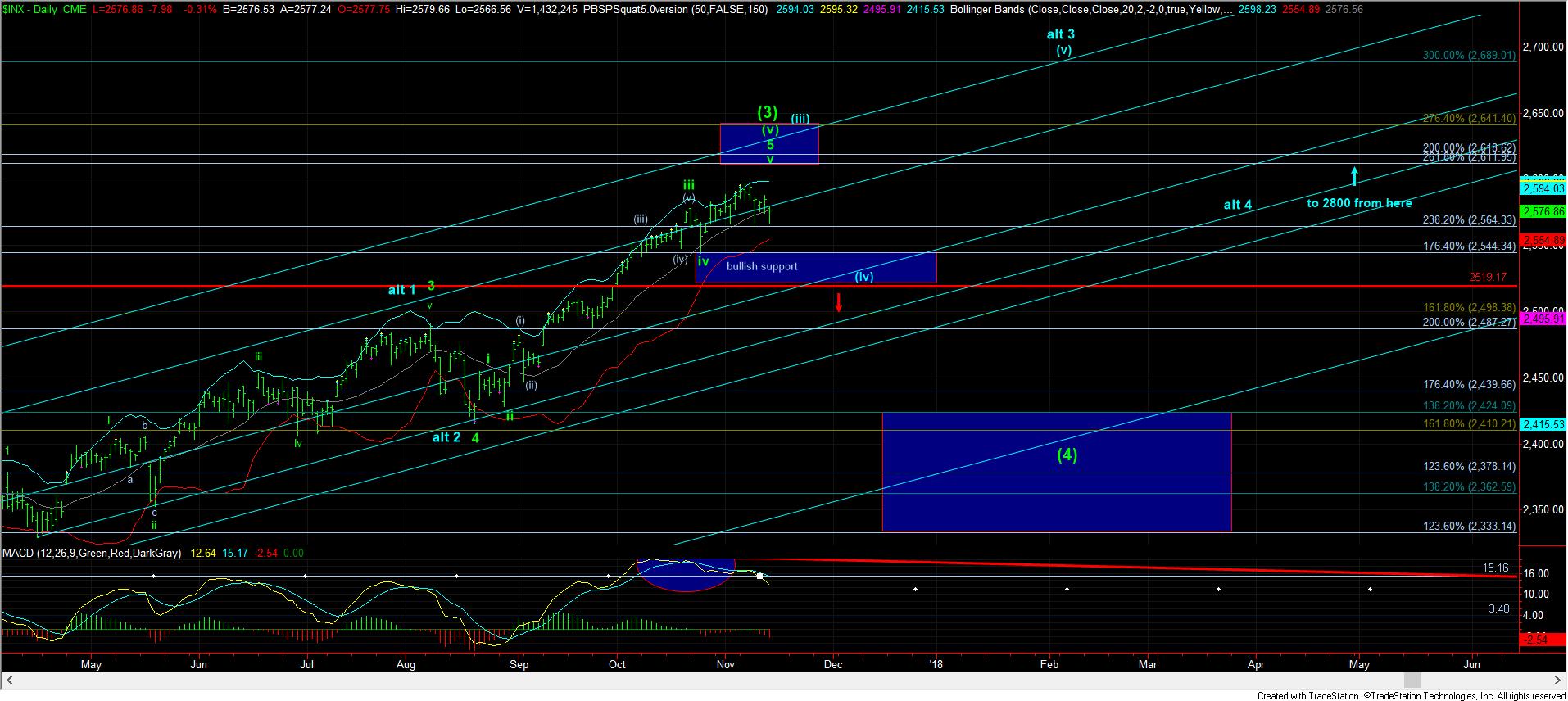

But, this morning, the market broke below yesterday’s low, and retested the 2566SPX region again. While it held SO FAR, I have now become even more cautious regarding the SPX’s ability to make a higher high into our target box overhead. As I addressed my larger concerns about the SPX this past weekend, breaking further bullish set-ups certainly reinforces those concerns.

You see, when a market has several bullish set ups which invalidate, it begins to suggest that the nature of the market may be shifting. And, while the IWM still retains its potential for a 5th wave higher as long as it holds the 143.75-144 support, a break of the 2566SPX level would make me question whether the SPX could reach the 2600+ region before it retests the bullish support below.

In the smaller degree, the IWM must break out over 146.45 in order to invalidate a set up targeting that 144 region. And, breaking out over 147 should have us clearing the downtrend channel in place, and have me viewing us as being in wave 5.

By now, it likely does not come as a surprise to you that we are viewing the market as “feeling out” a topping pattern. While my primary perspective has been that we can move up into the target box on my daily chart, last week’s action has certainly shaken my view on the probabilities of us being able to hit that target box. While I am still viewing the IWM as having strong potential to strike a higher high – as long as we hold the 143.75-144SPX support region – I am not anywhere near as confident that the SPX can rally up to its target box.

We have to begin to take notice that the nature of the market may have changed, or, at a minimum, is setting itself up to change if we get one more rally. As noted above, when the market begins to invalidate bullish set ups, one must begin to take notice. Therefore, I think it is healthy to maintain a certain amount of caution now on the bullish side of the market.

Yet, that does not mean I am suggesting one become aggressive in shorting the market. There are two things that would make me consider shorting the market. The first would be the completion of a 5th wave rally in the IWM. The second would be a break down in the SPX below the 2520SPX region.

So, for now, I remain bullish the IWM as long as support holds, and I remain marginally bullish the SPX, as long as we remain over 2566SPX. But, please recognize that when a strong bullish trend begins to break bullish set ups, it signals that the market is weakening, even if we are able to stretch up towards our target on the daily chart.