Big Swings In The Market Post Fed But Downside Risks Remain

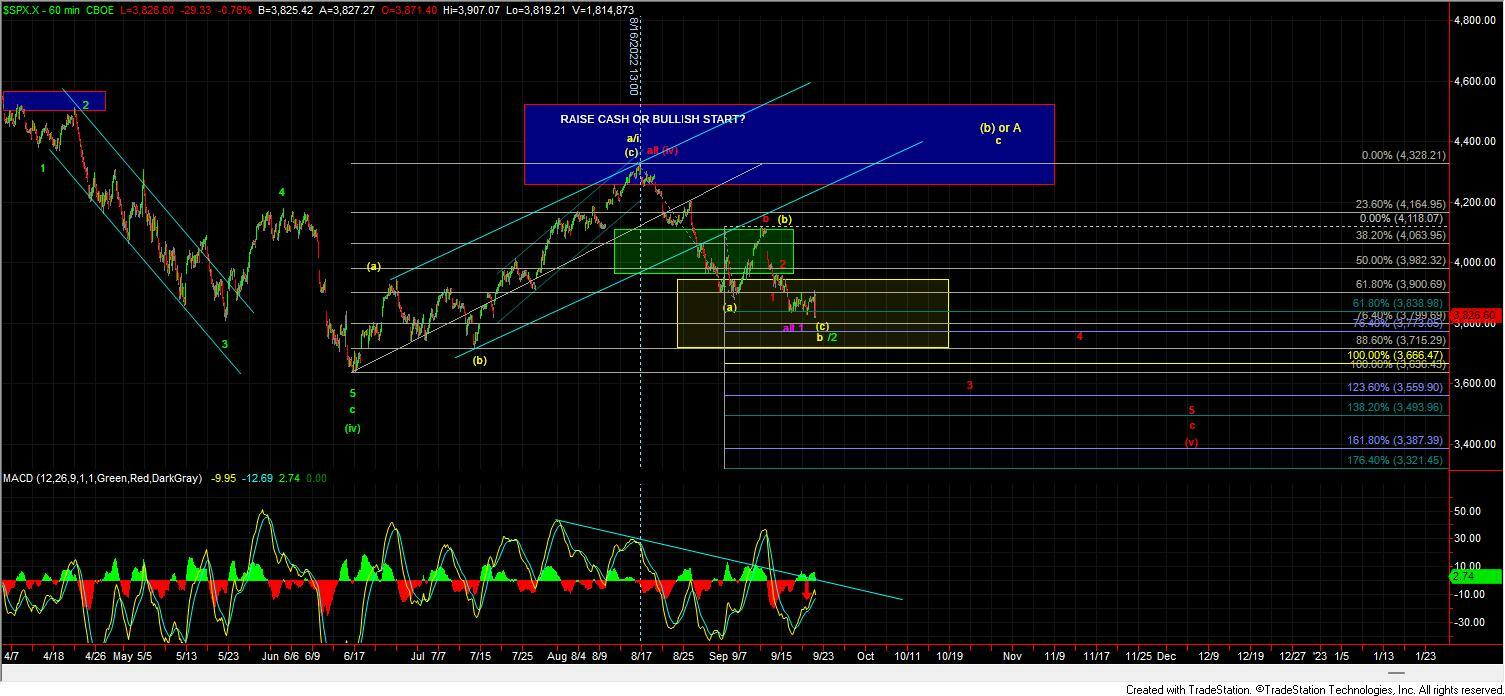

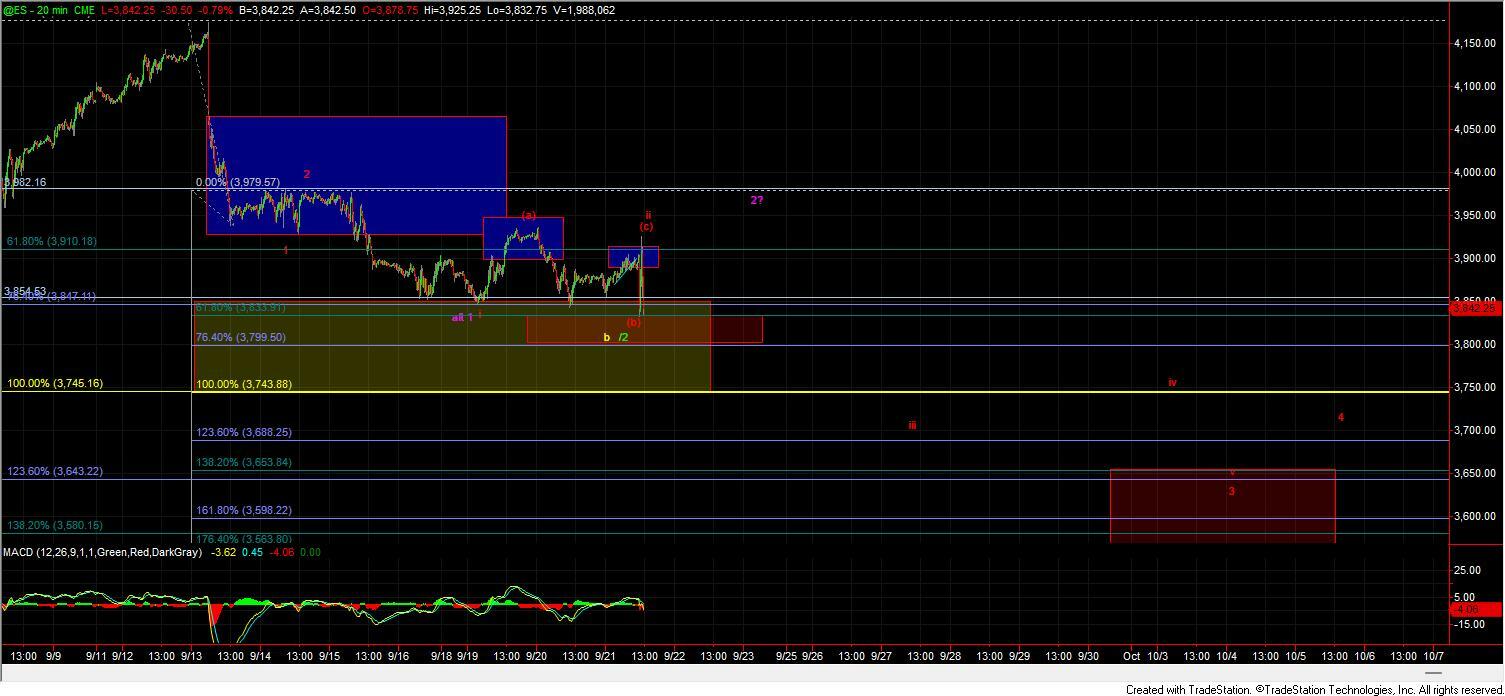

Today we saw the market open higher ahead of the FMOC announcement on what was tracing out to be a fairly clearly corrective move up off of the lows in the form of an ending diagonal. This was giving the market a setup to move sharply lower post-announcement as is typical when an ED completes its pattern. This was in fact exactly what occurred just after the 2 pm announcement. What followed that sharp drop however was a series of large intraday swings with the market then retracing the entire drop post-fed in very short order then dropping lower once again into the final hour of trading. While all of this action was quite dramatic and in the short term very whipsaw in nature it for the most part did not affect the larger degree counts and at this point in time, I am still leaning towards the red count as the primary path forward but still looking for a break of the pivot levels that we had previously laid out to give us further confirmation that we are indeed following through under this pattern.

Red Count

While the action today did make the red count a bit more complex with the whipsaw action the lows that were struck today were done so on what counts best as only three waves. So while the move up off of the low was quite sharp the three wave bottom was suggestive that the low was a wave (b) of a wave ii with the push up post FMOC being a wave c of that ii. Under this count we should now see a break back blwo the LOD at the 3832 level followed by a break of the 3799 level which is the lower end of the pivot of the wave 1 off of the 4177 high. This should then be followed by a break under the 3743 level which is the 100ext of the move down off of the 8/16 high. Moving through those levels would then clear the way for a move down into the 3653-3563 zone for the wave 3 of c with the ultimate wave 5 of c targets closer to the 3508-3362 zone below. If we were to see this break back over that zone followed by a break over the 3979 high then it would open the door for this to have put in a larger degree bottom in either the purple or green count.

