“Bearish” Follow Through

While the bears have gotten over their hangover and were able to complete the job today to take the market lower, this is only one battle, and the war has not yet been won. In fact, the set up for the bulls is just as good now as it is for the bears.

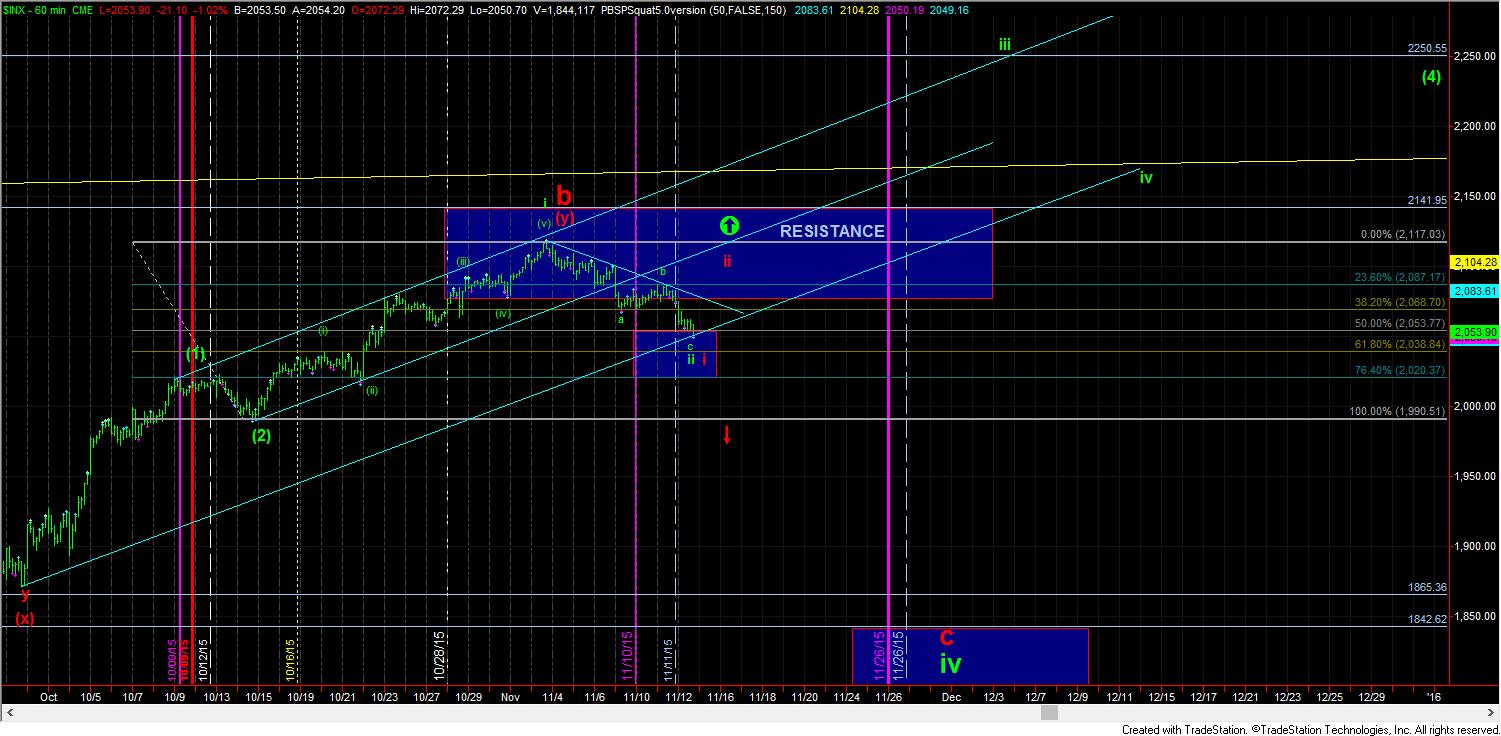

We are now in a region where I don’t see an edge for either side. We have a solid i-ii green bullish set up for the bulls, but they have to show up within the next few days to prove their mettle. As long as we remain over 2020SPX, the bulls are definitely in this game. However, should we take out the 2020SPX level, it will push their backs against the wall, and open the door for us to get the bigger c-wave down to the August lows.

As for the bearish case, I am still having questions as to how to count this overlapping mess we had off the recent resistance high we identified at 2117SPX. It can be an expanding leading diagonal still for all of wave I down, or it can still be in the heart of a 3rd wave down, which, to me, seems less likely at this time.

So, it leaves us with watching how the next rally takes shape. Should we see a clear impulsive 5 wave move off the lows, with a corrective pullback, thereafter taking out the high of the initial 5 up, then that is our signal that we are likely heading to new all time highs. But, if the rally is clearly corrective, and then we take out the bottom of the initial decline off the highs, we will likely be pointing down to the August lows.

Ultimately, it tells me the bulls and the bears are going to still fight it out in this region for the next few days, and potentially into next week, before the victor will be known.