Bottom Still Not Clear

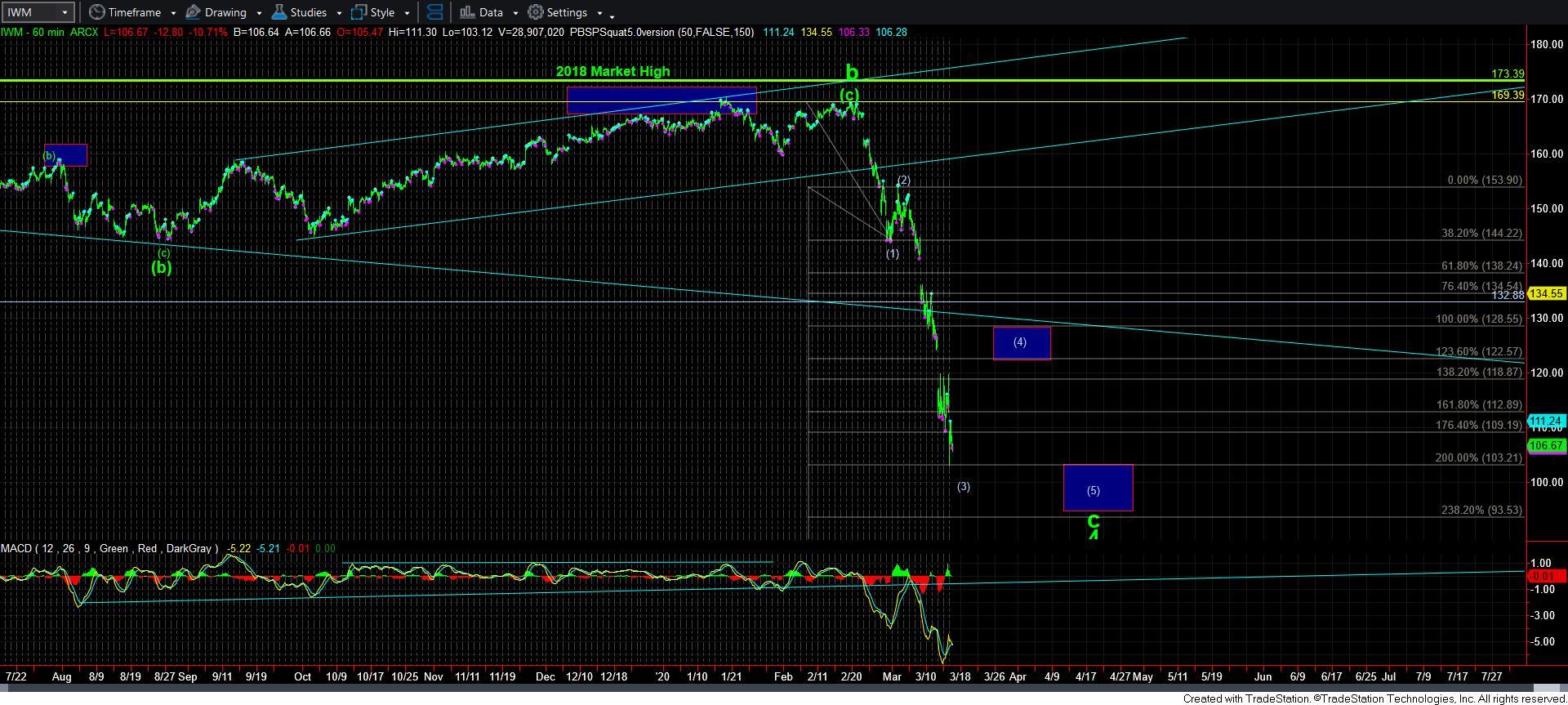

With the market continuing lower today, we still have no confirmation that the wave [3] of this c-wave has completed. While we have certainly extended quite a bit, there is still room for lower to be seen in the SPX, while the IWM has extended beyond my initial expectations.

I think the SPX is now a rather clear perspective down here, where Friday’s high seem to have only been wave iv of wave [3], with the current drop being wave v of [3]. However, I still have no indication that wave v of [3] has completed.

Based upon the micro structure gleaned from the SPY, as long as we remain below today’s rally high, we have a micro set up in place to take us down to the low struck in December of 2018, with the potential to even drop as deep as the 2266 region which is the 1.618 extension of waves [1][2] to the downside in SPX. In order to invalidate this IMMEDIATE potential, we will need to break back over today’s high to invalidate this micro set up.

Remember that we expected the market to drop that deep in this c-wave, but we may get it sooner rather than later.

In the IWM, if we continue to keep the pressure down, it opens the door to seeing the 4th wave of one lesser degree in the 95 region. As astounding as that may be, until we see a 4th wave bounce, I have to consider that potential at this time.

So, I think the next 24 hours of action will likely either confirm that wave [3] has completed at today’s lows, with an initial indication being a move over today’s intra-day rally high. Otherwise, the wave v of [3] will likely extend down to the December 2018 lows, and potentially even break them to target the 1.618 extension in the SPX.