Purple Count

The purple count would suggest that we are bottoming in a larger wave 1 needing a deeper retrae for a larger wave 2 of c down. Under this case I would likely have to count the lows today as the bottom of a wave (b) with any push higher as part of a wave (c) of 2. There really is not a great bottoming pattern under this case however which is why I am still leaning towards the red count as the primary path forward at this point in time. If we were able to break back up over the 3979 level however then we likey would be in this purple count with a potetnil for the door to be open for a possible larger degree bottom in the wave b / 2.

Green/yellow count

The green and yellow counts are going to trace out very similarly in the early stages and it will be tough to differentiate them which is why I am combining them into one narrative for the time being. Under this case, we should move back up over the 3979 high and then ultimately back over the 4135 level on its way back up over the highs that were struck in August. That move would then either be the start of a wave iii as part of a diagonal to new highs under the green path or as part of a larger wave (b) as I am showing in yellow. Again the early part of this move is likey to be similar so at this point I am going to combine the narrative to try to keep things a bit more simple.

So although the action today was quite dramatic and we did have to make adjustments in real-time to the micro count we never invalided the red count and have still been following a fairly clear fib pinball impulsive pattern to the downdie. So with that and as long as we continue to do so the red count will remain my primary count and I will simply look for further confirmation with a break of the pivot/support levels noted above. Should those levels hold and we move over resistance then we can look towards one of the bottoming patterns but for now and unless and until that does occur the pressure will remain down.