Bounce To Resistance - Market Analysis for Mar 26th, 2018

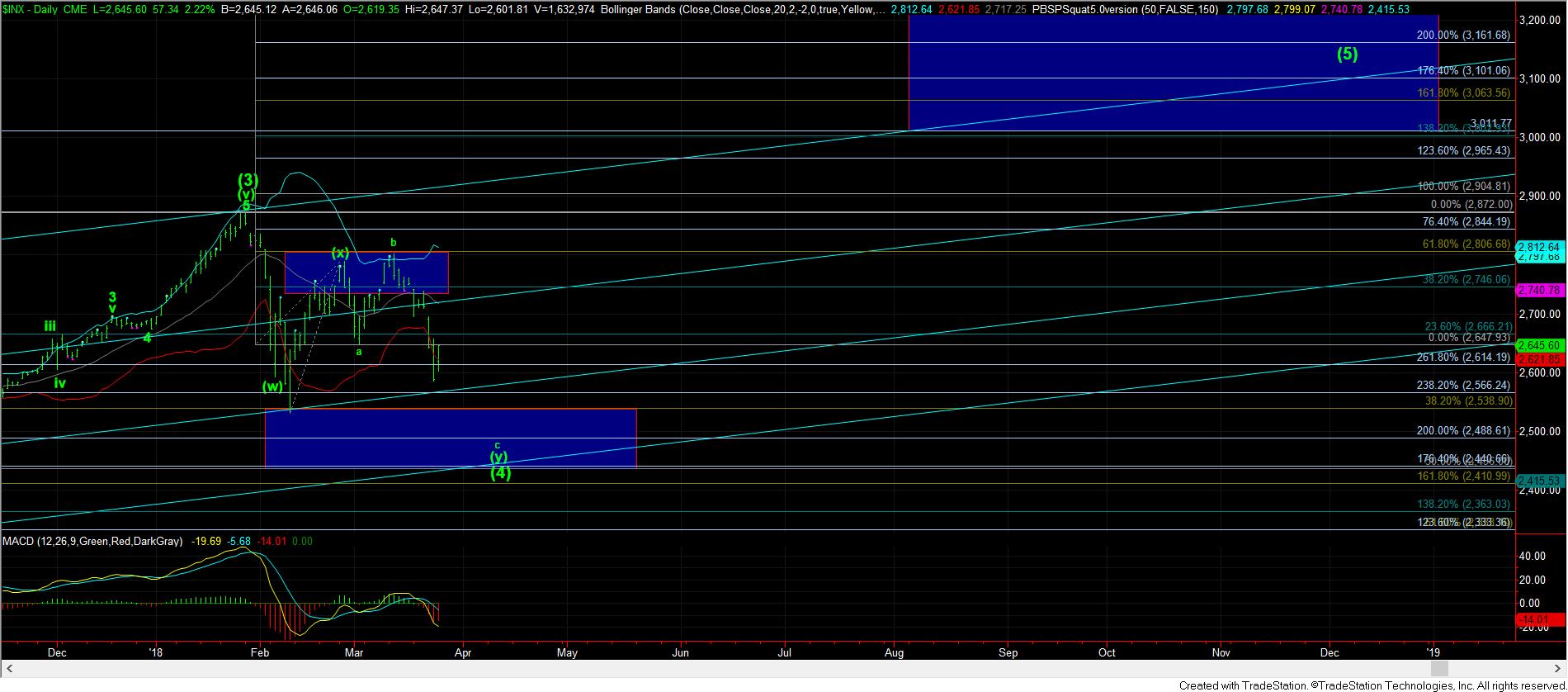

Based upon our general perspective, the market was due a bounce in wave iv in our primary wave count. And, as we noted over the weekend, as long as the market remains below the 2660SPX region on this bounce, then the bears are still very much in control.

Now, when we began this 4th wave structure two months ago, I warned you that there would be times when the patterns can get much more complex. And, should we see a break out over the 2660SPX region then we will clearly get much more complex.

But, for now, as long as we remain below the 2660SPX region this week, the bears will remain solidly in control, and we will likely test the February lows next in the 2530SPX region.

However, should we see a move through the 2660SPX region, then I will have to adopt the yellow count on the 5 minute chart, which outlines an ending diagonal for this c-wave of wave (4). While there are other alternatives should we see such a move through resistance (such as a triangle for wave (4), or even the potential 1-2 off the February lows – which still is possible, but has a lower probability at this time), for now I am going to remain in the wave (4) count until the market proves otherwise.

I want to take a moment to re-focus everyone on the bigger perspective again, since it is always so easy to lose sight of the bigger perspective while trying to navigate the smaller degree moves.

So, please remember that as long as this market holds over the 2400/40SPX support region, I am still expecting a rally to 3000+, with our primary targets at 3011, and a more ideal target around 3223SPX.

As far as the technicals are concerned, when you review the 60-minute SPX chart, we are starting to develop the appropriate set up to provide us with the positive divergences we would want to see in a c-wave in wave (4). This is starting to support our expectation that this is a corrective structure, and that we are in a c-wave of that corrective a-b-c structure.

So, while this wave (4) can still take us more time and provide many more twists and turns, please keep your eye on the bigger prize, especially since there are no high probability structures that are pointing below 2400SPX at this time.