B-Wave Still Has Not Topped

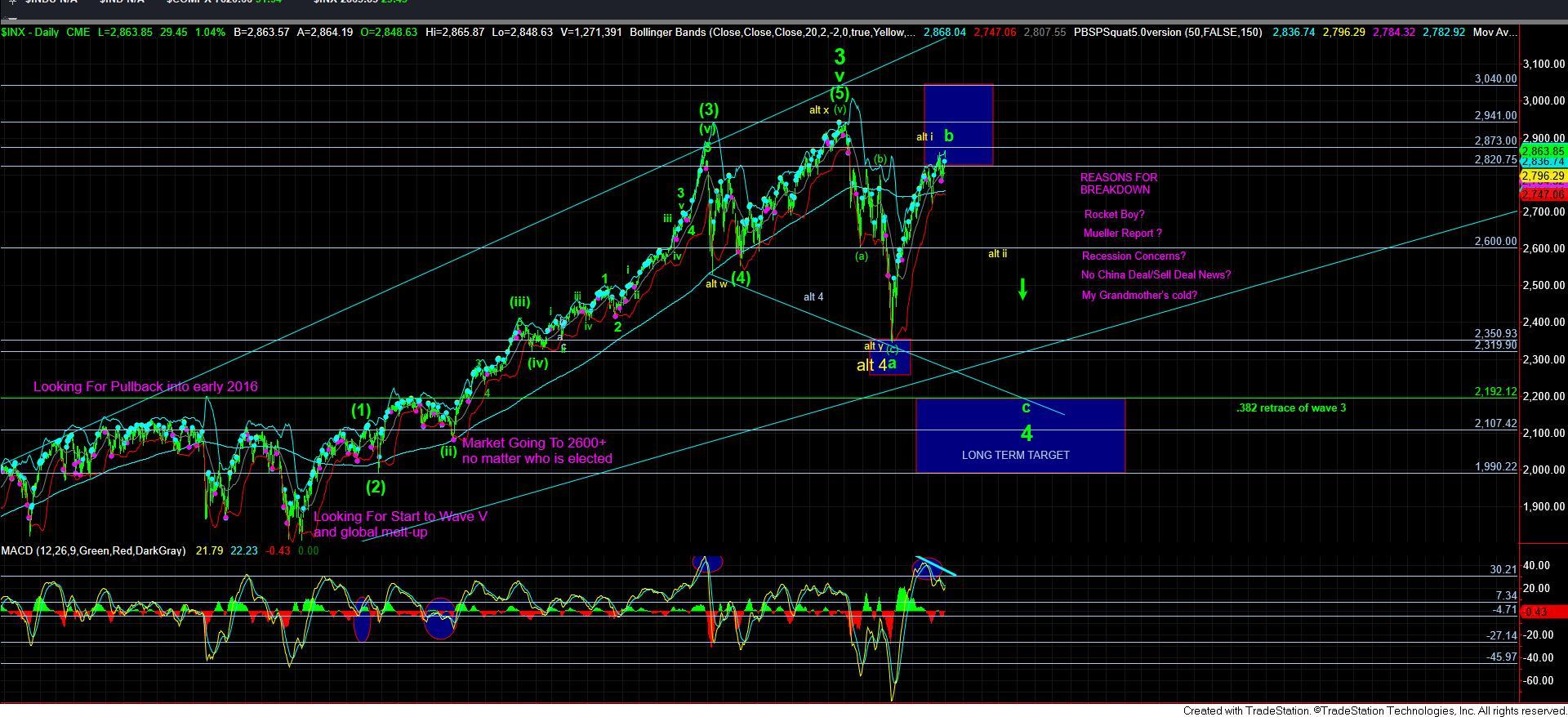

With the market moving through the March 21st high, it has made it clear that this b-wave rally has still not yet topped. However, nothing from what I wrote in the weekend analysis has really changed in my broader perspective.

What has changed is that we no longer have a i-ii downside set up in place. While I noted several times last week that the market not only has to provide the set up and open the trap door, we needed confirmation that it was going to drop through that trap door. And, without the follow through to the downside below 2770SPX, it has told us that it is not yet ready, as this b-wave is still extending.

So, how far can this b-wave still extend?

Well, as you see on the 5-minute chart, we are finally striking the target box we have had for over a month on this chart. And, the heart of this tax box has the point at which the [c] wave would be equal to .764 the size of the [a] wave in the rally off the December lows. That level is represented by the purple line in the middle of the box at the 2875SPX region.

The top of this resistance is in the 2885SPX region. So, my expectation is that we still see at least one more 4th wave pullback, which holds the micro support in the 2830/40SPX region, and then we attack the 2875SPX region. It takes a break of that micro support region to even begin to suggest this b-wave has potentially topped. But, the micro structure argues for at least one more 4-5 before it does top.

However, if the market is able to break out through the 2885SPX region (for which I really do not have a set up in place), then we have some minor resistance overhead in the 2910-15SPX region. But, a strong move through the 2885SPX opens the door to the original [a]=[c] target we had over a month ago in the 2950SPX region. Again, I really have no pattern set up pointing to that potential at this time, but clearly, we have no downside set up structure so shorting into this strength is not advisable for most of the members on our site – at least not until the market is able to drop through the next trap door set up.

Currently, 2830/40SPX is micro support, with support below that moved up from 2770SPX to 2785SPX.

In the bigger perspective, nothing has really changed for many months, as you can see from my daily chart. And, I still have no reason to change anything at this time. Until we see how the next larger pullback takes shape, I really have no clear indication to change my primary count at this time for all the same reasons I have set forth in my detailed weekend updates for the last two weeks.

Lastly, if you take a step back, you would realize we have basically been in the same general region now for weeks. And, due to the overlapping nature of the rally in what we are counting as a [c] wave, and the lack of a clear [b] wave, it has certainly made be assured of a top to this rally being in place much more difficult, which is why we have needed the requisite break of important support in a sustained fashion. So, while this process can certainly be frustrating - especially being in the same general region for weeks now - it is still advisable for most of our members not to aggressively short until the market makes it quite clear that a top has been struck.